ComEd 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ÈANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended December 31, 2006

OR

‘TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Commission File

Number

Name of Registrant; State of Incorporation; Address of

Principal Executive Offices; and Telephone Number

IRS Employer

Identification Number

1-16169 EXELON CORPORATION

(a Pennsylvania corporation)

10 South Dearborn Street

P.O. Box 805379

Chicago, Illinois 60680-5379

(312) 394-7398

23-2990190

333-85496 EXELON GENERATION COMPANY, LLC

(a Pennsylvania limited liability company)

300 Exelon Way

Kennett Square, Pennsylvania 19348

(610) 765-5959

23-3064219

1-1839 COMMONWEALTH EDISON COMPANY

(an Illinois corporation)

440 South LaSalle Street

Chicago, Illinois 60605-1028

(312) 394-4321

36-0938600

000-16844 PECO ENERGY COMPANY

(a Pennsylvania corporation)

P.O. Box 8699

2301 Market Street

Philadelphia, Pennsylvania 19101-8699

(215) 841-4000

23-0970240

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Name of Each Exchange on

Which Registered

EXELON CORPORATION:

Common Stock, without par value New York, Chicago and

Philadelphia

PECO ENERGY COMPANY:

Cumulative Preferred Stock, without par value: $4.68 Series, $4.40 Series, $4.30

Series and $3.80 Series

New York

Trust Receipts of PECO Energy Capital Trust III, each representing a 7.38%

Cumulative Preferred Security, Series D, $25 stated value, issued by PECO

Energy Capital, L.P. and unconditionally guaranteed by PECO Energy Company

New York

Securities registered pursuant to Section 12(g) of the Act:

COMMONWEALTH EDISON COMPANY:

Common Stock Purchase Warrants, 1971 Warrants and Series B Warrants

Table of contents

-

Page 1

... of Registrant; State of Incorporation; Address of Principal Executive Offices; and Telephone Number IRS Employer Identification Number Commission File Number 1-16169 EXELON CORPORATION (a Pennsylvania corporation) 23-2990190 10 South Dearborn Street P.O. Box 805379 Chicago, Illinois 60680-5379... -

Page 2

... 30, 2006, was as follows: Exelon Corporation Common Stock, without par value Exelon Generation Company, LLC Commonwealth Edison Company Common Stock, $12.50 par value PECO Energy Company Common Stock, without par value $38,019,493,399 Not applicable No established market None The number of shares... -

Page 3

... ...Commonwealth Edison Company ...PECO Energy Company ...Employees ...Environmental Regulation ...Managing the Risks in the Business ...Executive Officers of the Registrants ...RISK FACTORS ...Exelon Corporation ...Exelon Generation Company, LLC ...Commonwealth Edison Company ...PECO Energy Company... -

Page 4

... Events ...CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ...CONTROLS AND PROCEDURES ...Exelon Corporation ...Exelon Generation Company, LLC ...Commonwealth Edison Company ...PECO Energy Company ...OTHER INFORMATION ...DIRECTORS, EXECUTIVE OFFICERS OF THE... -

Page 5

Page No. PART IV ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES ... 379 397 397 398 399 400 401 SIGNATURES ...Exelon Corporation ...Exelon Generation Company, LLC ...Commonwealth Edison Company ...PECO Energy Company ...CERTIFICATION EXHIBITS ... iii -

Page 6

...combined Form 10-K is being filed separately by Exelon Corporation (Exelon), Exelon Generation Company, LLC (Generation), Commonwealth Edison Company (ComEd) and PECO Energy Company (PECO) (collectively, the Registrants). Information contained herein relating to any individual registrant is filed by... -

Page 7

... corporation named Commonwealth Edison Company, which was incorporated in 1907. ComEd's principal executive offices are located at 440 South LaSalle Street, Chicago, Illinois 60605, and its telephone number is 312-394-4321. PECO PECO's energy delivery business consists of the purchase and regulated... -

Page 8

..., ICC-approved standardized supplier forward contracts with ComEd and Ameren Corporation (Ameren). In addition, Power Team markets energy in the wholesale bilateral and spot markets. Generation's retail business provides retail electric and gas services as an unregulated retail energy supplier in... -

Page 9

... of the United States. The generating capacity that Generation controls through long-term contracts is in the Midwest, Southeast and South Central regions. Nuclear Facilities Generation has ownership interests in eleven nuclear generating stations currently in service, consisting of 19 units with 16... -

Page 10

... total electric supply which also includes MWs purchased for resale and fossil and hydroelectric generation. During 2006 and 2005, the nuclear generating facilities operated by Generation achieved a 93.9% and 93.5% capacity factor, respectively. Regulation of Nuclear Power Generation. Generation is... -

Page 11

... Island (c) ...(a) (b) (c) (d) (e) Stations previously owned by ComEd. Stations previously owned by PECO. Stations owned by AmerGen. NRC license renewals have been received for these units. Denotes year in which nuclear unit began commercial operations. 1 2 1 2 1 2 3 1 2 1 2 1 2 3 1 2 1 2 1 1988... -

Page 12

... fuel storage claims and issues. The Standard Contracts with the DOE also required the payment to the DOE of a one-time fee applicable to nuclear generation through April 6, 1983. The fee related to the former PECO units has been paid. Pursuant to the Standard Contracts, ComEd previously elected to... -

Page 13

... current ICC order, ComEd is not permitted to collect amounts for decommissioning subsequent to 2006. Nuclear decommissioning costs associated with the nuclear generating stations formerly or partly owned by PECO continue to be recovered currently through rates charged by PECO to customers. Amounts... -

Page 14

...'s power marketing activities. For additional information regarding Generation's electric generating facilities, see ITEM 2. Properties-Generation. Licenses. Fossil generation plants are generally not licensed and, therefore, the decision on when to retire plants is, fundamentally, a commercial one... -

Page 15

...and transmission of electricity. Open-Access Transmission tariffs established under FERC regulation give Generation access to transmission lines that enable it to participate in competitive wholesale markets. Because Generation sells power in the wholesale markets, Generation is a public utility for... -

Page 16

...-Based Rates Matters Currently, Exelon's entities have been approved by FERC to sell power at market-based rates. On May 19, 2006, FERC issued a Notice of Proposed Rule Making (NOPR) on Market-Based Rates for Wholesale Sales of Electric Energy, Capacity and Ancillary Services by Public Utilities... -

Page 17

... Market-Based Rates Matters and its impact on the Registrants. PJM Reliability Pricing Model (RPM) On August 31, 2005, PJM filed its RPM with FERC to replace its current capacity market rules. The RPM proposal provided for a forward capacity auction using a demand curve and locational deliverability... -

Page 18

...capacity not used to meet customer demand, in the wholesale electricity markets. Generation has also purchased transmission service to ensure that it has reliable transmission capacity to physically move its power supplies to meet customer delivery needs. Power Team also manages the price and supply... -

Page 19

... marketing activities. Power Team also uses financial and commodity contracts for proprietary trading purposes but this activity accounts for only a small portion of Power Team's efforts. At December 31, 2006, Generation's long-term commitments relating to the purchase and sale of energy, capacity... -

Page 20

ComEd and PECO Exelon's regulated energy delivery operations consist of ComEd and PECO. ComEd is engaged principally in the purchase and regulated retail and wholesale sale of electricity and the provision of distribution and transmission services to a diverse base of residential, commercial, ... -

