Avis 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

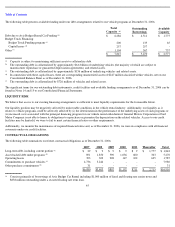

Table of Contents

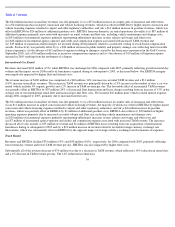

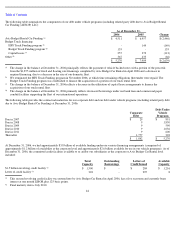

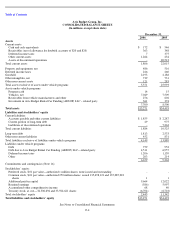

(b)

Represents debt under vehicle programs (including related party debt due to Avis Budget Rental Car Funding), which was issued to

support the purchase of vehicles.

(c)

Primarily represents commitments to purchase vehicles from either General Motors Corporation or Ford Motor Company. These

commitments are subject to the vehicle manufacturers’ satisfying their obligations under the repurchase and guaranteed depreciation

agreements. The purchase of such vehicles is financed through the issuance of debt under vehicle programs in addition to cash received

upon the sale of vehicles primarily under repurchase and guaranteed depreciation agreements (see Note 15 to our Consolidated Financial

Statements).

The above table does not include future cash payments related to interest expense or any potential amount of future payments that we may be

required to make under standard guarantees and indemnifications that we have entered into in the ordinary course of business. For more

information regarding guarantees and indemnifications, see Note 16 to our Consolidated Financial Statements.

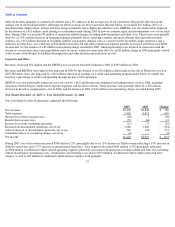

ACCOUNTING POLICIES

Critical Accounting Policies

In presenting our financial statements in conformity with generally accepted accounting principles, we are required to make estimates and

assumptions that affect the amounts reported therein. Several of the estimates and assumptions we are required to make relate to matters that

are inherently uncertain as they pertain to future events and/or events that are outside of our control. If there is a significant unfavorable change

to current conditions, it could result in a material adverse impact to our consolidated results of operations, financial position and liquidity. We

believe that the estimates and assumptions we used when preparing our financial statements were the most appropriate at that time. Presented

below are those accounting policies that we believe require subjective and complex judgments that could potentially affect reported results.

However, our businesses operate in environments where we are paid a fee for a service performed, and therefore the results of the majority of

our recurring operations are recorded in our financial statements using accounting policies that are not particularly subjective, nor complex.

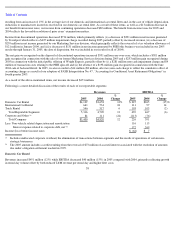

Goodwill and Other Indefinite-lived Intangible Assets. We have reviewed the carrying value of our goodwill and other indefinite-lived

intangible assets as required by Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and Other Intangible Assets.” In

performing this review, we are required to make an assessment of fair value for our goodwill and other indefinite-lived intangible assets. When

determining fair value, we utilize various assumptions, including projections of future cash flows. A change in these underlying assumptions

will cause a change in the results of the tests and, as such, could cause the fair value to be less than the respective carrying amount. In such

event, we would then be required to record a charge, which would impact earnings. We review the carrying value of goodwill and other

indefinite-lived intangible assets for impairment annually, or more frequently if circumstances indicate impairment may have occurred.

The aggregate carrying value of our goodwill and other indefinite-lived intangible assets was approximately $2.2 billion and $666 million,

respectively, at December 31, 2006.

Our goodwill and other indefinite-lived intangible assets are allocated among three reporting units. Accordingly, it is difficult to quantify the

impact of an adverse change in financial results and related cash flows, as such change may be isolated to one of our reporting units or spread

across our entire organization. In either case, the magnitude of any impairment to goodwill or other indefinite-lived intangible assets resulting

from adverse changes cannot be estimated. However, our businesses are concentrated in one industry and, as a result, an adverse change in the

vehicle rental industry will impact our consolidated results and may result in impairment of our goodwill or other indefinite-lived intangible

assets.

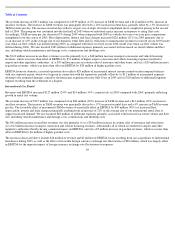

Income Taxes.

We recognize deferred tax assets and liabilities based on the differences between the financial statement carrying amounts and

the tax bases of assets and liabilities. We regularly review our deferred tax assets

46

(d)

Primarily represents commitments under service contracts for information technology and telecommunications.