Dish Network 2010 Annual Report Download - page 51

Download and view the complete annual report

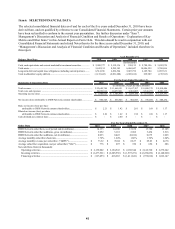

Please find page 51 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

44

44

Our subscriber-specific investments to acquire new subscribers have a significant impact on our cash flow. While

fewer subscribers might translate into lower ongoing cash flow in the long-term, cash flow is actually aided, in the

short-term, by the reduction in subscriber-specific investment spending. As a result, a slow down in our business

due to external or internal factors does not introduce the same level of short-term liquidity risk as it might in other

industries.

Availability of Credit and Effect on Liquidity

The ability to raise capital has generally existed for DISH Network despite the weak economic conditions. Because

of the cash flow of our company and the absence of any material debt payments until October 2011, modest

fluctuations in the cost of capital will not impact our current operational plans. Currently, we have no existing lines

of credit, nor have we historically.

Future Liquidity

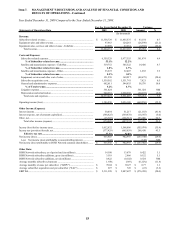

Our “Subscriber-related expenses” as a percentage of “Subscriber-related revenue” was 53.2% during the year ended

December 31, 2010 compared to 55.1% during the same period in 2009. ARPU was positively impacted by price

increases in February and June 2010. “Subscriber-related expenses” continued to be negatively impacted by

increased programming costs and initiatives to improve customer service. We continue to focus on addressing

operational inefficiencies specific to DISH Network, which we believe will contribute to long-term subscriber

growth.

If we are unsuccessful in overturning the District Court’s ruling on Tivo’s motion for contempt, we are not

successful in developing and deploying potential new alternative technology and we are unable to reach a license

agreement with Tivo on reasonable terms, we may be required to eliminate DVR functionality in all but

approximately 192,000 digital set-top boxes in the field and cease distribution of digital set-top boxes with DVR

functionality. In that event we would be at a significant disadvantage to our competitors who could continue

offering DVR functionality, which would likely result in a significant decrease in new subscriber additions as well

as a substantial loss of current subscribers. Furthermore, the inability to offer DVR functionality could cause certain

of our distribution channels to terminate or significantly decrease their marketing of DISH Network services. The

adverse effect on our financial position and results of operations if the District Court’s contempt order is upheld is

likely to be significant. Additionally, the supplemental damage award of $103 million and further award of

approximately $200 million does not include damages, contempt sanctions or interest for the period after June 2009.

In the event that we are unsuccessful in our appeal, we could also have to pay substantial additional damages,

contempt sanctions and interest. Depending on the amount of any additional damage or sanction award or any

monetary settlement, we may be required to raise additional capital at a time and in circumstances in which we

would normally not raise capital. Therefore, any capital we raise may be on terms that are unfavorable to us, which

might adversely affect our financial position and results of operations and might also impair our ability to raise

capital on acceptable terms in the future to fund our own operations and initiatives. We believe the cost of such

capital and its terms and conditions may be substantially less attractive than our previous financings.

If we are successful in overturning the District Court’s ruling on Tivo’s motion for contempt, but unsuccessful in

defending against any subsequent claim in a new action that our original alternative technology or any potential new

alternative technology infringes Tivo’s patent, we could be prohibited from distributing DVRs or could be required

to modify or eliminate our then-current DVR functionality in some or all set-top boxes in the field. In that event we

would be at a significant disadvantage to our competitors who could continue offering DVR functionality and the

adverse effect on our business would be material. We could also have to pay substantial additional damages.