Page 21

...purchase option (PPO) that is based on market-based rates. As of December 31, 2006, one competitive electric generation supplier had been granted approval by the ICC to serve residential customers in Illinois; however, it is not currently supplying electricity to any of ComEd's residential customers... -

Page 22

.... PECO. Under the Pennsylvania Electricity Generation Customer Choice and Competition Act (Competition Act), all of PECO's retail electric customers have the right to choose their generation suppliers. At December 31, 2006, less than 1% of each of PECO's residential and large commercial 17 -

Page 23

... commercial and industrial load were purchasing generation service from competitive electric generation suppliers. Customers who purchase electricity from a competitive electric generation supplier continue to pay a delivery charge to PECO. In addition to retail competition for generation services... -

Page 24

... transmission facilities, are required to provide open access to their transmission facilities under filed tariffs at cost-based rates. Under FERC's Order No. 889, ComEd and PECO are required to comply with FERC's Standards of Conduct regulation, as amended, governing the communication of non-public... -

Page 25

... rate regulation. PECO also provides billing, metering, installation, maintenance and emergency response services. PECO's natural gas supply is provided by purchases from a number of suppliers for terms of up to three years. These purchases are delivered under long-term firm transportation contracts... -

Page 26

...Board ruled that a new election must be conducted. This election took place on November 16, 2006. The employees again voted against union representation. Environmental Regulation General Exelon, Generation, ComEd and PECO are subject to regulation regarding environmental matters by the United States... -

Page 27

...line at the Braidwood Nuclear Generating Station. On March 16, 2006, the Attorney General of the State of Illinois, and the State's Attorney for Will County, Illinois filed...NPL). These potentially responsible parties (PRPs) can be ordered to perform a cleanup, can be sued for costs associated with an... -

Page 28

... or third party. MGP Sites MGPs manufactured gas in Illinois and Pennsylvania from approximately 1850 to the 1950s. ComEd and PECO generally did not operate MGPs as corporate entities but did, however, acquire MGP sites as part of the absorption of smaller utilities. ComEd and PECO have identified... -

Page 29

... power plants, as it had considered in its proposed rulemaking. Generation is currently evaluating its compliance options with regard to the final CAIR and CAMR regulations. Final compliance decisions will be affected by a number of factors, including, but not limited to, the final form of state... -

Page 30

... addressing climate change. Exelon believes that its planned greenhouse gas management efforts, including increased use of renewable energy, its current energy efficiency initiatives and its efforts in the areas of carbon sequestration, will allow it to achieve this goal. The anticipated cost... -

Page 31

... of generation supply. During 2006, the PAPUC issued additional implementation orders and proposed regulations related to compliance schedules, banking of alternative energy credits, compliance, cost recovery, force majeure, alternative compliance payments and voluntary alternative energy purchases... -

Page 32

... to aggressively manage its scheduled refueling outages to minimize their duration and to maintain high nuclear generating capacity factors, resulting in a stable generation base for Generation's short and long-term supply commitments and Power Team trading activities. Operating services arrangement... -

Page 33

...trust funds maintained by Generation. The collections by PECO are based on estimates of decommissioning costs for each of the nuclear facilities in which Generation has an ownership interest, other than AmerGen facilities. The ICC permitted ComEd to recover $73 million per year from retail customers... -

Page 34

... the delivery service rates that will be charged to customers. Appeals are pending related to each order. A third order allows ComEd's residential customers to have the choice to elect to defer any electric rate increases over 10% in each of the years 2007 to 2009. Any deferred balances will... -

Page 35

... costs from customers. To effectively manage its obligation to provide power to meet its customers' demand, PECO has a full-requirements PPA with Generation which reduces PECO's exposure to the volatility of customer demand and market prices through 2010. Transmission congestion. ComEd and PECO... -

Page 36

... and Public Policy Executive Vice President, Exelon, President, Exelon Energy Delivery and President, Exelon Generation Executive Vice President and Chief Human Resources Officer Executive Vice President, Finance and Markets and Chief Financial Officer Senior Vice President and Corporate Controller... -

Page 37

... was Executive Vice President and Chief Financial Officer of Credit Acceptance Corporation; and Vice President, Controller of Kmart Corporation. Mr. Hilzinger was elected as an officer of Exelon effective April 15, 2002. Mr. Hilzinger was Principal Accounting Officer for ComEd and PECO through... -

Page 38

...officer of PECO effective January 1, 2001. Prior to his election to his listed positions, Mr. Galvanoni was Director of Financial Reporting and Analysis, Exelon. Mr. Galvanoni has also served as Director of Accounting and Reporting, Generation; Director of Reporting, Exelon; and was a senior manager... -

Page 39

... over time Exelon will shift from a company with relatively stable cash flows from its regulated affiliates to a company with cash flows that could vary significantly with changes in market prices for electricity and natural gas. Prior to 2007, Generation supplied electricity to ComEd at prices that... -

Page 40

... 31, 2008. Generation's share of this supply is 35%. Because retail customers in both Pennsylvania and Illinois can switch from PECO or ComEd to a competitive electric generation supplier for their energy needs, planning to meet PECO's obligation to supply PECO with all of the energy PECO needs to... -

Page 41

...lower energy sales. Each 24-day outage, depending on the capacity of the station, will decrease the total nuclear annual capacity factor between 0.3% and 0.5%. The number of refueling outages, including the AmerGen plants and the co-owned plants, was 11 in 2006 with 9 planned for 2007. The projected... -

Page 42

... the Atomic Energy Act, related regulations or the terms of the licenses for nuclear facilities. A change in the Atomic Energy Act or the applicable regulations or licenses may require a substantial increase in capital expenditures or may result in increased operating or decommissioning costs and... -

Page 43

...report by unit (annually for Generation's four retired units) addressing Generation's ability to meet the NRC-estimated funding levels (NRC Funding Levels) including scheduled contributions to and earnings on the decommissioning trust funds. As of December 31, 2006, Generation identified trust funds... -

Page 44

... used to meet its long-term supply commitments, including its commitments to ComEd and PECO, are largely dependent on wholesale prices of electricity and Generation's ability to successfully market energy, capacity and ancillary services. The wholesale spot market price of electricity for each hour... -

Page 45

... capacity at a time when those markets are weak. Generation's risk management policies cannot fully eliminate the risk associated with its energy trading activities. Power Team's power trading (including fuel procurement and power marketing) activities expose Generation to risks of commodity price... -

Page 46

... plants through annual, short-term and spot-market purchases. Natural gas is procured through annual, monthly and spot-market purchases. Nuclear fuel assemblies are obtained through long-term uranium concentrate inventory and supply contracts, contracted conversion services, contracted enrichment... -

Page 47

... customer rates for delivery service and procurement of electricity increased. Additionally, ComEd's residential customers have the choice to elect to defer certain increases to future periods. See Note 4 of the Combined Notes to the Consolidated Financial Statements for more information. PECO's gas... -

Page 48

... costs, purchased power and potentially renewable energy credit costs and capital expenditures. ComEd and PECO continue to monitor developments related to RPSs at the Federal and state levels. For additional information, see ITEM 1. Business "Environmental Regulation-Renewable and Alternative Energy... -

Page 49

... against claims by customers relating to failure of service. Under Illinois law, however, ComEd can be required to pay damages to its customers in the event of extended outages affecting large numbers of its customers. The effect of higher purchased gas cost charges to customers may decrease PECO... -

