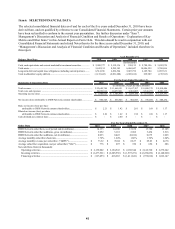

Dish Network 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

45

45

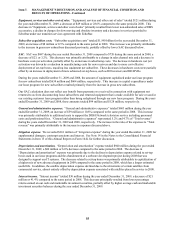

Because both we and EchoStar are defendants in the Tivo lawsuit, we and EchoStar are jointly and severally liable

to Tivo for any final damages and sanctions that may be awarded by the District Court. We have determined that we

are obligated under the agreements entered into in connection with the Spin-off to indemnify EchoStar for

substantially all liability arising from this lawsuit. EchoStar contributed an amount equal to its $5 million

intellectual property liability limit under the Receiver Agreement. We and EchoStar have further agreed that

EchoStar’s $5 million contribution would not exhaust EchoStar’s liability to us for other intellectual property claims

that may arise under the Receiver Agreement. We and EchoStar also agreed that we would each be entitled to joint

ownership of, and a cross-license to use, any intellectual property developed in connection with any potential new

alternative technology.

If Voom prevails in its breach of contract suit against us, we could be required to pay substantial damages, which

would have a material adverse affect on our financial position and results of operations. In January 2008, Voom HD

Holdings (“Voom”) filed a lawsuit against us in New York Supreme Court, alleging breach of contract and other

claims arising from our termination of the affiliation agreement governing carriage of certain Voom HD channels on

the DISH Network satellite TV service. At that time, Voom also sought a preliminary injunction to prevent us from

terminating the agreement. The Court denied Voom’s request, finding, among other things, that Voom had not

demonstrated that it was likely to prevail on the merits. In April 2010, we and Voom each filed motions for

summary judgment. Voom later filed two motions seeking discovery sanctions. On November 9, 2010, the Court

issued a decision denying both motions for summary judgment, but granting Voom’s motions for discovery

sanctions. The Court’s decision provides for an adverse inference jury instruction at trial and precludes our damages

expert from testifying at trial. We appealed the grant of Voom’s motion for discovery sanctions to the New York

State Supreme Court, Appellate Division, First Department. On February 15, 2011, the appellate Court granted our

motion to stay the trial pending our appeal. Voom is claiming over $2.5 billion in damages.

We entered into an $87.5 million Credit Facility with DBSD North America on February 1, 2011. The Credit

Facility remains subject to approval by the Bankruptcy Court. In addition, on February 1, 2011 we committed to

acquire 100% of the equity of reorganized DBSD North America for approximately $1.0 billion subject to certain

adjustments, including interest accruing on DBSD North America’s existing debt. This transaction is to be

completed upon satisfaction of certain conditions, including approval by the FCC and DBSD North America’s

emergence from bankruptcy. See Note 18 in the Notes to the Consolidated Financial Statements in Item 15 of this

Annual Report on Form 10-K for further discussion.

The Spin-off. On January 1, 2008, we completed the distribution of our technology and set-top box business and

certain infrastructure assets (the “Spin-off”) into a separate publicly-traded company, EchoStar. DISH Network and

EchoStar operate as separate publicly-traded companies, and neither entity has any ownership interest in the other.

However, a substantial majority of the voting power of the shares of both companies is owned beneficially by

Charles W. Ergen, our Chairman, President and Chief Executive Officer or by certain trusts established by Mr.

Ergen for the benefit of his family.

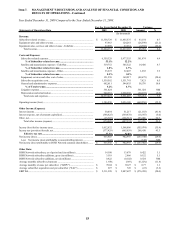

EXPLANATION OF KEY METRICS AND OTHER ITEMS

Subscriber-related revenue. “Subscriber-related revenue” consists principally of revenue from basic, premium

movie, local, HD programming, pay-per-view, Latino and international subscription television services, equipment

rental fees and other hardware related fees, including fees for DVRs, equipment upgrade fees and additional outlet

fees from subscribers with multiple receivers, advertising services, fees earned from our in-home service operations

and other subscriber revenue. Certain of the amounts included in “Subscriber-related revenue” are not recurring on

a monthly basis.

Equipment sales and other revenue. “Equipment sales and other revenue” principally includes the non-subsidized

sales of DBS accessories to retailers and other third-party distributors of our equipment domestically and to DISH

Network subscribers.