Foot Locker 2011 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2011 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

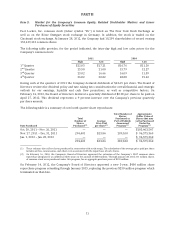

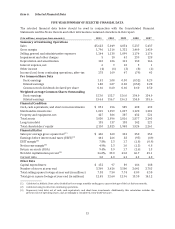

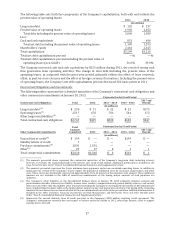

Overview of Consolidated Results

In March of 2010, the Company announced a strategic plan, which included a series of operating initiatives

and long-term financial objectives to achieve its vision of becoming the leading global retailer of

athletically inspired shoes and apparel. Several of those objectives were exceeded during 2011 and

progress was made towards attaining many of the metrics. In March 2012, an updated long-range plan and

new long-term financial objectives were announced in light of our progress over the first two years of our

long-range plan. Our updated objectives and 2011 results are presented below:

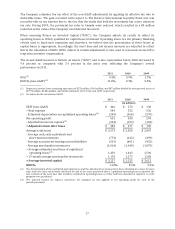

2011

Prior

Long-term

Objectives

Updated

Long-term

Objectives

Sales (in millions) $5,623 $6,000 $7,500

Sales per gross square foot $ 406 $ 400 $ 500

EBIT margin (non-GAAP) 7.9% 8.0% 11.0%

Net income margin (non-GAAP) 5.0% 5.0% 7.0%

ROIC (non-GAAP) 11.8% 10.0% 14.0%

The Company recorded net income from continuing operations of $278 million, or $1.80 per diluted share

in 2011; this compares with $169 million, or $1.07 per diluted share, for the prior-year period. Included in

the results are impairment charges related to the CCS tradename intangible asset of $5 million and

$10 million in 2011 and 2010, respectively. Excluding these charges in both periods, as well as the money

market gain in 2010, non-GAAP diluted earnings per share increased by 65 percent to $1.82 per share in

2011 from $1.10 in 2010. Other highlights of our 2011 financial performance include:

• Sales increased by 11.4 percent and comparable-store sales increased by 9.8 percent as

compared with the corresponding prior-year period. This increase was in addition to the 2010

comparable-store increase of 5.8 percent, reflecting the success of our strategic plan and the

continuing favorable athletic trend.

• Gross margin increased 190 basis points in 2011 as compared with 2010. The cost of

merchandise rate improved by 70 basis points for the same period, while our buyers and

occupancy expenses improved by 120 basis points reflecting improved leverage on higher sales.

• Selling, general and administrative expenses were 22.1 percent of sales, an improvement of

40 basis points as compared with the prior year.

• Cash and cash equivalents at January 28, 2012 were $851 million, representing an increase of

$155 million.

• Cash flow provided from operations was $497 million representing an increase of $171 million as

compared with the prior year. This increase reflects the strong sales performance coupled with

improved merchandise management. Merchandise inventories, excluding foreign currency

fluctuations increased by 1.6 percent while sales, excluding foreign currency fluctuations,

increased by 9.7 percent.

• Capital expenditures during 2011 totaled $152 million and were primarily directed to

the remodeling or relocation of 182 stores, the build-out of 70 new stores, and

continued improvements to our websites’ features and functionality, furthering the cross

channel experience.

• Dividends totaling $101 million were declared and paid. Effective with the first quarter 2012

dividend payment, the dividend rate was increased by 9 percent to $0.18 per share.

• A total of $104 million, or 4.9 million shares, were repurchased as part of the previously

announced share repurchase program. On February 14, 2012, a new 3-year, $400 million share

repurchase program extending through January 2015 was approved.

• ROIC increased to 11.8 percent as compared with the prior-year result of 8.3 percent, reflecting

profitability improvements and a more efficient balance sheet.

18