Page 50

...for PECO. In addition, increased purchased gas cost charges to customers also may result in increased bad debt expense from an increase in the number of uncollectible customer balances. The effects of weather and the related impact on electricity and gas usage may decrease ComEd's and PECO's results... -

Page 51

... of restructured electricity markets in public forums escalated during 2006 as retail rate freezes expired in a number of states as fuel prices increased, thereby driving up retail prices for electricity. ComEd's customers are experiencing increases in their costs for electric service beginning in... -

Page 52

...of Exelon's ownership interest in ComEd; possible reductions in credit ratings which could increase borrowing costs; uncertainty in collection of receivables from ComEd for services provided by BSC; uncertainty in the enforcement of Generation's rights under its supplier forward contracts with ComEd... -

Page 53

...Federal and/or state legislation to regulate carbon emissions could occur in the future. If these plans become effective, Exelon and Generation may incur costs to either further limit the emissions from certain of their fossilfuel fired facilities or in procuring emission allowance credits issued by... -

Page 54

... Service (IRS), such as Exelon's decision to defer the tax gain on ComEd's 1999 sale of its fossil generating assets. The Registrants also estimate their ability to utilize tax benefits, including those in the form of carryforwards for which the benefits have already been reflected, and tax credits... -

Page 55

...for state income taxes reported by Exelon on an annual basis. However, management's estimates of future income tax rates are affected by various factors and actual income tax obligations may differ from management's estimates. See Note 4 of the Combined Notes to Consolidated Financial Statements for... -

Page 56

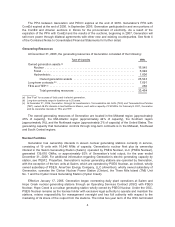

... company's business, financial condition, operating results and prospects. ITEM 1B. UNRESOLVED STAFF COMMENTS Exelon, Generation, ComEd and PECO None. ITEM 2. PROPERTIES Generation The following table sets forth Generation's owned net electric generating capacity by station at December 31, 2006... -

Page 57

... Salem, capacity reflects the annual mean rating. All other stations, including Salem, reflect a summer rating. (c) All nuclear stations are boiling water reactors except Braidwood, Byron, Salem and Three Mile Island, which are pressurized water reactors. (d) Net generation capacity is stated at... -

Page 58

... Generation's consolidated financial condition or results of operations. ComEd and PECO The electric substations and a portion of the transmission rights of way are located on property owned by ComEd and PECO. A significant portion of the electric transmission and distribution facilities is located... -

Page 59

... storage capacity of 1,980,000 gallons and a peaking capability of 25 mmcf/day. In addition, PECO owns 29 natural gas city gate stations at various locations throughout its gas service territory. Mortgages The principal plants and properties of ComEd are subject to the lien of ComEd's Mortgage dated... -

Page 60

... on a monthly basis regarding purchases made by Exelon of its common stock during the fourth quarter of 2006. Maximum Number (or Approximate Dollar Value) of Shares that May Yet Be Purchased Under the Plans or Programs (b) Period Total Number of Shares Purchased (a) Average Price Paid per... -

Page 61

... Under applicable Federal law, Generation, ComEd and PECO can pay dividends only from retained, undistributed or current earnings. A significant loss recorded at Generation, ComEd or PECO may limit the dividends that these companies can distribute to Exelon. Under Illinois law, ComEd may not pay any... -

Page 62

... the use of share repurchases from time to time, when authorized by the Board of Directors, to return cash or balance sheet capacity to Exelon shareholders after funding maintenance capital and other commitments and in the absence of higher value-added growth opportunities. Previously, Exelon had... -

Page 63

...goodwill impairment charge of $776 million and $1.2 billion in 2006 and 2005, respectively. (b) Change between 2006 and 2005 was primarily due to the impact of adopting SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No... -

Page 64

... Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operation included in ITEM 7 of this Report on Form 10-K. The results of operations for Generation's retail business are not included in periods prior to 2004. (in millions) 2006 For the Years... -

Page 65

... to and should be read in conjunction with ComEd's Consolidated Financial Statements and Management's Discussion and Analysis of Financial Condition and Results of Operation included in ITEM 7 of this Report on Form 10-K. (in millions) 2006 For the Years Ended December 31, 2005 2004 2003 2002... -

Page 66

... of Financial Condition and Results of Operation included in ITEM 7 of this Report on Form 10-K. (in millions) 2006 For the Years Ended December 31, 2005 2004 2003 2002 Statement of Operations data: Operating revenues ...Operating income ...Income before cumulative effect of a change in accounting... -

Page 67

... contracted electric generating facilities, its wholesale energy marketing operations and competitive retail sales operations. ComEd, whose business consists of the purchase and regulated retail and wholesale sale of electricity and the provision of distribution and transmission services to retail... -

Page 68

... ICC's July 2006 rate order; a charge of approximately $55 million for the write-off of capitalized costs associated with the now terminated proposed merger with PSEG; increased severance and severance-related charges; unfavorable weather conditions in the ComEd and PECO service territories; reduced... -

Page 69

... assistance programs. ComEd is currently evaluating this request. This order is subject to rehearing and appeal. ComEd Rate Case-On July 26, 2006, the ICC issued its order in the Rate Case approving a revenue increase of approximately $8 million and the recovery of several items that previously... -

Page 70

.... Current market prices for electricity have increased significantly over the past few years due to the rise in natural gas and fuel prices. As a result, PECO customers' generation rates are below current wholesale energy market prices and Generation's margins on sales in excess of ComEd's and PECO... -

Page 71

... benefits and rising payroll costs due to inflation. Also, Exelon will continue to incur significant capital costs associated with its commitment to produce and deliver energy reliably to its customers. Increasing capital costs may include the price of uranium which fuels the nuclear facilities... -

Page 72

... activities which are validated by comparison to current decommissioning projects and other third-party estimates. Decommissioning cost studies are updated, on a rotational basis, for each of Generation's nuclear units at a minimum of every five years. Cost Escalation Studies. Generation uses cost... -

Page 73

... Statements for further information regarding the Rate Case. In the assessments, Exelon and ComEd estimated the fair value of the ComEd reporting unit using a probability-weighted, discounted cash flow model with multiple scenarios. The fair value incorporates management's assessment of current... -

Page 74

... (Exelon, Generation, ComEd and PECO) The Registrants have a significant investment in electric generation assets and electric and natural gas transmission and distribution assets. Depreciation of these assets is generally provided over their estimated service lives on a straight-line basis using... -

Page 75

...its electric and gas assets, which resulted in the implementation of new depreciation rates effective March 2006. The impact of the new rates was not material. Defined Benefit Pension and Other Postretirement Benefits (Exelon, Generation, ComEd and PECO) Exelon sponsors defined benefit pension plans... -

Page 76

...8.75%, respectively, for estimating its 2007 pension costs. Additionally, Exelon will use a discount rate and expected return on plan assets of 5.85% and 7.87%, respectively, for estimating its 2007 other postretirement benefit costs. The following tables illustrate the effects of changing the major... -

Page 77

...under applicable accounting standards. As these assumptions change from period to period, recorded pension and postretirement benefit amounts and funding requirements could also change. Regulatory Accounting (Exelon, ComEd and PECO) Exelon, ComEd and PECO account for their regulated electric and gas... -

Page 78

also utilizes energy option contracts and energy financial swap arrangements to limit the market price risk exposure associated with forward energy commodity prices. Additionally, Generation enters into energy-related derivatives for trading purposes. ComEd has derivatives related to one wholesale ... -

