Dish Network 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-33

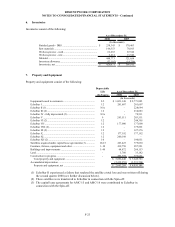

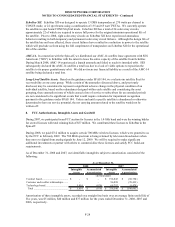

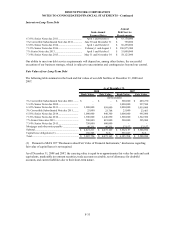

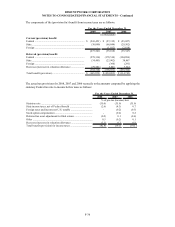

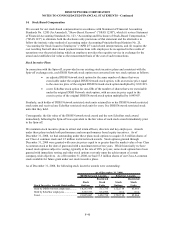

Interest on Long-Term Debt

Annual

Semi-Annual Debt Service

Payment Dates Requirements

6 3/8% Senior Notes due 2011.................................... April 1 and October 1 63,750,000$

3% Convertible Subordinated Note due 2011.............. June 30 and December 31 750,000$

6 5/8% Senior Notes due 2014.................................... April 1 and October 1 66,250,000$

7 1/8% Senior Notes due 2016.................................... February 1 and August 1 106,875,000$

7 % Senior Notes due 2013.......................................... April 1 and October 1 35,000,000$

7 3/4% Senior Notes due 2015.................................... May 31 and November 30 58,125,000$

Our ability to meet our debt service requirements will depend on, among other factors, the successful

execution of our business strategy, which is subject to uncertainties and contingencies beyond our control.

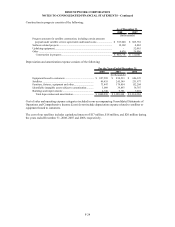

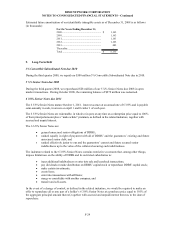

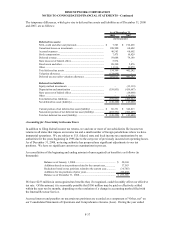

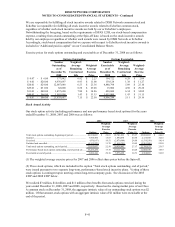

Fair Value of our Long-Term Debt

The following table summarizes the book and fair values of our debt facilities at December 31, 2008 and

2007:

Book Value Fair Value Book Value Fair Value

3% Convertible Subordinated Note due 2010 ........ $ - $ - $ 500,000 $ 489,270

5 3/4% Senior Notes due 2008............................... - - 1,000,000 997,500

6 3/8% Senior Notes due 2011............................... 1,000,000 899,000 1,000,000 1,019,000

3% Convertible Subordinated Note due 2011......... 25,000 23,768 25,000 23,463

6 5/8% Senior Notes due 2014............................... 1,000,000 840,300 1,000,000 995,000

7 1/8% Senior Notes due 2016............................... 1,500,000 1,246,890 1,500,000 1,522,500

7 % Senior Notes due 2013..................................... 500,000 419,000 500,000 505,000

7 3/4% Senior Notes due 2015............................... 750,000 600,000 - -

Mortgages and other notes payable ........................ 46,211 46,211 37,157 37,157

Subtotal................................................................... $ 4,821,211 $ 4,075,169 $ 5,562,157 $ 5,588,890

Capital lease obligations (1).................................... 186,545 N/A 563,547 N/A

Total........................................................................ 5,007,756$ 4,075,169$ 6,125,704$ 5,588,890$

2008 2007

(In thousands)

As of December 31,

(1) Pursuant to SFAS 107 “Disclosures about Fair Value of Financial Instruments,” disclosures regarding

fair value of capital leases is not required.

As of December 31, 2008 and 2007, the carrying value is equal to or approximates fair value for cash and cash

equivalents, marketable investment securities, trade accounts receivable, net of allowance for doubtful

accounts, and current liabilities due to their short-term nature.