Avis 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

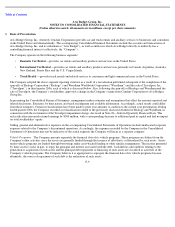

project. The Company amortizes software developed or obtained for internal use on a straight-line basis, from three to seven years, when

such software is substantially ready for use. The net carrying value of software developed or obtained for internal use was $50 million and

$95 million as of December 31, 2006 and 2005, respectively.

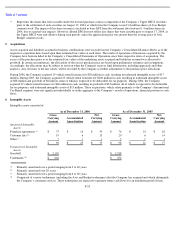

On March 30, 2005, the Financial Accounts Standards Board (“FASB”) issued FASB Interpretation No. 47, “Accounting for Conditional

Asset Retirement Obligations” (“FIN 47”), which clarifies that conditional asset retirement obligations are within the scope of SFAS

No. 143, “Accounting for Asset Retirement Obligations.” FIN 47 requires the Company to recognize a liability for the fair value of

conditional asset retirement obligations if the fair value of the liability can be reasonably estimated. The Company adopted the provisions

of FIN 47 in fourth quarter 2005, as required. Accordingly, the Company recorded a $14 million ($8 million after tax, or $0.08 per diluted

share) non-cash charge to reflect the cumulative effect of accounting change during 2005 relating to the Company’s obligation to remove

assets at certain leased properties.

IMPAIRMENT OF LONG-LIVED ASSETS

In connection with SFAS No. 142, “Goodwill and Other Intangible Assets” (“SFAS No. 142”),

the Company is required to assess goodwill

and other indefinite-lived intangible assets for impairment annually, or more frequently if circumstances indicate impairment may have

occurred. The Company assesses goodwill for such impairment by comparing the carrying value of its reporting units to their fair values.

Each of the Company’s reportable segments represents a reporting unit. The Company determines the fair value of its reporting units

utilizing discounted cash flows and incorporates assumptions that it believes marketplace participants would utilize. When available and as

appropriate, the Company uses comparative market multiples and other factors to corroborate the discounted cash flow results. Other

indefinite-lived intangible assets are tested for impairment and written down to fair value, as required by SFAS No. 142.

The Company evaluates the recoverability of its other long-

lived assets, including amortizing intangible assets, if circumstances indicate an

impairment may have occurred, pursuant to SFAS No. 144. This analysis is performed by comparing the respective carrying values of the

assets to the current and expected future cash flows, on an undiscounted basis, to be generated from such assets. Property and equipment is

evaluated separately within each segment. If such analysis indicates that the carrying value of these assets is not recoverable, the carrying

value of such assets is reduced to fair value through a charge to the Company’s Consolidated Statements of Operations.

The Company performs its annual impairment testing for goodwill and other indefinite lived intangible assets in the fourth quarter of each

year subsequent to completing its annual forecasting process. In performing this test, the Company determines fair value using the present

value of expected future cash flows. Within the Company’s continuing operations, there was no impairment of intangible assets in 2006,

2005 or 2004. Impairment charges recorded for other long-lived assets were not material during 2006, 2005 or 2004. However, during

2006 the Company recorded a non-cash impairment charge of approximately $1.3 billion within discontinued operations to reflect the

difference between Travelport’s carrying value and its estimated fair value, less costs to dispose. In addition, as a result of the analysis

performed in 2005, the Company determined that the carrying values of goodwill and certain other indefinite-lived intangible assets

assigned to Travelport’

s consumer travel businesses within discontinued operations exceeded their estimated fair values. Consequently, the

Company also tested its other long-lived assets within Travelport’s consumer travel business for impairment. In connection with the

impairment assessments performed, the Company recorded a pretax charge of $425 million within discontinued operations, of which $254

million reduced the value of goodwill and $171 million reduced the value of other intangible assets (including $120 million related to

trademarks). This impairment resulted from a decline in future anticipated cash flows primarily generated by Travelport’s consumer travel

businesses.

F

-

15