Page 79

... value of interest-rate swap agreements, the Registrants use external dealer prices and/or internal valuation models that utilize assumptions of available market pricing curves. Accounting for Contingencies (Exelon, Generation, ComEd and PECO) In the preparation of their financial statements, the... -

Page 80

...for both open claims asserted and an estimate of claims incurred but not reported (IBNR). The IBNR reserve is estimated based on actuarial assumptions and analysis and is updated annually. Projecting future events, such as the number of new claims to be filed each year, the average cost of disposing... -

Page 81

...on daily customer usage measured by generation or gas throughput volume, estimated customer usage by class, estimated losses of energy during delivery to customers and applicable customer rates. Increases in volumes delivered to the utilities' customers and favorable rate mix due to changes in usage... -

Page 82

...Income. Exelon's net income for 2006 reflects higher realized prices on market sales and increased nuclear output at Generation; a one-time benefit of approximately $158 million to recover previously incurred severance costs approved by the December 2006 amended ICC rate order; a one-time benefit of... -

Page 83

... a one-time benefit of $201 million to recover certain costs approved by the ICC's July 2006 rate order and the ICC's December 2006 amended rate order; the impact of the reduction in Generation's estimated nuclear asset retirement obligation; mark-to-market gains associated with Exelon's investment... -

Page 84

... service entities, including BSC, Enterprises, investments in synthetic fuelproducing facilities and intersegment eliminations. Net Income (Loss) Before Cumulative Effect of Changes in Accounting Principles by Business Segment 2006 2005 Favorable (unfavorable) variance Generation ...ComEd ...PECO... -

Page 85

... expense and lower other income. The increase in Generation's revenue, net of purchased power and fuel expense was due to realized revenues associated with forward sales contracts entered into in prior periods which were recognized at higher prices, combined with lower purchased power and fuel... -

Page 86

... scheduled rate increase through 2010 under PECO's 1998 restructuring settlement. This rate increase will have a favorable effect on Generation's operating income in future years. Wholesale and retail electric sales. The changes in Generation's wholesale and retail electric sales for 2006 compared... -

Page 87

... including capacity, energy and fuel costs associated with tolling agreements. Generation experienced a decrease of $319 million due to lower volumes of purchased power in the market as a result of a lower demand from affiliates. Additionally, overall lower prices paid for purchased power in 2006... -

Page 88

...fuel costs associated with electric sales. Average electric supply cost does not include fuel costs associated with retail gas sales. n.m. Not meaningful Nuclear fleet operating data and purchased power cost data for 2006 and 2005 were as follows: 2006 2005 Nuclear fleet capacity factor ...Nuclear... -

Page 89

... related to staff augmentation and recurring maintenance work at Nuclear and Power, a $19 million increase in nuclear refueling outage costs associated with the additional planned refueling outage days during 2006 as compared to 2005, and higher costs for inspection and maintenance activities... -

Page 90

...) Net Loss. ComEd's decreased net loss in 2006 compared to 2005 was driven by a smaller impairment of goodwill in 2006, lower purchased power expense and one-time benefits associated with reversing previously incurred expenses as a result of the July 2006 and December 2006 ICC rate orders as more... -

Page 91

... the volume of deliveries, but affects revenue collected from customers related to supplied energy and generation service. As of December 31, 2006, one competitive electric generation supplier had been granted approval to serve residential customers in the ComEd service territory. However, they are... -

Page 92

... conditions in the ComEd service territory relative to the prior year. Customer choice. The decrease in purchased power expense from customer choice was primarily due to more ComEd non-residential customers electing to purchase energy from a competitive electric generation supplier. PJM transmission... -

Page 93

... 2006 ICC rate order and the December 2006 ICC order on rehearing, ComEd recorded one-time benefits associated with reversing previously incurred expenses, including MGP costs, severance costs and procurement case costs. See Notes 4 and 18 of the Combined Notes to Consolidated Financial Statements... -

Page 94

... of receivable in 2005 ...Loss on disposition of assets and investments, net ...Other ...Increase in other, net ... $87 15 (3) (3) (4) $92 (a) As a result of the July 2006 ICC rate order, ComEd recorded a one-time benefit associated with reversing previously incurred expenses to retire debt early... -

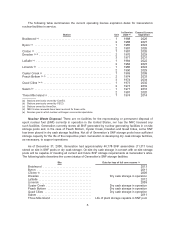

Page 95

... tariffed rates. (b) Delivery only service reflects customers electing to receive generation service from a competitive electric generation supplier. Electric Revenue 2006 2005 Variance % Change Full service (a) Residential ...Small commercial & industrial ...Large commercial & industrial ...Public... -

Page 96

...an energy charge at market rates, transmission and distribution charges, and a CTC through December 2006. (c) Delivery only revenues reflect revenue under tariff rates from customers electing to receive electricity from a competitive electric generation supplier, which includes a distribution charge... -

Page 97

...first quarter 2006 rates. Customer choice. All PECO customers have the choice to purchase energy from a competitive electric generation supplier. This choice does not impact the volume of deliveries, but affects revenue collected from customers related to supplied energy and generation service. PECO... -

Page 98

... with customer choice reflected customers from all customer classes returning to PECO as their electric supplier as a result of rising wholesale energy prices and a number of competitive electric generation suppliers exiting the market during 2005 and 2006. Unbilled revenue-change in estimate. In... -

Page 99

... as a result of rising wholesale energy prices and a number of competitive electric generation suppliers exiting the market during 2005 and 2006. PJM transmission. The increase in PJM transmission expense reflects increased peak demand and consumption by PECO-supplied customers due to load growth as... -

Page 100

...higher average accounts receivable balances in 2006 compared to 2005 resulting from increased revenues; (ii) changes in PAPUC-approved regulations related to customer payment terms; and (iii) an increase in the number of low-income customers participating in customer assistance programs, which allow... -

Page 101

... rates. (b) Delivery only service reflects customers receiving electric generation service from a competitive electric generation supplier. Electric Revenue 2006 2005 Variance % Change Full service Residential ...Small commercial & industrial ...Large commercial & industrial ...Public authorities... -

Page 102

... Delivery only revenue reflects revenue from customers receiving generation service from a competitive electric generation supplier, which includes a distribution charge and a CTC. (c) Wholesale and miscellaneous revenues include transmission revenue from PJM and other wholesale energy sales. PECO... -

Page 103

... increase in the number of customers choosing ComEd or PECO as their electric supplier and higher transmission revenues, partially offset by decreased CTC collections at ComEd. The increase in revenues from non-affiliates at Generation was primarily due to higher prices on energy sold in the market... -

Page 104

...for 2004. The goodwill impairment charge increased the effective income tax rate from continuing operations by 22.3% for 2005. See Note 12 of the Combined Notes to the Consolidated Financial Statements for further discussion of the change in the effective income tax rate. Discontinued Operations. On... -

Page 105

... includes corporate operations, shared service entities, including BSC, Enterprises, investments in synthetic fuelproducing facilities and intersegment eliminations. Results of Operations-Generation 2005 2004 Favorable (unfavorable) variance Operating revenues ...Operating expenses Purchased power... -

Page 106

... periods in the ComEd and PECO service territories and an increase in the number of customers returning from competitive electric generation suppliers in 2005 compared to the prior year. Wholesale and retail electric sales. The changes in Generation's wholesale and retail electric sales for 2005... -

