Dish Network 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

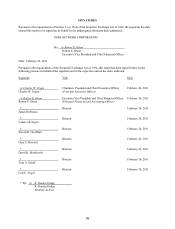

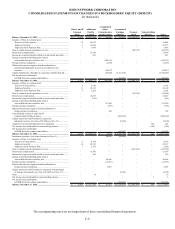

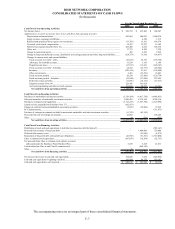

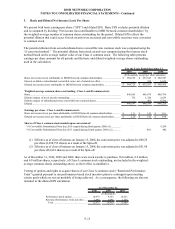

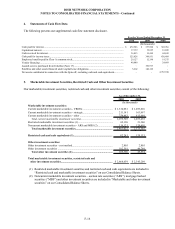

DISH NETWORK CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands)

The accompanying notes are an integral part of these consolidated financial statements.

F-6

Accumulated

Class A and B Additional Other Accumulated

Common Paid-In Comprehensive Earnings Treasury Noncontrolling

Stock Capital Income (Loss) (Deficit) Stock Interest Total

Balance, December 31, 2007............................................................. 4,936$ 2,033,864$ 46,698$ (84,456)$ (1,361,053)$ -$ 639,989$

Issuance of Class A common stock:

Exercise of stock options ............................................................... 12 19,033 - - - - 19,045

Employee benefits........................................................................... 6 19,369 - - - - 19,375

Employee Stock Purchase Plan ...................................................... 1 1,965 - - - - 1,966

Class A common stock repurchases, at cost......................................... - - - - (82,733) - (82,733)

Stock-based compensation................................................................... - 15,349 - - - - 15,349

Income tax (expense) benefit related to stock awards and other.......... - 947 - - - - 947

Change in unrealized holding gains (losses)

on available-for-sale securities, net................................................. - - (102,151) - - - (102,151)

Foreign currency translation................................................................ - - (3,278) - - - (3,278)

Deferred income tax (expense) benefit attributable to

unrealized holding gains (losses) on available-for-sale

securities.......................................................................................... - - (10,017) - - - (10,017)

Capital distribution to EchoStar in connection with the Spin-off........ - - (39,250) (3,311,295) - - (3,350,545)

Net income (loss) attributable

to DISH Network common shareholders......................................... - - - 902,947 - - 902,947

Balance, December 31, 2008............................................................. 4,955$ 2,090,527$ (107,998)$ (2,492,804)$ (1,443,786)$ -$ (1,949,106)$

Issuance of Class A common stock:

Exercise of stock options ............................................................... 5 3,189 - - - - 3,194

Employee benefits........................................................................... 11 12,187 - - - - 12,198

Employee Stock Purchase Plan ...................................................... 2 2,222 - - - - 2,224

Class A common stock repurchases, at cost......................................... - - - - (18,594) - (18,594)

Stock-based compensation................................................................... - 12,227 - - - - 12,227

Income tax (expense) benefit related to stock awards and other.......... - (141) - - - - (141)

Change in unrealized holding gains (losses)

on available-for-sale securities, net................................................. - - 113,590 - - - 113,590

Foreign currency translation................................................................ - - (106) - - - (106)

Deferred income tax (expense) benefit attributable to

foreign currency translation............................................................. - - 128 - - - 128

Cash dividend on Class A and Class B

common stock ($2.00 per share)...................................................... - - - (894,150) - - (894,150)

Capital transaction with EchoStar in connection

with launch service, net of tax of $5,280 (see Note 17)................... - - - (9,180) - - (9,180)

Acquisition of noncontrolling interest in subsidiary............................ - - - - - 625 625

Net income (loss) attributable to noncontrolling interest..................... - - - - - (142) (142)

Net income (loss) attributable

to DISH Network common shareholders......................................... - - - 635,545 - - 635,545

Balance, December 31, 2009............................................................. 4,973$ 2,120,211$ 5,614$ (2,760,589)$ (1,462,380)$ 483$ (2,091,688)$

Investment securities - fair value election (see Note 5)....................... - - 49,656 (49,656) - - -

Issuance of Class A common stock:

Exercise of stock options ............................................................... 5 4,134 - - - - 4,139

Employee benefits........................................................................... 14 29,113 - - - - 29,127

Employee Stock Purchase Plan ...................................................... 1 2,379 - - - - 2,380

Class A common stock repurchases, at cost......................................... - - - - (107,079) - (107,079)

Stock-based compensation................................................................... - 15,387 - - - - 15,387

Income tax (expense) benefit related to stock awards and other.......... - 559 - - - - 559

Change in unrealized holding gains (losses)

on available-for-sale securities, net................................................. - - 46,496 - - - 46,496

Foreign currency translation................................................................ - - (13,476) - - - (13,476)

Deferred income tax (expense) benefit attributable to

foreign currency translation............................................................. - - 5,067 - - - 5,067

Capital transaction with EchoStar in connection with purchases

of strategic investments, net of tax of $2,895 (see Note 17)............ - - - (9,103) - - (9,103)

Other.................................................................................................... - 16 - - - - 16

Net income (loss) attributable to noncontrolling interest..................... - - - - - 3 3

Net income (loss) attributable

to DISH Network common shareholders......................................... - - - 984,729 - - 984,729

Balance, December 31, 2010............................................................. 4,993$ 2,171,799$ 93,357$ (1,834,619)$ (1,569,459)$ 486$ (1,133,443)$

- -