Dish Network 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-12

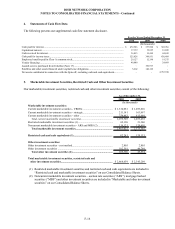

Long-Term Deferred Revenue, Distribution and Carriage Payments

Certain programmers provide us up-front payments. Such amounts are deferred and recognized as

reductions to “Subscriber-related expenses” on a straight-line basis over the relevant remaining contract

term (generally up to 10 years). The current and long-term portions of these deferred credits are recorded

in our Consolidated Balance Sheets in “Deferred revenue and other” and “Long-term deferred revenue,

distribution and carriage payments and other long-term liabilities,” respectively.

Sales Taxes

We account for sales taxes imposed on our goods and services on a net basis in our Consolidated

Statements of Operations and Comprehensive Income (Loss). Since we primarily act as an agent for the

governmental authorities, the amount charged to the customer is collected and remitted directly to the

appropriate jurisdictional entity.

Income Taxes

We establish a provision for income taxes currently payable or receivable and for income tax amounts

deferred to future periods. Deferred tax assets and liabilities are recorded for the estimated future tax

effects of differences that exist between the book and tax basis of assets and liabilities. Deferred tax assets

are offset by valuation allowances when we believe it is more likely than not that such net deferred tax

assets will not be realized.

Accounting for Uncertainty in Income Taxes

From time to time, we engage in transactions where the tax consequences may be subject to uncertainty.

We record a liability when, in management’s judgment, a tax filing position does not meet the more likely

than not threshold. For tax positions that meet the more likely than not threshold, we may record a liability

depending on management’s assessment of how the tax position will ultimately be settled. We adjust our

estimates periodically for ongoing examinations by and settlements with various taxing authorities, as well

as changes in tax laws, regulations and precedent. We classify interest and penalties, if any, associated

with our uncertain tax positions as a component of “Interest expense, net of amounts capitalized” and

“Other, net,” respectively.

Fair Value of Financial Instruments

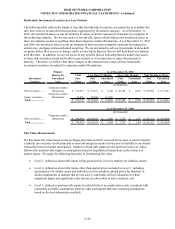

The carrying value for cash and cash equivalents, marketable investment securities, trade accounts receivable,

net of allowance for doubtful accounts, and current liabilities is equal to or approximates fair value due to their

short-term nature.

Fair values for our publicly traded debt securities are based on quoted market prices. The fair values of our

private debt is estimated based on an analysis in which we evaluate market conditions, related securities,

various public and private offerings, and other publicly available information. In performing this analysis,

we make various assumptions, among other things, regarding credit spreads, and the impact of these factors

on the value of the notes. See Note 9 for the fair value of our long-term debt.

Deferred Debt Issuance Costs

Costs of issuing debt are generally deferred and amortized to interest expense ratably over the terms of the

respective notes (see Note 9).