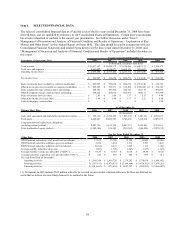

Dish Network 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

42

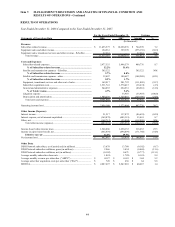

EXPLANATION OF KEY METRICS AND OTHER ITEMS

Subscriber-related revenue. “Subscriber-related revenue” consists principally of revenue from basic, movie, local,

pay-per-view, Latino and international subscription television services, equipment rental fees and other hardware

related fees, including fees for DVRs and additional outlet fees from subscribers with multiple receivers, advertising

services, fees earned from our DishHOME Protection Plan, equipment upgrade fees, HD programming and other

subscriber revenue. Certain of the amounts included in “Subscriber-related revenue” are not recurring on a monthly

basis.

Equipment sales and other revenue. “Equipment sales and other revenue” principally includes the unsubsidized sales

of DBS accessories to retailers and other third-party distributors of our equipment and to DISH Network subscribers.

During 2007 and 2006, this category also included sales of non-DISH Network digital receivers and related

components to international customers and satellite and transmission revenue, which related to the set-top box business

and other assets that were distributed to EchoStar in connection with the Spin-off.

Equipment sales, transitional services and other revenue – EchoStar. “Equipment sales, transitional services and

other revenue – EchoStar” includes revenue related to equipment sales, and transitional services and other agreements

with EchoStar associated with the Spin-off.

Subscriber-related expenses. “Subscriber-related expenses” principally include programming expenses, costs

incurred in connection with our in-home service and call center operations, billing costs, refurbishment and repair

costs related to receiver systems, subscriber retention and other variable subscriber expenses.

Satellite and transmission expenses – EchoStar. “Satellite and transmission expenses – EchoStar” includes the cost

of digital broadcast operations provided to us by EchoStar, which were previously performed internally, including

satellite uplinking/downlinking, signal processing, conditional access management, telemetry, tracking and control and

other professional services. In addition, this category includes the cost of leasing satellite and transponder capacity on

satellites that were distributed to EchoStar in connection with the Spin-off.

Satellite and transmission expenses – other. “Satellite and transmission expenses – other” includes transponder

leases and other related services. Prior to the Spin-off, “Satellite and transmission expenses – other” included costs

associated with the operation of our digital broadcast centers, including satellite uplinking/downlinking, signal

processing, conditional access management, telemetry, tracking and control, satellite and transponder leases, and other

related services, which were previously performed internally.

Equipment, transitional services and other cost of sales. “Equipment, transitional services and other cost of sales”

principally includes the cost of unsubsidized sales of DBS accessories to retailers and other distributors of our

equipment domestically and to DISH Network subscribers. In addition, this category includes costs related to

equipment sales, transitional services and other agreements with EchoStar associated with the Spin-off.

During 2007 and 2006, “Equipment, transitional services and other cost of sales” also included costs associated with

non-DISH Network digital receivers and related components sold to international customers and satellite and

transmission expenses, which related to the set-top box business and other assets that were distributed to EchoStar in

connection with the Spin-off.

Subscriber acquisition costs. In addition to leasing receivers, we generally subsidize installation and all or a portion

of the cost of our receiver systems in order to attract new DISH Network subscribers. Our “Subscriber acquisition

costs” include the cost of our receiver systems sold to retailers and other distributors of our equipment, the cost of

receiver systems sold directly by us to subscribers, net costs related to our promotional incentives, and costs related to

installation and acquisition advertising. We exclude the value of equipment capitalized under our lease program for

new subscribers from “Subscriber acquisition costs.”

SAC. Management believes subscriber acquisition cost measures are commonly used by those evaluating

companies in the pay-TV industry. We are not aware of any uniform standards for calculating the “average

subscriber acquisition costs per new subscriber activation,” or SAC, and we believe presentations of SAC may not

be calculated consistently by different companies in the same or similar businesses. Our SAC is calculated as

“Subscriber acquisition costs,” plus the value of equipment capitalized under our lease program for new subscribers,

divided by gross subscriber additions. We include all the costs of acquiring subscribers (e.g., subsidized and