Dish Network 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

39

Voom

In January 2008, Voom HD Holdings (“Voom”) filed a lawsuit against us in New York Supreme Court, alleging

breach of contract and other claims arising from our termination of the affiliation agreement governing carriage of

certain Voom HD channels on the DISH Network satellite TV service. At that time, Voom also sought a

preliminary injunction to prevent us from terminating the agreement. The Court denied Voom’s request, finding,

among other things, that Voom had not demonstrated that it was likely to prevail on the merits. In April 2010, we

and Voom each filed motions for summary judgment. Voom later filed two motions seeking discovery sanctions.

On November 9, 2010, the Court issued a decision denying both motions for summary judgment, but granting

Voom’s motions for discovery sanctions. The Court’s decision provides for an adverse inference jury instruction

at trial and precludes our damages expert from testifying at trial. We appealed the grant of Voom’s motion for

discovery sanctions to the New York State Supreme Court, Appellate Division, First Department. On February

15, 2011, the appellate Court granted our motion to stay the trial pending our appeal. Voom is claiming over $2.5

billion in damages. We intend to vigorously defend this case. We cannot predict with any degree of certainty the

outcome of the suit or determine the extent of any potential liability or damages.

Other

In addition to the above actions, we are subject to various other legal proceedings and claims which arise in the

ordinary course of business, including, among other things, disputes with programmers regarding fees. In our

opinion, the amount of ultimate liability with respect to any of these actions is unlikely to materially affect our

financial position, results of operations or liquidity.

PART II

Item 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

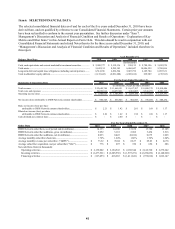

Market Information. Our Class A common stock is quoted on the Nasdaq Global Select Market under the symbol

“DISH.” The high and low closing sale prices of our Class A common stock during 2010 and 2009 on the Nasdaq

Global Select Market (as reported by Nasdaq) are set forth below. The sales prices of our Class A common stock

reported below are not adjusted to reflect the dividend paid on December 2, 2009, discussed below.

2010 High Low

First Quarter.................................... 21.80$ 17.75$

Second Quarter............................... 23.15 18.15

Third Quarter.................................. 20.84 17.44

Fourth Quarter................................ 20.81 17.97

2009 High Low

First Quarter.................................... 13.91$ 9.07$

Second Quarter............................... 17.92 11.54

Third Quarter.................................. 19.30 14.50

Fourth Quarter................................ 22.15 17.28

As of February 14, 2011, there were approximately 10,715 holders of record of our Class A common stock, not

including stockholders who beneficially own Class A common stock held in nominee or street name. As of February

14, 2011, 234,190,057 of the 238,435,208 outstanding shares of our Class B common stock were held by Charles W.

Ergen, our Chairman, President and Chief Executive Officer and the remaining 4,245,151 were held in trusts

established by Mr. Ergen for the benefit of his family. There is currently no trading market for our Class B common

stock.