Dish Network 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-17

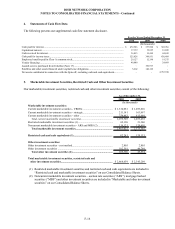

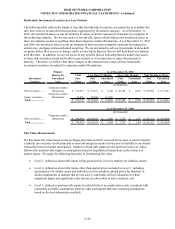

Marketable Investment Securities

Our marketable investment securities portfolio consists of various debt and equity instruments, all of which

are classified as available-for-sale (see Note 2).

Current Marketable Investment Securities - VRDNs

Variable rate demand notes (“VRDNs”) are long-term floating rate municipal bonds with embedded put

options that allow the bondholder to sell the security at par plus accrued interest. All of the put options are

secured by a pledged liquidity source. Our VRDN portfolio is comprised of investments in many

municipalities, which are backed by financial institutions or other highly rated companies that serve as the

pledged liquidity source. While they are classified as marketable investment securities, the put option

allows VRDNs to be liquidated generally on a same day or on a five business day settlement basis.

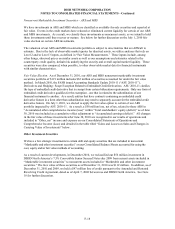

Current Marketable Investment Securities - Strategic

Our current strategic marketable investment securities include strategic and financial investments in public

companies that are highly speculative and have experienced and continue to experience volatility. As of

December 31, 2010, a significant portion of our strategic investment portfolio consisted of securities of several

issuers, and the value of that portfolio depends on those issuers.

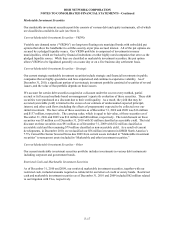

We account for certain debt securities acquired at a discount under the cost recovery method, partial

accrual or full accrual methods based on management’s quarterly evaluation of these securities. These debt

securities were purchased at a discount due to their credit quality. As a result, the yield that may be

accreted (accretable yield) is limited to the excess of our estimate of undiscounted expected principal,

interest, and other cash flows (including the effects of prepayments) expected to be collected over our

initial investment. The face value of these securities as of December 31, 2010 and 2009 was $16 million

and $137 million, respectively. The carrying value, which is equal to fair value, of these securities as of

December 31, 2010 and 2009 was $16 million and $80 million, respectively. The total discount on these

securities was $3 million as of December 31, 2010 with $3 million classified as accretable yield. The total

discount on these securities was $91 million as of December 31, 2009 with $12 million classified as

accretable yield and the remaining $79 million classified as non-accretable yield. As a result of current

developments, in December 2010, we reclassified our $56 million investment in DBSD North America’s

7.5% Convertible Senior Secured Notes due 2009 from current assets included in “Marketable investment

securities” to noncurrent assets included in “Marketable and other investment securities.”

Current Marketable Investment Securities - Other

Our current marketable investment securities portfolio includes investments in various debt instruments

including corporate and government bonds.

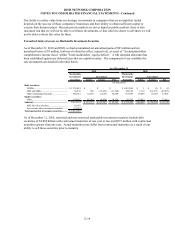

Restricted Cash and Marketable Investment Securities

As of December 31, 2010 and 2009, our restricted marketable investment securities, together with our

restricted cash, included amounts required as collateral for our letters of credit or surety bonds. Restricted

cash and marketable investment securities as of December 31, 2010 and 2009 included $62 million related

to our litigation with Tivo, respectively.