Dish Network 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-41

We are responsible for fulfilling all stock incentive awards related to DISH Network common stock and

EchoStar is responsible for fulfilling all stock incentive awards related to EchoStar common stock,

regardless of whether such stock incentive awards are held by our or EchoStar’s employees.

Notwithstanding the foregoing, based on the requirements of SFAS 123R, our stock-based compensation

expense, resulting from awards outstanding at the Spin-off date, is based on the stock incentive awards

held by our employees regardless of whether such awards were issued by DISH Network or EchoStar.

Accordingly, stock-based compensation that we expense with respect to EchoStar stock incentive awards is

included in “Additional paid-in capital” on our Consolidated Balance Sheets.

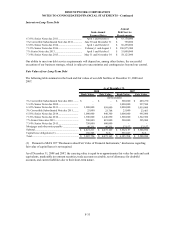

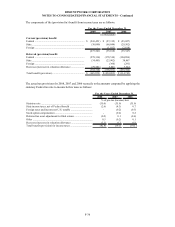

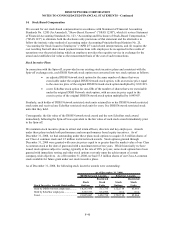

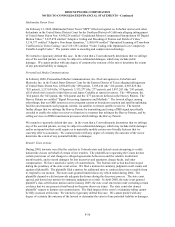

Exercise prices for stock options outstanding and exercisable as of December 31, 2008 are as follows:

Number

Outstanding

as of

December 31,

2008

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price

Number

Exercisable

as of

December 31,

2008

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price

0.07$ - 6.00$ 177,942 6.92 2.23$ 104,722 6.28 2.09$

6.01$ - 20.00$ 6,976,097 8.93 11.08$ 139,124 1.38 11.27$

20.01$ - 29.00$ 12,087,048 6.53 25.36$ 4,888,798 5.89 25.10$

29.01$ - 31.00$ 82,000 8.58 29.28$ 15,000 4.50 29.28$

31.01$ - 40.00$ 1,457,600 7.80 34.86$ 403,600 6.34 34.02$

40.01$ - 66.00$ 1,055,000 1.43 51.15$ 1,055,000 1.43 51.15$

0.07$ - 66.00$ 21,835,687 7.15 22.50$ 6,606,244 5.11 29.16$

Options Outstanding Options Exercisable

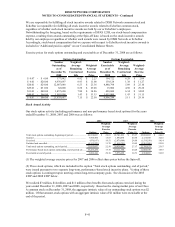

Stock Award Activity

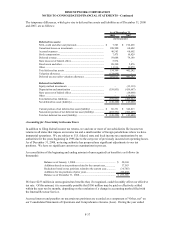

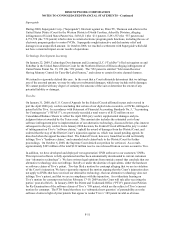

Our stock option activity (including performance and non-performance based stock options) for the years

ended December 31, 2008, 2007 and 2006 was as follows:

Options

Wei

g

hted-

Average

Exercise

Price Options

Wei

g

hted-

Average

Exercise

Price (1) Options

Wei

g

hted-

Average

Exercise

Price (1)

Total stock options outstanding, beginning of period........................ 20,938,403 22.61$ 22,741,833 25.67$ 25,086,883 24.43$

Granted ............................................................................................. 7,998,500 13.67 1,890,870 40.50 2,135,500 32.41

Exercised .......................................................................................... (976,187) 19.51 (2,079,909) 24.88 (1,519,550) 14.14

Forfeited and cancelled...................................................................... (6,125,029) 11.70 (1,614,391) 19.69 (2,961,000) 25.99

Total stock options outstanding, end of period.................................. 21,835,687 22.50 20,938,403 27.17 22,741,833 25.67

Performance based stock options outstanding, end of period (2)....... 10,253,250 17.19 10,111,750 20.28 11,006,750 18.87

Exercisable at end of period.............................................................. 6,606,244 29.16 5,976,459 34.73 6,568,883 32.85

2008 2007 2006

(1) The weighted average exercise prices for 2007 and 2006 reflect share prices before the Spin-off.

(2) These stock options, which are included in the caption “Total stock options outstanding, end of period,”

were issued pursuant to two separate long-term, performance-based stock incentive plans. Vesting of these

stock options is contingent upon meeting certain long-term company goals. See discussion of the 2005

LTIP and 2008 LTIP below.

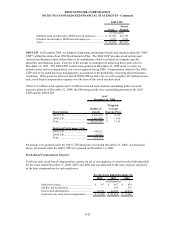

We realized $3 million, $14 million, and $11 million of tax benefits from stock options exercised during the

years ended December 31, 2008, 2007 and 2006, respectively. Based on the closing market price of our Class

A common stock on December 31, 2008, the aggregate intrinsic value of our outstanding stock options was $2

million. Of that amount, stock options with an aggregate intrinsic value of $1 million were exercisable at the

end of the period.