Dish Network 2008 Annual Report Download - page 97

Download and view the complete annual report

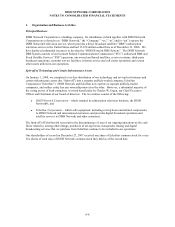

Please find page 97 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-15

Subscriber-Related Expenses

The cost of television programming distribution rights is generally incurred on a per subscriber basis and

various upfront carriage payments are recognized when the related programming is distributed to

subscribers. The cost of television programming rights to distribute live sporting events for a season or

tournament is charged to expense using the straight-line method over the course of the season or

tournament. “Subscriber-related expenses” in the Consolidated Statements of Operations and

Comprehensive Income (Loss) principally include programming expenses, costs incurred in connection

with our in-home service and call center operations, billing costs, refurbishment and repair costs related to

receiver systems, subscriber retention and other variable subscriber expenses. These costs are recognized

as the services are performed or as incurred.

“Subscriber-related expenses” also include the cost of sales from equipment sales, and expenses related to

installation and other services from our original agreement with AT&T. Cost of sales from equipment sales

to AT&T are deferred and recognized over the estimated average co-branded subscriber life. Expenses

from installation and certain other services performed at the request of AT&T are recognized as the

services are performed. Under the revised AT&T agreement, we include costs from equipment and

installations in “Subscriber acquisition costs” or, for leased equipment, in capital expenditures, rather than

in “Subscriber-related expenses.” We continue to include in “Subscriber-related expenses” the costs

deferred from equipment sales made to AT&T. These costs are amortized over the estimated life of the

subscribers acquired under the original AT&T agreement.

Subscriber Acquisition Costs

Subscriber acquisition costs in our Consolidated Statements of Operations and Comprehensive Income (Loss)

consist of costs incurred to acquire new subscribers through third parties and our direct customer acquisition

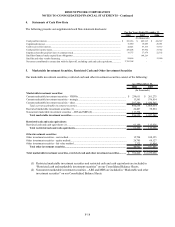

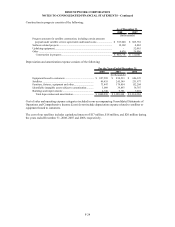

distribution channel. Subscriber acquisition costs include the following line items from our Consolidated

Statements of Operations and Comprehensive Income (Loss):

x “Cost of sales – subscriber promotion subsidies” includes the cost of our receiver systems sold to

retailers and other distributors of our equipment and receiver systems sold directly by us to

subscribers.

x “Other subscriber promotion subsidies” includes net costs related to promotional incentives and

costs related to installation.

x “Subscriber acquisition advertising” includes advertising and marketing expenses related to the

acquisition of new DISH Network subscribers. Advertising costs are expensed as incurred.

Accounting for dealer sales under our promotions falls within the scope of EITF 01-9. In accordance with that

guidance, we characterize amounts paid to our independent dealers as consideration for equipment installation

services and for equipment buydowns (commissions and rebates) as a reduction of revenue. We expense

payments for equipment installation services as “Other subscriber promotion subsidies.” Our payments for

equipment buydowns represent a partial or complete return of the dealer’s purchase price and are, therefore,

netted against the proceeds received from the dealer. We report the net cost from our various sales promotions

through our independent dealer network as a component of “Other subscriber promotion subsidies.” No net

proceeds from the sale of subscriber related equipment pursuant to our subscriber acquisition promotions are

recognized as revenue.

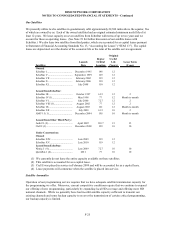

Equipment Lease Programs

DISH Network subscribers have the choice of leasing or purchasing the satellite receiver and other equipment

necessary to receive our programming. Most of our new subscribers choose to lease equipment and thus we

retain title to such equipment. Equipment leased to new and existing subscribers is capitalized and depreciated

over their estimated useful lives.