Dish Network 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-38

December 31, 2008, we recorded $6 million in interest and penalty expense to earnings. Accrued interest

and penalties was $7 million at December 31, 2008.

11. Acquisition of Sling Media, Inc.

During October 2007, we acquired all remaining outstanding shares (94%) of Sling Media, Inc. (“Sling

Media”) for cash consideration of $342 million, including direct transaction costs of $8 million. We also

exchanged Sling Media employee stock options for our options to purchase approximately 342,000 of our

common stock valued at approximately $16 million. Sling Media, a leading innovator in the digital-

lifestyle space, was acquired to allow us to offer new products and services to our subscribers. On January

1, 2008, Sling Media was distributed to EchoStar in the Spin-off.

This transaction was accounted for as a purchase business combination in accordance with Statement of

Financial Accounting Standards No. 141, “Business Combinations” (“SFAS 141”). The purchase

consideration was allocated based on the fair values of identifiable tangible and intangible assets and

liabilities as follows:

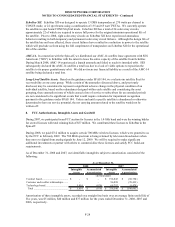

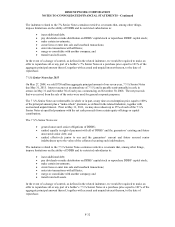

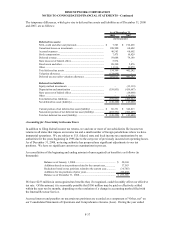

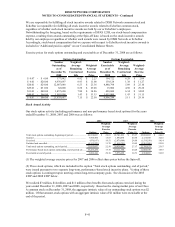

Final

Purchase Price

Allocation

(In thousands)

Tangible assets.......................................... 28,779$

Prepaid compensation costs....................... 11,844

Other noncurrent assets (1)........................ (9,541)

Acquisition intangibles.............................. 61,800

In-process research and development........ 22,200

Goodwill.................................................... 256,917

Total assets acquired................................. 371,999$

Current liabilities....................................... (19,233)

Long-term liabilities (2)............................. (10,922)

Net assets acquired.................................... 341,844$

(1) Represents the elimination of our previously recorded 6% non-controlling interest in Sling

Media.

(2) Includes $9 million deferred tax liability related to the acquisition intangibles.

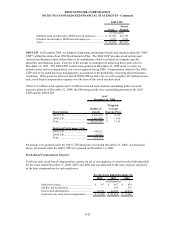

The total $62 million of acquired intangible assets resulting from the Sling Media transaction is comprised

of technology-based intangibles and trademarks totaling approximately $34 million with estimated

weighted-average useful lives of seven years, reseller relationships totaling approximately $24 million with

estimated weighted-average useful lives of three years and contract-based intangibles totaling

approximately $4 million with estimated weighted-average useful lives of four years. The in-process

research and development costs of $22 million were expensed to general and administrative expense upon

acquisition in accordance with SFAS 141. The goodwill recorded as a result of the acquisition is not

deductible for income tax purposes.

The business combination did not have a material impact on our results of operations for the year ended

December 31, 2007 and would not have materially impacted our results of operations for these periods had

the business combination occurred on January 1, 2007. Further, the business combination would not have

had a material impact on our results of operations for the comparable period in 2006 had the business

combination occurred on January 1, 2006.