Avis 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

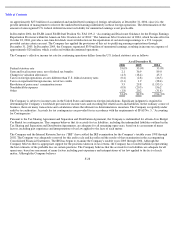

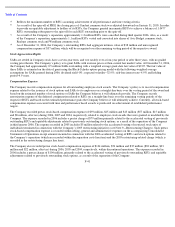

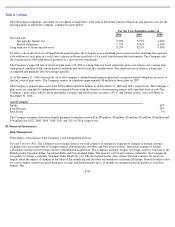

agreed to guarantee each other’s as well as the Company’s obligation under each entity’s deferred compensation plans for amounts

deferred in respect of 2005 and earlier years.

The Company does not believe that the impact of any unresolved proceedings constituting an Assumed Liability related to the CUC

accounting irregularities should result in a material liability to the Company in relation to its consolidated financial position or liquidity, as

Realogy and Wyndham each have agreed to assume responsibility for these liabilities as well as other liabilities related to the Company’s

litigation that is not related to its vehicle rental operations, as discussed and further described above. Such litigation assumed by Realogy

and Wyndham includes litigation which was retained by the Company in connection with the sale of its former Marketing Services

division and a dispute regarding expenses related to a settled breach of contract claim.

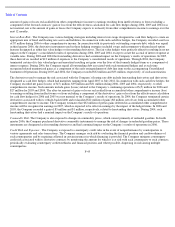

In addition to the matters discussed above, the Company is also involved in claims, legal proceedings and governmental inquiries related to

its vehicle rental operations, including contract disputes, business practices, intellectual property, environmental issues and other

commercial, employment and tax matters, including breach of contract claims by licensees. The Company believes that it has adequately

accrued for such matters as appropriate or, for matters not requiring accrual, believes that they will not have a material adverse effect on its

results of operations, financial position or cash flows based on information currently available. However, litigation is inherently

unpredictable and, although the Company believes that its accruals are adequate and/or that it has valid defenses in these matters,

unfavorable resolutions could occur, which could have a material adverse effect on the Company’s results of operations or cash flows in a

particular reporting period. During February 2006, the Company settled a litigation matter with respect to claims made by the purchaser of

a business sold by Avis prior to the Company’s acquisition of Avis in 2001. The amount awarded for the settlement had been fully

reserved for in connection with the acquisition. The cash outflow of $95 million associated with such settlement is recorded within the net

assets acquired and acquisition-related payments line item on the accompanying Consolidated Statement of Cash Flows.

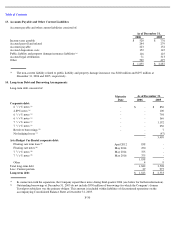

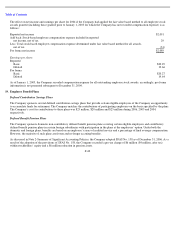

Standard Guarantees/Indemnifications

In the ordinary course of business, the Company enters into numerous agreements that contain standard guarantees and indemnities

whereby the Company indemnifies another party for breaches of representations and warranties. In addition, many of these parties are also

indemnified against any third party claim resulting from the transaction that is contemplated in the underlying agreement. Such guarantees

or indemnifications are granted under various agreements, including those governing (i) purchases, sales or outsourcing of assets or

businesses, (ii) leases of real estate, (iii) licensing of trademarks, (iv) access to credit facilities and use of derivatives and (v) issuances of

debt or equity securities. The guarantees or indemnifications issued are for the benefit of the (i) buyers in sale agreements and sellers in

purchase agreements, (ii) landlords in lease contracts, (iii) franchisees in licensing agreements, (iv) financial institutions in credit facility

arrangements and derivative contracts, and (v) underwriters in debt or equity security issuances. While some of these guarantees extend

only for the duration of the underlying agreement, many survive the expiration of the term of the agreement or extend into perpetuity

(unless subject to a legal statute of limitations). There are no specific limitations on the maximum potential amount of future payments that

the Company could be required to make under these guarantees, nor is the Company able to develop an estimate of the maximum potential

amount of future payments to be made under these guarantees as the triggering events are not subject to predictability. With respect to

certain of the aforementioned guarantees, such as indemnifications of landlords against third party claims for the use of real estate property

leased by the Company, the Company maintains insurance coverage that mitigates any potential payments to be made.

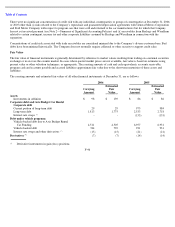

Other Guarantees

The Company has provided certain guarantees to subsidiaries of Realogy, Wyndham and Travelport which, as previously discussed, were

disposed during third quarter 2006. These guarantees relate primarily to various real estate and product operating leases. The maximum

potential amount of future payments that the Company may be required to make under the guarantees relating to the various real estate and

product

F

-

36