Page 107

... capacity, energy and fuel costs). Generation experienced overall higher realized prices for purchased power in 2005 compared to 2004, resulting in a $654 million increase. This was offset by a decrease of $327 million due to lower volumes of purchased power in the market as a result of more demand... -

Page 108

... to overall energy market conditions resulting in higher prices for raw materials (e.g., oil, natural gas and coal) used in the production of electricity. Additionally, there was an increase of $16 million related to higher nuclear and fossil generation need to meet affiliates' demand. Fuel Resale... -

Page 109

... 2004 ...Tamuin International ...Accrual for estimated future asbestos-related bodily injury claims ...Nuclear operating services agreement ...Pension, payroll and benefit costs ...Boston Generating ...Decommissioning-related activity ...Other ...Increase in operating and maintenance expense ...This... -

Page 110

... million realized in the second quarter of 2005 related to the decommissioning trust fund investments for the AmerGen plants, primarily associated with changes in Generation's investment strategy. Effective Income Tax Rate. The effective income tax rate from continuing operations was 39.0% for 2005... -

Page 111

... demand for electricity is affected by weather conditions. In ComEd's service territory, cooling and heating degree days were 90% and 1% higher, respectively, than the prior year. Customer choice. All ComEd customers have the choice to purchase energy from a competitive electric generation supplier... -

Page 112

... conditions in the ComEd service territory, which increased the amount of electricity sold. Customer choice. The increase in purchased power expense from customer choice was primarily due to fewer ComEd non-residential customers electing to purchase energy from a competitive electric generation... -

Page 113

...: Increase (decrease) Severance-related expenses (a) ...Employee fringe benefits (b) ...Pension expense and deferred compensation (c) ...Allowance for uncollectible accounts ...Injuries and damages ...Corporate allocations (b) ...Storm costs ...Contractors ...PSEG merger integration costs ...Other... -

Page 114

...was received for Illinois electricity distribution taxes. Interest Expense, Net. The reduction in interest expense, net for 2005 compared to 2004 was primarily due to long-term debt retirements and prepayments in 2004 pursuant to Exelon's accelerated liability management plan and scheduled payments... -

Page 115

... tariffed rates. (b) Delivery only service reflects customers electing to receive generation service from a competitive electric generation supplier. Electric Revenue 2005 2004 Variance % Change Full service Residential ...Small commercial & industrial ...Large commercial & industrial ...Public... -

Page 116

... Delivery only revenues reflect revenue under tariff rates from customers electing to receive electricity from a competitive electric generation supplier, which includes a distribution charge and a CTC. Prior to ComEd's full integration into PJM on May 1, 2004, ComEd's transmission charges received... -

Page 117

... average rate for 2004. Customer choice. All PECO customers have the choice to purchase energy from a competitive electric generation supplier. This choice does not impact the volume of deliveries, but affects revenue collected from customers related to supplied energy and generation service. PECO... -

Page 118

...PPA with Generation. Fuel expense for gas increased due to higher gas prices. See "Operating Revenues" above. Customer choice. The increase in purchased power expense from customer choice was primarily due to a significant number of residential customers returning to PECO as their energy provider in... -

Page 119

... due to increases in vegetation management services compared to the prior year at PECO. (b) Consists of salary continuance severance costs, curtailment charges for pension and other post retirement benefits, and special termination benefit charges related to other postretirement benefits. The... -

Page 120

... Financial Statements for further discussion of the adoption of FIN 47. PECO Electric Operating Statistics and Revenue Detail PECO's electric sales statistics and revenue detail are as follows: Retail Deliveries-(in GWhs) 2005 2004 Variance % Change Full service (a) Residential ...Small commercial... -

Page 121

... tariffed rates, which includes the cost of energy, the cost of the transmission and the distribution of the energy and a CTC. (b) Delivery only revenue reflects revenue from customers receiving generation service from a competitive electric generation supplier, which includes a distribution charge... -

Page 122

... from the sale of electric energy to wholesale customers, including ComEd and PECO. Generation's future cash flows from operating activities will be affected by future demand for and market prices of energy and its ability to continue to produce and supply power at competitive costs as well as to... -

Page 123

...the changes in commercial paper, income taxes and the current portion of long-term debt. The increase in cash flows from operations during 2006 was primarily the result of $2 billion of discretionary contributions to Exelon's pension plans during 2005, which was initially funded through a term loan... -

Page 124

...changes in market prices relative to positions with counterparties. During 2006 and 2005, Generation had net payments of approximately $220 million and $165 million, respectively, primarily due to increased use of financial instruments to economically hedge future sales of power and future purchases... -

Page 125

... and upgrades to existing facilities (including material condition improvements during nuclear refueling outages) and nuclear fuel. Generation anticipates that its capital expenditures will be funded by internally generated funds, borrowings or capital contributions from Exelon. ComEd and PECO... -

Page 126

..., Exelon settled interest rate swaps for a net payment of $38 million and paid approximately $12 million of fees in connection with the debt offering. In 2005, ComEd used funding received from $324 million of commercial paper to retire long-term debt. From time to time and as market conditions... -

Page 127

... Calumet), a subsidiary of Peoples Energy Corporation, were joint owners of Southeast Chicago Energy Project, LLC (SCEP), a 350-megawatt natural gas-fired, peaking electric power plant located in Chicago, Illinois, which began operation in 2002. In 2002, Generation and Peoples Calumet owned 70... -

Page 128

... in other financing activities during 2006 and 2005, respectively. Credit Issues Exelon Credit Facilities Exelon meets its short-term liquidity requirements primarily through the issuance of commercial paper by the Registrants. At December 31, 2006, Exelon, Generation, ComEd and PECO have access to... -

Page 129

... the agreement at the time of borrowing. In the cases of Exelon, Generation and PECO, the maximum LIBOR adder is 65 basis points; and in the case of ComEd, it is 200 basis points. The average interest rates on commercial paper in 2006 for Exelon, Generation, ComEd and PECO were approximately 5.02... -

Page 130

...' securities ratings at December 31, 2006: Securities Moody's Investors Service Standard & Poor's Corporation Fitch Ratings. Exelon Generation ComEd PECO Senior unsecured debt Commercial paper Senior unsecured debt Commercial paper Senior unsecured debt Senior secured debt Commercial paper... -

Page 131

... the short-term and long-term security ratings of ComEd due to perceived political risk related to the rate freeze extension proposal. S&P downgraded ComEd's senior unsecured debt to BB+, which is below investment grade. The ratings on Exelon, PECO and Generation were affirmed. The ratings for all... -

Page 132

.... Under applicable law, Generation, ComEd and PECO can pay dividends only from retained, undistributed or current earnings. A significant loss recorded at Generation, ComEd or PECO may limit the dividends that these companies can distribute to Exelon. At December 31, 2006, Exelon had retained... -

Page 133

... commitments represent Generation's expected payments under these arrangements at December 31, 2006. Expected payments include certain capacity charges which are contingent on plant availability. Does not include ComEd's supplier forward contracts as these contracts do not require purchases of fixed... -

Page 134

... Statements for further detail on ComEd's supplier forward contracts. (c) On February 20, 2003, ComEd entered into separate agreements with Chicago and with Midwest Generation (Midwest Agreement). Under the terms of the agreement with Chicago, ComEd will pay Chicago $60 million over ten years... -

