Avis 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317

|

|

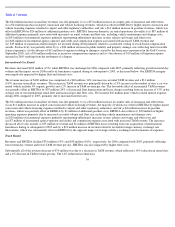

Table of Contents

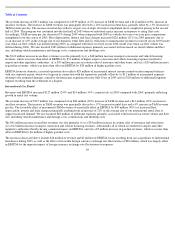

financing by Avis Budget Car Rental (ii) the establishment of a $1.5 billion revolving credit facility by Avis Budget Car Rental (iii) the

completion of a tender offer for $2.6 billion of our corporate debt by repurchasing approximately $2.5 billion outstanding aggregate principal

amount of our 6

1

/

4

% notes due in January 2008 and March 2010, 7

3

/

8

% notes due in January 2013 and 7

1

/

8

% notes due in March 2015

and the subsequent redemption of the untendered portion of such debt and (iv) the repayment of aggregate principal of $950 million due in

August 2006 under our 6

7

/

8

% and 4.89% notes. As a result of the spin-offs of Realogy and Wyndham, we repaid outstanding borrowings of

$560 million (including $265 million which was recorded within discontinued operations) and $600 million under our former $2.0 billion

revolving credit facility and asset-linked facility, respectively, and terminated these facilities during July 2006.

In connection with the separation, we entered into a separation agreement, tax sharing agreement and transition services agreement with

Realogy, Wyndham and Travelport.

On August 29, 2006, our stockholders approved certain amendments to our Certificate of Incorporation, including a change in our name from

Cendant Corporation to Avis Budget Group, Inc. and a 1-for-10 reverse stock split of our common stock, each of which became effective on

the New York Stock Exchange at the opening of the market on September 5, 2006 and, at that time, our ticker symbol changed to ‘‘CAR’’.

RESULTS OF OPERATIONS

Discussed below are our consolidated results of operations and the results of operations for each of our reportable segments. Generally

accepted accounting principles require us to segregate and report as discontinued operations, for all periods presented, the account balances and

activities of Jackson Hewitt, PHH, Wright Express, our former Marketing Services division, Realogy, Wyndham and Travelport. Previously,

we could not classify our former mortgage business as a discontinued operation due to Realogy's participation in a mortgage origination

venture that was established with PHH in connection with our January 2005 spin-off of PHH. However, due to the spin-off of Realogy on

July 31, 2006, this business is classified as a discontinued operation.

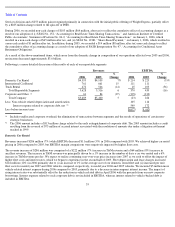

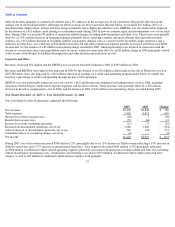

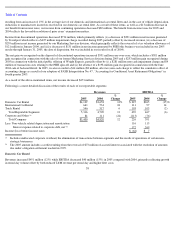

We measure performance using the following key operating statistics: (i) rental days, which represents the total number of days (or portion

thereof) a vehicle was rented, and (ii) T&M revenue per rental day, which represents the average daily revenue we earned from rental and

mileage fees charged to our customers. Our car rental operating statistics (rental days and T&M revenue per rental day) are all calculated based

on the actual usage of the vehicle during a 24-hour period. We believe that this methodology, while conservative, provides our management

with the most relevant statistics in order to manage the business. Our calculation may not be comparable to other companies’ calculation of

similarly-titled statistics.

The reportable segments presented below represent our operating segments for which separate financial information is available and is utilized

on a regular basis by our chief operating decision maker to assess performance and to allocate resources. In identifying our reportable

segments, we also consider the nature of services provided by our operating segments. Management evaluates the operating results of each of

our reportable segments based upon revenue and “EBITDA,” which we define as income from continuing operations before non-

vehicle related

depreciation and amortization, non-vehicle related interest and income taxes. Our presentation of EBITDA may not be comparable to similarly-

titled measures used by other companies.

33