Dish Network 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

53

Other, net. “Other, net” expense totaled $56 million during the year ended December 31, 2007, a decrease of $93

million compared to “Other” income of $37 million during 2006. The decrease in “Other” primarily resulted from $56

million in charges to earnings for other-than-temporary declines in fair value of our common stock investment in a

foreign public company and a non-marketable investment security during 2007. In addition, we had a decrease in net

unrealized and realized gains during 2007 compared to 2006.

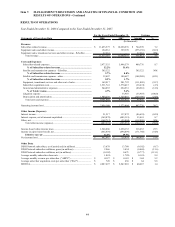

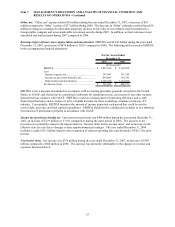

Earnings before interest, taxes, depreciation and amortization. EBITDA was $2.847 billion during the year ended

December 31, 2007, an increase of $478 million or 20.2% compared to 2006. The following table reconciles EBITDA

to the accompanying financial statements:

2007 2006

EBITDA................................................................ 2,847,010$ 2,369,058$

Less:

Interest expense, net ........................................... 267,447 331,749

Income tax provision (benefit), net...................... 494,099 314,743

Depreciation and amortization............................ 1,329,410 1,114,294

Net income (loss).................................................. 756,054$ 608,272$

For the Years Ended

December 31,

(In thousands)

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United

States, or GAAP, and should not be considered a substitute for operating income, net income or any other measure

determined in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall

financial performance and we believe it to be a helpful measure for those evaluating companies in the pay-TV

industry. Conceptually, EBITDA measures the amount of income generated each period that could be used to

service debt, pay taxes and fund capital expenditures. EBITDA should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with GAAP.

Income tax (provision) benefit, net. Our income tax provision was $494 million during the year ended December 31,

2007, an increase of $179 million or 57.0% compared to during the same period in 2006. The increase in the

provision was primarily related to the improvement in “Income (loss) before income taxes” and an increase in the

effective state tax rate due to changes in state apportionment percentages. The year ended December 31, 2006

includes a credit of $13 million related to the recognition of state net operating loss carryforwards (“NOLs”) for prior

periods.

Net income (loss). Net income was $756 million during the year ended December 31, 2007, an increase of $148

million compared to $608 million in 2006. The increase was primarily attributable to the changes in revenue and

expenses discussed above.