Dish Network 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-54

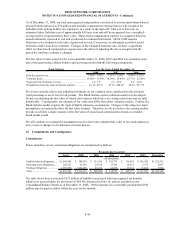

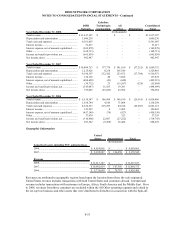

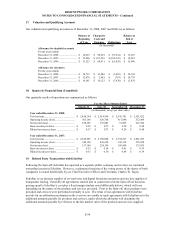

17. Valuation and Qualifying Accounts

Our valuation and qualifying accounts as of December 31, 2008, 2007 and 2006 are as follows:

Balance at

Beginning

of Year

Charged to

Costs and

Expenses Deductions

Balance at

End of

Year

Allowance for doubtful accounts

For the years ended:

December 31, 2008............................ 14,019$ 98,629$ (97,441)$ 15,207$

December 31, 2007............................ 15,006$ 101,256$ (102,243)$ 14,019$

December 31, 2006............................ 11,523$ 68,911$ (65,428)$ 15,006$

Allowance for inventory

For the years ended:

December 31, 2008............................ 14,739$ 15,046$ (7,683)$ 22,102$

December 31, 2007............................ 12,878$ 2,642$ (781)$ 14,739$

December 31, 2006............................ 10,185$ 10,123$ (7,430)$ 12,878$

(In thousands)

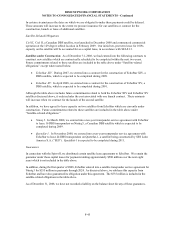

18. Quarterly Financial Data (Unaudited)

Our quarterly results of operations are summarized as follows:

March 31 June 30 September 30 December 31

Year ended December 31, 2008:

Total revenue............................................... 2,844,394$ 2,914,990$ 2,936,781$ 2,921,022$

Operating income (loss)............................... 505,168 620,708 417,840 512,464

Net income (loss)......................................... 258,583 335,885 91,895 216,584

Basic income per share ............................... 0.58$ 0.75$ 0.20$ 0.48$

Diluted income per share ............................ 0.57$ 0.73$ 0.20$ 0.48$

Year ended December 31, 2007:

Total revenue .............................................. 2,644,985$ 2,760,008$ 2,794,327$ 2,891,055$

Operating income (loss)............................... 340,198 441,654 396,514 395,038

Net income (loss)......................................... 157,140 224,199 199,680 175,035

Basic income per share ............................... 0.35$ 0.50$ 0.45$ 0.39$

Diluted income per share ............................ 0.35$ 0.50$ 0.44$ 0.39$

(In thousands, except per share data)

For the Three Months Ended

19. Related Party Transactions with EchoStar

Following the Spin-off, EchoStar has operated as a separate public company and we have no continued

ownership interest in EchoStar. However, a substantial majority of the voting power of the shares of both

companies is owned beneficially by our Chief Executive Officer and Chairman, Charles W. Ergen.

EchoStar is our primary supplier of set-top boxes and digital broadcast operations and our key supplier of

transponder leasing. Generally all agreements entered into in connection with the Spin-off are based on

pricing equal to EchoStar’s cost plus a fixed margin (unless noted differently below), which will vary

depending on the nature of the products and services provided. Prior to the Spin-off, these products were

provided and services were performed internally at cost. The terms of our agreements with EchoStar

provide for an arbitration mechanism in the event we are unable to reach agreement with EchoStar as to the

additional amounts payable for products and services, under which the arbitrator will determine the

additional amounts payable by reference to the fair market value of the products and services supplied.