Page 135

... Corporation (Distrigas) for gas supply, primarily for the Boston Generating units. Under the agreement, gas purchase prices from Distrigas are indexed to the New England gas markets. Exelon New England has guaranteed Mystic's financial obligations to Distrigas under the long-term supply... -

Page 136

... to Consolidated Financial Statements for discussion of Exelon's commercial commitments as of December 31, 2006. Refund Claims ComEd and PECO have several pending tax refund claims seeking acceleration of certain tax deductions and additional tax credits. ComEd and PECO are unable to estimate the... -

Page 137

...as long-term debt to financing trusts within the Consolidated Balance Sheets. Effective December 31, 2003, ComEd Financing II, ComEd Financing III, ComEd Funding, LLC, ComEd Transitional Funding Trust, PECO Trust III and PETT were deconsolidated from the financial statements of Exelon in conjunction... -

Page 138

... maintained. Such losses could have a material adverse effect on Exelon and Generation's financial condition and their results of operations and cash flows. PECO Accounts Receivable Agreement PECO is party to an agreement with a financial institution under which it can sell or finance with limited... -

Page 139

..., vice president of corporate planning, vice president of strategy, vice president of audit services and officers representing Exelon's business units. The RMC reports to the Exelon Board of Directors on the scope of the risk management activities. Commodity Price Risk (Exelon, Generation and ComEd... -

Page 140

... Hedging Activities. Electricity available from Generation's owned or contracted generation supply in excess of Generation's obligations to customers, including ComEd's and PECO's retail load, is sold into the wholesale markets. To reduce price risk caused by market fluctuations, Generation enters... -

Page 141

...the level of forward prices and volatility factors as of December 31, 2006 and may change as a result of changes in these factors. Management uses its best estimates to determine the fair value of commodity and derivative contracts Generation holds and sells. These estimates consider various factors... -

Page 142

...-flow hedges for the years ended December 31, 2006 and December 31, 2005, providing insight into the drivers of the changes (new hedges entered into during the period and changes in the value of existing hedges). Information related to energy merchant activities is presented separately from interest... -

Page 143

... 31, 2006, the fair value of this contract of $6 million was recorded on ComEd's Consolidated Balance Sheet as a current liability. ComEd has exposure to commodity price risk in relation to ancillary services that are purchased from PJM. Credit Risk (Exelon, Generation, ComEd and PECO) Generation... -

Page 144

... not include accounts receivable exposure. $944 40 10 3 $997 $ 61 13 - 1 $ 75 $- - - - $- $1,005 53 10 4 $1,072 Collateral. As part of the normal course of business, Generation routinely enters into physical or financially settled contracts for the purchase and sale of capacity, energy, fuels... -

Page 145

... is managed by credit and collection policies which are consistent with state regulatory requirements. ComEd and PECO are each currently obligated to provide service to all electric customers within their respective franchised territories. ComEd and PECO record a provision for uncollectible accounts... -

Page 146

...generation suppliers, may act as agents to provide a single bill and provide associated billing and collection services to retail customers located in PECO's retail electric service territory. Currently, there are no third parties providing billing of PECO's charges to customers or advanced metering... -

Page 147

... Balance Sheets. The mix of securities in the trust funds is designed to provide returns to be used to fund decommissioning and to compensate Generation for inflationary increases in decommissioning costs; however, the equity securities in the trust funds are exposed to price fluctuations... -

Page 148

... its credit ratings and general business conditions, as well as that of the utility industry in general. If these conditions deteriorate to where Generation no longer has access to the capital markets at reasonable terms, Generation has access to a revolving credit facility that Generation currently... -

Page 149

..., commercial commitments and off-balance sheet obligations is set forth under "Contractual Obligations and Off-Balance Sheet Obligations" in "EXELON CORPORATION-Liquidity and Capital Resources" of this Report. Critical Accounting Policies and Estimates See Exelon, Generation, ComEd and PECO-Critical... -

Page 150

.... Capital resources are used primarily to fund ComEd's capital requirements, including construction, retirement of debt, the payment of dividends and contributions to Exelon's pension plans. ComEd did not pay a dividend during 2006. Cash Flows from Operating Activities A discussion of items... -

Page 151

..., commercial commitments and off-balance sheet obligations is set forth under "Contractual Obligations and Off-Balance Sheet Obligations" in "EXELON CORPORATION-Liquidity and Capital Resources" of this Report. Critical Accounting Policies and Estimates See Exelon, Generation, ComEd and PECO-Critical... -

Page 152

...paper program. See the "Credit Issues" section of "Liquidity and Capital Resources" for further discussion. Capital resources are used primarily to fund PECO's capital requirements, including construction, retirement of debt, the payment of dividends and contributions to Exelon's pension plans. Cash... -

Page 153

... under "Contractual Obligations, Commercial Commitments and Off-Balance Sheet Obligations" in "EXELON CORPORATION-Liquidity and Capital Resources" of this Report. Critical Accounting Policies and Estimates See Exelon, Generation, ComEd and PECO-Critical Accounting Policies and Estimates above for... -

Page 154

... the effectiveness of Exelon's internal control over financial reporting as of December 31, 2006 has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which appears on the next page of this Annual Report on Form 10-K. February 13... -

Page 155

...: We have completed integrated audits of Exelon Corporation's consolidated financial statements and of its internal control over financial reporting as of December 31, 2006, in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our opinions, based on our... -

Page 156

... as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable... -

Page 157

...of Generation's management. Our responsibility is to express an opinion on these financial statements and the financial statement schedule based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 158

... of ComEd's management. Our responsibility is to express an opinion on these financial statements and the financial statement schedule based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 159

... of PECO's management. Our responsibility is to express an opinion on these financial statements and the financial statement schedule based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States... -

Page 160

Exelon Corporation and Subsidiary Companies Consolidated Statements of Operations For the Years Ended December 31, 2006 2005 2004 (in millions, except per share data) Operating revenues ...Operating expenses Purchased power ...Fuel ...Operating and maintenance ...Impairment of goodwill ...... -

Page 161

...Issuance of short-term debt ...Retirement of short-term debt ...Change in short-term debt ...Dividends paid on common stock ...Proceeds from employee stock plans ...Purchase of treasury stock ...Other financing activities ...Net cash flows used in financing activities ...Increase (decrease) in cash... -

Page 162

... and Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Assets Current assets Cash and cash equivalents ...Restricted cash and investments ...Accounts receivable, net Customer ...Other ...Mark-to-market derivative assets ...Inventories, net, at average cost Fossil... -

Page 163

... Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Liabilities and shareholders' equity Current liabilities Commercial paper and notes payable ...Long-term debt due within one year ...Long-term debt to ComEd Transitional Funding Trust and PECO Energy Transition... -

Page 164

... 31, 2004 ...666,688 Net income ...- Long-term incentive plan activity ...8,862 Employee stock purchase plan issuances ...259 Common stock purchases ...- Common stock dividends declared ...- Other comprehensive loss, net of income taxes of $(127) ...- Balance, December 31, 2005 ...675,809 Net income... -

Page 165

Exelon Corporation and Subsidiary Companies Consolidated Statements of Comprehensive Income For the Years Ended December 31, 2006 2005 2004 (in millions) Net income ...Other comprehensive income (loss) Minimum pension liability, net of income taxes of $674, $3, and $(228), respectively ...Net ... -

Page 166

Exelon Generation Company, LLC and Subsidiary Companies Consolidated Statements of Operations For the Years Ended December 31, 2006 2005 2004 (in millions) Operating revenues Operating revenues ...Operating revenues from affiliates ...Total operating revenues ...Operating expenses Purchased power ... -

