Dish Network 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

59

59

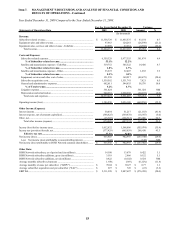

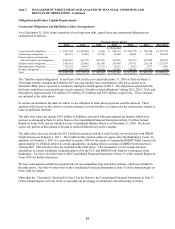

Cash flows from financing activities. Our financing activities generally include net proceeds related to the issuance of

long-term debt, cash used for the repurchase, redemption or payment of long-term debt and capital lease obligations,

dividends paid on our Class A and Class B common stock and repurchases of our Class A common stock. For the year

ended December 31, 2010, we reported net cash outflows from financing activities of $127 million. For the year ended

December 31, 2009, we reported net cash inflows from financing activities of $418 million. For the year ended

December 31, 2008, we reported net cash outflows from financing activities of $1.412 billion.

The net cash inflows in 2009 primarily related to the issuance of long-term debt, partially offset by our dividend

payment of $894 million. The net cash outflows in 2010 primarily related to the repurchases of our Class A common

stock.

The increase in net cash inflows from 2008 to 2009 primarily resulted from a decrease in the repayment of long-term

debt and capital lease obligations, an increase in the net proceeds related to the issuance of long-term debt and a decline

in stock repurchases. This increase in net cash inflows was partially offset by the dividend payment of $894 million

during 2009. In addition, the 2008 cash outflows were negatively impacted by the distribution to EchoStar related to

the Spin-off.

Other Liquidity Items

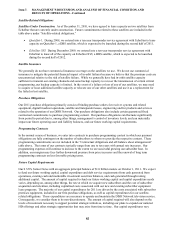

Subscriber Churn

DISH Network added approximately 33,000 net new subscribers during the year ended December 31, 2010,

compared to approximately 422,000 net new subscribers during the same period in 2009. This decrease primarily

resulted from increased churn. Our average monthly subscriber churn rate for the year ended December 31, 2010

was 1.76%, compared to 1.64% for the same period in 2009. See “Results of Operations” above for further

discussion. There are a number of factors that impact our future cash flow compared to the cash flow we generate at

any given point in time, including subscriber churn and how successful we are at retaining our current subscribers.

As we lose subscribers from our existing base, the positive cash flow from that base is correspondingly reduced.

Satellites

Operation of our subscription television service requires that we have adequate satellite transmission capacity for the

programming we offer. Moreover, current competitive conditions require that we continue to expand our offering of

new programming, particularly by expanding local HD coverage and offering more HD national channels. While

we generally have had in-orbit satellite capacity sufficient to transmit our existing channels and some backup

capacity to recover the transmission of certain critical programming, our backup capacity is limited. In the event of

a failure or loss of any of our satellites, we may need to acquire or lease additional satellite capacity or relocate one

of our other satellites and use it as a replacement for the failed or lost satellite. Such a failure could result in a

prolonged loss of critical programming or a significant delay in our plans to expand programming as necessary to

remain competitive and cause us to expend a significant portion of our cash to acquire or lease additional satellite

capacity.

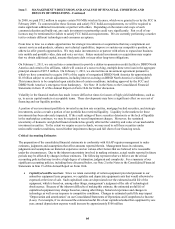

Security Systems

Increases in theft of our signal or our competitors’ signals could, in addition to reducing new subscriber activations,

also cause subscriber churn to increase. We use Security Access Devices in our receiver systems to control access

to authorized programming content. Our signal encryption has been compromised in the past and may be

compromised in the future even though we continue to respond with significant investment in security measures,

such as Security Access Device replacement programs and updates in security software, that are intended to make

signal theft more difficult. It has been our prior experience that security measures may only be effective for short

periods of time or not at all and that we remain susceptible to additional signal theft. During 2009, we completed

the replacement of our Security Access Devices and re-secured our system. We expect additional future

replacements of these devices will be necessary to keep our system secure. We cannot ensure that we will be

successful in reducing or controlling theft of our programming content and we may incur additional costs in the

future if our system’s security is compromised.