Dish Network 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

57

Subscriber Acquisition and Retention Costs. We incur significant up-front costs to acquire subscribers, including

advertising, retailer incentives, equipment, installation, and new customer promotions. While we attempt to recoup

these up-front costs over the lives of their subscription, there can be no assurance that we will. We deploy business

rules such as higher credit requirements and contractual commitments, and we strive to provide outstanding

customer service, to increase the likelihood of customers keeping their DISH Network service over longer periods of

time. Our subscriber acquisition costs may vary significantly from period to period.

We incur significant costs to retain our existing customers, mostly by upgrading their equipment to HD and DVR

receivers. As with our subscriber acquisition costs, our retention spending includes the cost of equipment and

installation. We also offer free programming and/or promotional pricing for limited periods for existing customers

in exchange for a commitment. A major component of our retention efforts includes the installation of equipment

for customers who move. Our subscriber retention costs may vary significantly from period to period.

Other. We are also vulnerable to fraud, particularly in the acquisition of new subscribers. While we are addressing

the impact of subscriber fraud through a number of actions, including eliminating certain payment options for

subscribers, such as the use of pre-paid debit cards, there can be no assurance that we will not continue to experience

fraud which could impact our subscriber growth and churn. The current economic downturn may create greater

incentive for signal thefts and subscriber frauds, which could lead to higher subscriber churn and reduced revenue.

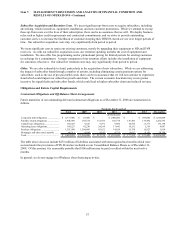

Obligations and Future Capital Requirements

Contractual Obligations and Off-Balance Sheet Arrangements

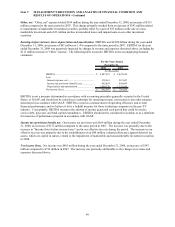

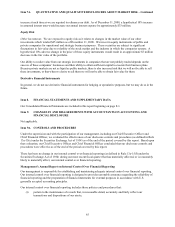

Future maturities of our outstanding debt and contractual obligations as of December 31, 2008 are summarized as

follows:

Total 2009 2010 2011 2012 2013 Thereafter

Long-term debt obligations..................... 4,775,000$ 25,000$ -$ 1,000,000$ -$ 500,000$ 3,250,000$

Satellite-related obligations.................... 1,948,490 184,754 132,385 105,774 136,492 136,492 1,252,593

Capital lease obligations......................... 186,545 9,229 9,391 9,800 10,556 11,371 136,198

Operating lease obligations..................... 109,223 42,230 24,168 17,641 10,551 5,536 9,097

Purchase obligations .............................. 1,397,990 1,304,489 43,651 14,859 15,334 15,827 3,830

Mortgages and other notes payable ....... 46,211 4,104 4,143 4,375 4,622 4,183 24,784

Total....................................................... 8,463,459$ 1,569,806$ 213,738$ 1,152,449$ 177,555$ 673,409$ 4,676,502$

Payments due by period

(In thousands)

The table above does not include $233 million of liabilities associated with unrecognized tax benefits which were

accrued under the provisions of FIN 48 and are included on our Consolidated Balance Sheets as of December 31,

2008. Of this amount, it is reasonably possible that $106 million may be paid or settled within the next twelve

months.

In general, we do not engage in off-balance sheet financing activities.