Dish Network 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

61

61

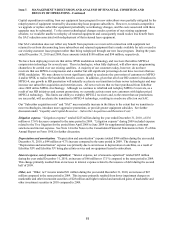

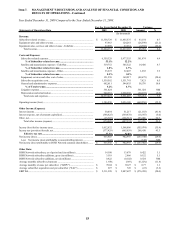

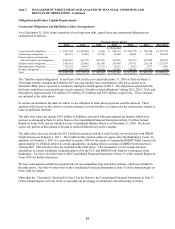

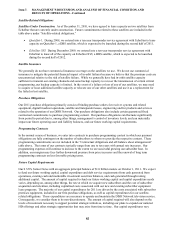

Obligations and Future Capital Requirements

Contractual Obligations and Off-Balance Sheet Arrangements

As of December 31, 2010, future maturities of our long-term debt, capital lease and contractual obligations are

summarized as follows:

Total 2011 2012 2013 2014 2015 Thereafter

Long-term debt obligations................. 6,227,965$ 1,006,094$ 6,444$ 506,114$ 1,005,778$ 756,160$ 2,947,375$

Capital lease obligations...................... 286,971 24,801 21,700 22,630 24,881 27,339 165,620

Interest expense on long-term

debt and capital lease obligations..... 2,443,097 467,758 401,896 399,672 362,274 264,500 546,997

Satellite-related obligations................. 2,416,671 229,492 242,308 250,749 230,731 230,514 1,232,877

Operating lease obligations................. 115,533 48,647 31,739 19,232 8,355 3,077 4,483

Purchase obligations ........................... 1,917,381 1,022,932 256,998 253,947 240,543 136,701 6,260

Total.................................................... 13,407,618$ 2,799,724$ 961,085$ 1,452,344$ 1,872,562$ 1,418,291$ 4,903,612$

Payments due by period

(In thousands)

The “Satellite-related obligations” in our Form 10-K for the year ended December 31, 2009 as filed on March 1,

2010 inadvertently excluded the EchoStar XVI ten-year satellite lease commitment, which was agreed to in

December 2009, and is expected to commence during the fourth quarter of 2012. The obligations associated with

this lease would have increased the previously reported “Satellite-related obligations” during 2012, 2013, 2014, and

thereafter by approximately $18 million, $72 million, $72 million and $553 million, respectively. These amounts

are included in the table above.

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These

amounts will increase to the extent we procure insurance for our satellites or contract for the construction, launch or

lease of additional satellites.

The table above does not include $193 million of liabilities associated with unrecognized tax benefits which were

accrued, as discussed in Note 10 in the Notes to the Consolidated Financial Statements in Item 15 of this Annual

Report on Form 10-K, and are included on our Consolidated Balance Sheets as of December 31, 2010. We do not

expect any portion of this amount to be paid or settled within the next twelve months.

The table above does not include the $87.5 million associated with the Credit Facility we entered into with DBSD

North America on February 1, 2011. The Credit Facility remains subject to approval by the Bankruptcy Court. In

addition, on February 1, 2011 we committed to acquire 100% of the equity of reorganized DBSD North America for

approximately $1.0 billion subject to certain adjustments, including interest accruing on DBSD North America’s

existing debt. This amount is also not included in the table above. This transaction is to be completed upon

satisfaction of certain conditions, including approval by the FCC and DBSD North America’s emergence from

bankruptcy. See Note 18 in the Notes to the Consolidated Financial Statements in Item 15 of this Annual Report on

Form 10-K for further discussion.

We have semi-annual cash interest requirements for our outstanding long-term debt securities, which are included in

the table above. See Note 9 in the Notes to the Consolidated Financial Statements in Item 15 of this Annual Report on

Form 10-K for details.

Other than the “Guarantees” disclosed in Note 14 in the Notes to the Consolidated Financial Statements in Item 15

of this Annual Report on Form 10-K, we generally do not engage in off-balance sheet financing activities.