Page 167

...activities ...Changes in assets and liabilities: Accounts receivable ...Receivables from and payables to affiliates, net ...Inventories ...Accounts payable, accrued expenses and other current liabilities ...Counterparty collateral asset ...Counterparty collateral liability ...Income taxes ...Pension... -

Page 168

Exelon Generation Company, LLC and Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Assets Current assets Cash and cash equivalents ...Restricted cash and investments ...Accounts receivable, net Customer ...Other ...Mark-to-market derivative assets ...... -

Page 169

Exelon Generation Company, LLC and Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Liabilities and member's equity Current liabilities Commercial paper ...Long-term debt due within one year ...Accounts payable ...Mark-to-market derivative liabilities ...... -

Page 170

Exelon Generation Company, LLC and Subsidiary Companies Consolidated Statements of Changes in Member's Equity Accumulated Other Comprehensive Income (Loss) Total Member's Equity (in millions) Membership Interest Undistributed Earnings Balance, December 31, 2003 ...Net income ...Non-cash ... -

Page 171

Exelon Generation Company, LLC and Subsidiary Companies Consolidated Statements of Comprehensive Income For the Years Ended December 31, 2006 2005 2004 (in millions) Net income ...Other comprehensive income (loss) Net unrealized gain (loss) on cash-flow hedges, net of income taxes of $371, $(116) ... -

Page 172

Commonwealth Edison Company and Subsidiary Companies Consolidated Statements of Operations For the Years Ended December 31, 2006 2005 2004 (in millions) Operating revenues Operating revenues ...Operating revenues from affiliates ...Total operating revenues ...Operating expenses Purchased power ...... -

Page 173

... operating activities ...Changes in assets and liabilities: ...Accounts receivable ...Inventories ...Accounts payable, accrued expenses and other current liabilities ...Receivables from and payables to affiliates, net ...Income taxes ...Pension and non-pension postretirement benefit contributions... -

Page 174

Commonwealth Edison Company and Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Assets Current assets Cash and cash equivalents ...Accounts receivable, net Customer ...Other ...Inventories, net, at average cost ...Deferred income taxes ...Receivables from ... -

Page 175

Commonwealth Edison Company and Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Liabilities and shareholders' equity Current liabilities Commercial paper ...Long-term debt due within one year ...Long-term debt to ComEd Transitional Funding Trust due within one ... -

Page 176

Commonwealth Edison Company and Subsidiary Companies Consolidated Statements of Changes in Shareholders' Equity Preferred Retained Accumulated and Other Receivable Earnings Retained Other Total Common Preference Paid In from (Deficits) Earnings Comprehensive Shareholders' Stock Stock Capital Parent ... -

Page 177

Commonwealth Edison Company and Subsidiary Companies Consolidated Statements of Comprehensive Income (Loss) For the Years Ended December 31, (in millions) 2006 2005 2004 Net income (loss) ...Other comprehensive income (loss) Foreign currency translation adjustment, net of income taxes of $0, $(1) ... -

Page 178

PECO Energy Company and Subsidiary Companies Consolidated Statements of Operations For the Years Ended December 31, 2006 2005 2004 (in millions) Operating revenues Operating revenues ...Operating revenues from affiliates ...Total operating revenues ...Operating expenses Purchased power ...... -

Page 179

...-cash operating activities ...Changes in assets and liabilities: Accounts receivable ...Inventories ...Accounts payable, accrued expenses and other current liabilities ...Receivables from and payables to affiliates, net ...Income taxes ...Pension and non-pension postretirement benefit contributions... -

Page 180

... Companies Consolidated Balance Sheets December 31, 2006 2005 (in millions) Assets Current assets Cash and cash equivalents ...Restricted cash ...Accounts receivable, net Customer ...Other ...Affiliate ...Inventories, net, at average cost Gas ...Materials and supplies ...Contributions to Exelon... -

Page 181

...Subsidiary Companies Consolidated Balance Sheets (in millions) December 31, 2006 2005 Liabilities and shareholders' equity Current liabilities Commercial paper ...Borrowings from Exelon intercompany money pool ...Long-term debt to PECO Energy Transition Trust due within one year ...Accounts payable... -

Page 182

PECO Energy Company and Subsidiary Companies Consolidated Statements of Changes in Shareholders' Equity Accumulated Receivable Other Total Common Preferred from Retained Comprehensive Shareholders' Stock Stock Parent Earnings Income (Loss) Equity (in millions) Balance, December 31, 2003 ...$1,999 ... -

Page 183

PECO Energy Company and Subsidiary Companies Consolidated Statements of Comprehensive Income For the Years Ended December 31, 2006 2005 2004 (in millions) Net income ...Other comprehensive income (loss) Change in net unrealized gain (loss) on cash-flow hedges, net of income taxes of $(2), $(3) and... -

Page 184

... retail sales operations of Exelon Generation Company, LLC (Generation). The energy delivery businesses include the purchase and regulated retail and wholesale sale of electricity and the provision of distribution and transmission services by Commonwealth Edison Company (ComEd) in northern Illinois... -

Page 185

... net income. Use of Estimates (Exelon, Generation, ComEd and PECO) The preparation of financial statements of each of Exelon, Generation, ComEd and PECO (collectively, the Registrants) in conformity with accounting principles generally accepted in the United States (GAAP) requires management to make... -

Page 186

... and Exchange Commission (SEC) under the Public Utility Holding Company Act of 1935 (PUHCA) prior to its repeal effective February 8, 2006, and ComEd and PECO apply Statement of Financial Accounting Standards (SFAS) No. 71, "Accounting for the Effects of Certain Types of Regulation," (SFAS No... -

Page 187

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 188

... to the capital of the party receiving the benefit. Losses on Reacquired and Retired Debt (Exelon, Generation, ComEd and PECO) Consistent with rate recovery for rate-making purposes, ComEd's and PECO's recoverable losses on reacquired debt related to regulated operations are deferred and amortized... -

Page 189

... and charged to fuel expense when used. PECO has several long-term storage contracts for natural gas as well as a liquefied natural gas storage facility. Materials and Supplies. Materials and supplies inventory generally includes the average costs of transmission, distribution and generating plant... -

Page 190

... energy costs of $39 million were recorded as current assets on Exelon's and PECO's Consolidated Balance Sheets. Leases (Exelon, Generation, ComEd and PECO) The Registrants account for leases in accordance with SFAS No. 13, "Accounting for Leases" and determine whether their long-term purchase power... -

Page 191

... Electric Utility Plant and Note 19-Supplemental Financial Information for additional information regarding property, plant and equipment. Nuclear Fuel (Exelon and Generation) The cost of nuclear fuel is capitalized and charged to fuel expense using the unit-of-production method. The estimated cost... -

Page 192

... (Exelon, Generation, ComEd and PECO) Depreciation is generally provided over the estimated service lives of property, plant and equipment on a straight-line basis using the composite method. ComEd's depreciation includes a provision for estimated removal costs as authorized by the ICC. Annual... -

Page 193

... Financial Statements-(Continued) (Dollars in millions, except per share data unless otherwise noted) Average Service Life Percentage by Asset Category Exelon Generation ComEd PECO 2006 Electric-transmission and distribution (a) ...Electric-generation ...Gas (a) ...Common-electric and gas... -

