Avis 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

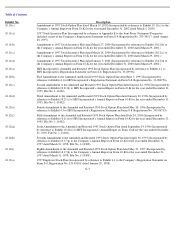

Table of Contents

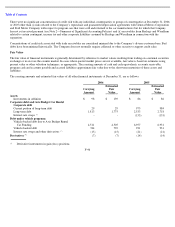

amount of gains or losses reclassified from other comprehensive income to earnings resulting from ineffectiveness or from excluding a

component of the forward contracts’ gain or loss from the effectiveness calculation for cash flow hedges during 2006, 2005 and 2004 was

not material, nor is the amount of gains or losses the Company expects to reclassify from other comprehensive income to earnings over the

next 12 months.

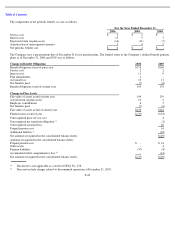

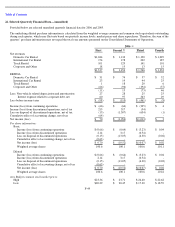

Interest Rate Risk . The Company uses various hedging strategies including interest rate swaps designated as cash flow hedges to create an

appropriate mix of fixed and floating rate assets and liabilities. In connection with such cash flow hedges, the Company recorded a net loss

of $7 million during 2006 to other comprehensive income. In connection with its previously outstanding corporate debt, which was repaid

in third quarter 2006, the derivative instruments used in these hedging strategies included swaps and instruments with purchased option

features designated as either fair value hedges or freestanding derivatives. The fair value hedges were perfectly effective resulting in no net

impact on the Company’s consolidated results of operations during 2006, 2005 and 2004, except to create the accrual of interest expense at

variable rates. During 2006 and 2004 the freestanding derivatives had a nominal impact on the Company’s results of operations. In 2005,

these derivatives resulted in $12 million of expenses to the Company’s consolidated results of operations. Through 2004, the Company

terminated certain of its fair value hedges and amortized resulting net gains over the lives of the formerly hedged items as a component of

interest expense. During 2006, the Company repaid all outstanding debt associated with such terminated hedges and at such time

recognized related unamortized gains as a component of the early extinguishment of debt line item on the accompanying Consolidated

Statement of Operations. During 2005 and 2004, the Company recorded $32 million and $33 million, respectively, of such amortization.

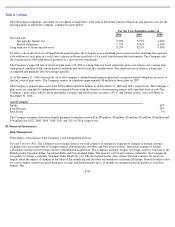

The derivatives used to manage the risk associated with the Company’s floating rate debt include freestanding derivatives and derivatives

designated as cash flow hedges, which had maturities ranging from April 2007 to July 2012. In connection with such cash flow hedges, the

Company recorded net gains (losses) of $(5) million, $39 million and $31 million during 2006, 2005 and 2004, respectively, to other

comprehensive income. Such amounts include gains (losses) related to the Company’s continuing operations of $(5) million for 2006 and

$27 million for 2005 and 2004. The after-tax amount of gains or losses reclassified from accumulated other comprehensive income (loss)

to earnings resulting from ineffectiveness or from excluding a component of the derivatives’ gain or loss from the effectiveness calculation

for cash flow hedges for 2006 and 2005 was not material to the Company’s results of operations. In 2004, the Company terminated certain

derivatives associated with its vehicle-backed debt and reclassified $12 million of gains ($8 million, net of tax) from accumulated other

comprehensive income to income. The Company estimates that $32 million of pretax gains deferred in accumulated other comprehensive

income will be recognized in earnings in 2007, which is expected to be offset in earnings by the impact of the hedged items. In 2006 and

2005, the Company recorded a gain of $5 million and $1 million, respectively, related to freestanding derivatives. During 2004, such

freestanding derivatives had a nominal impact on the Company’s results of operations.

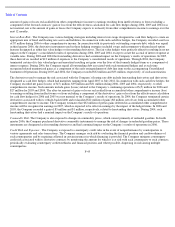

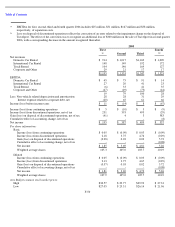

Commodity Risk. The Company is also exposed to changes in commodity prices, which consist primarily of unleaded gasoline. In fourth

quarter 2006, the Company purchased derivative commodity instruments to manage the risk of changes in unleaded gasoline prices. These

instruments are designated as freestanding derivatives and had a nominal impact on the Company’s results of operations in 2006.

Credit Risk and Exposure . The Company is exposed to counterparty credit risks in the event of nonperformance by counterparties to

various agreements and sales transactions. The Company manages such risk by evaluating the financial position and creditworthiness of

such counterparties and by requiring collateral in certain instances in which financing is provided. The Company mitigates counterparty

credit risk associated with its derivative contracts by monitoring the amount for which it is at risk with each counterparty to such contracts,

periodically evaluating counterparty creditworthiness and financial position, and where possible, dispersing its risk among multiple

counterparties.

F

-

45