Page 194

... funds. The rates used for capitalizing AFUDC are computed under a method prescribed by regulatory authorities (see Note 19- Supplemental Financial Information). The following table summarizes total cost incurred, capitalized interest and credits of AFUDC by year: Exelon Generation ComEd PECO 2006... -

Page 195

... impairment charges Exelon and ComEd recorded in 2006 and 2005, respectively. Derivative Financial Instruments (Exelon, Generation, ComEd and PECO) The Registrants may enter into derivatives to manage their exposure to fluctuations in interest rates, changes in interest rates related to planned... -

Page 196

... of Generation's energy marketing business, Generation enters into contracts to buy and sell energy to meet the requirements of its customers. These contracts include short-term and long-term commitments to purchase and sell energy and energy-related products in the retail and wholesale markets with... -

Page 197

... Management Policy. These contracts are recognized on the balance sheet at fair value and changes in the fair value of these derivative financial instruments are recognized in earnings. Severance Benefits (Exelon, Generation, ComEd and PECO) The Registrants account for their ongoing severance plans... -

Page 198

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 199

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 200

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 201

..., Exelon uses historical data to estimate employee forfeitures. Exelon reviews the actual and estimated forfeitures on an annual basis and records an adjustment if necessary. Utilizing the Black-Scholes-Merton option-pricing model and the assumptions discussed above, the weighted average grant-date... -

Page 202

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 203

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 204

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 205

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 206

... have on their financial statements. SFAS No. 158 In September 2006, the FASB issued SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R)", which was effective for the Exelon and Generation as of... -

Page 207

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 208

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 209

... and Generation) Termination of Proposed Merger with PSEG (Exelon) On December 20, 2004, Exelon entered into an Agreement and Plan of Merger (Merger Agreement) with Public Service Enterprise Group Incorporated (PSEG), a public utility holding company primarily located and serving customers in New... -

Page 210

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 211

... of Southeast Chicago Energy Project, LLC (SCEP) (Exelon and Generation) Generation and Peoples Calumet, LLC (Peoples Calumet), a subsidiary of Peoples Energy Corporation, were joint owners of SCEP, a 350-megawatt natural gas-fired, peaking electric power plant located in Chicago, Illinois, which... -

Page 212

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 213

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 214

...25, 2004. Responsibility for plant operations and power marketing activities were transferred to the lenders' special purpose entity on September 1, 2004. Boston Generating was reported in the Generation segment of Exelon's consolidated financial statements prior to its sale. At the date of the sale... -

Page 215

... establish rates for the post-2006 period, which are more fully described below. Illinois Procurement Case (Exelon and ComEd). On February 25, 2005, ComEd made a filing with the ICC to seek regulatory approval of tariffs that would authorize ComEd to bill its customers for electricity costs incurred... -

Page 216

.... In order to mitigate the effects of changes in future prices, electricity to serve residential and commercial customers with loads less than 400kW will be procured through staggered contracts. The ICC will subsequently review on an annual basis the prudence of ComEd's electricity purchases, but... -

Page 217

... contract Suppliers American Electric Power Service Corporation ...Conectiv Energy Supply, Inc...Constellation Energy Commodities Group, Inc...DTE Energy Trading, Inc ...Edison Mission Marketing & Trading, Inc ...Energy America, LLC ...Exelon Generation Company, LLC ...FPL Energy Power Marketing... -

Page 218

... assistance programs-see "Renewable Energy Filings" below. This order is subject to rehearing and appeal. Illinois Rate Case (Exelon and ComEd). On August 31, 2005, ComEd filed a rate case with the ICC to comprehensively review its tariff and to adjust ComEd's rates for delivering electricity... -

Page 219

...(Exelon and ComEd). In 2006, the ICC approved a real-time pricing program which will offer residential customers an alternative to standard flat-rate utility billing. Starting in 2007, residential customers registered in the program will be able to control their electricity bills by using less power... -

Page 220

... Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share data unless otherwise noted) In the ICC's December 20, 2006 order approving ComEd's residential... -

Page 221

... through 2006. Beginning in 2007, this provision is no longer applicable to ComEd. Delivery Service Rates (Exelon and ComEd). On March 3, 2003, ComEd entered into, and the ICC subsequently entered orders that implemented, an agreement (Agreement) with various Illinois retail market participants... -

Page 222

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 223

... has the right to file with the PAPUC for a change in retail rates to reflect the impact of any change in wholesale transmission rates. Customer Choice (Exelon, ComEd and PECO). All of ComEd's retail customers are eligible to choose a competitive electric generation supplier and most non-residential... -

Page 224

... of affiliate abuse or reciprocal dealing. On May 19, 2006, FERC issued a Notice of Proposed Rule Making (NOPR) on Market-Based Rates for Wholesale Sales of Electric Energy, Capacity and Ancillary Services by Public Utilities. The NOPR proposes a set of regulations that would modify the tests that... -

Page 225

... efficiency in electric generation, delivery and use. The Energy Policy Act, through amendment of the Federal Power Act, also transferred to FERC certain additional authority. FERC was granted new authority to review the acquisition or merger of generating facilities, along with the responsibility... -

Page 226

... on the estimated useful lives of the stations, which assumes the renewal of the licenses for all nuclear generating stations. As a result, these license renewals had no impact on the Consolidated Statements of Operations. 5. Accounts Receivable (Exelon, Generation, ComEd and PECO) Customer accounts... -

Page 227

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 228

... Statements-(Continued) (Dollars in millions, except per share data unless otherwise noted) December 31, 2005 Exelon Generation ComEd PECO Asset Category Electric-transmission and distribution ...Electric-generation ...Gas-transmission and distribution ...Common ...Nuclear fuel ...Construction work... -

Page 229

... Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share data unless otherwise noted) 7. Jointly Owned Electric Utility Plant (Exelon, Generation... -

Page 230

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 231

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 232

Exelon Corporation and Subsidiary Companies Exelon Generation Company, LLC and Subsidiary Companies Commonwealth Edison Company and Subsidiary Companies PECO Energy Company and Subsidiary Companies Combined Notes to Consolidated Financial Statements-(Continued) (Dollars in millions, except per share... -

Page 233

..., Generation and ComEd) Generation utilizes derivatives to manage the utilization of its available generating capacity and the provision of wholesale energy to its affiliates. Exelon and Generation also utilize energy option contracts and energy financial swap arrangements to limit the market price... -

Page 234

... Balance Sheets for the fair value of energy derivatives. The following table provides a summary of the fair value balances recorded by Exelon, Generation and ComEd as of December 31, 2006: December 31, 2006 Derivatives Current assets ...Noncurrent assets ...Total mark-to-market energy contract... -

Page 235

... fuelproducing facilities. (b) Excludes Exelon's interest-rate swaps. Normal Operations and Hedging Activities (Generation). Electricity available from Generation's owned or contracted generation supply in excess of Generation's obligations to customers, including ComEd's and PECO's retail load... -

Page 236

... income taxes) relating to mark-to-market activity of certain non-trading purchase power and sale contracts pursuant to SFAS No. 133. Generation's, ComEd's and Exelon's other mark-to-market activity on non-trading purchase power and sale contracts are reported in fuel and purchased power, revenue... -

Page 237

... Activities (Generation). Proprietary trading includes all contracts entered into purely to profit from market price changes as opposed to hedging an exposure and is subject to limits established by Exelon's Risk Management Committee. These contracts are recognized on the Consolidated Balance Sheets... -

Page 238