eTrade 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

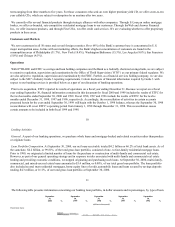

Weighted average interest rate during the year 6.39 %

5.32 %

5.69 %

Maximum month-end balance during the year $ 2,173,410 $ 790,474 $ 519,078

Private issuer mortgage-backed securities underlying the

agreements as of the end of the year:

Carrying value, including accrued interest $ 1,303,517 $ 863,598 $ 441,323

Estimated market value $ 1,289,313 $ 832,397 $ 438,955

Agency Securities underlying the agreements as of the end of

the year:

Carrying value, including accrued interest $ 648,433 $ — $ —

Estimated market value $ 644,317 $ — $ —

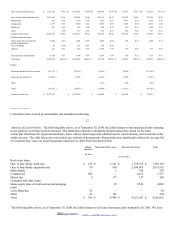

The following table sets forth information regarding the weighted average interest rates and the highest and average month end

balances of our borrowings.

Category Ending Balance Monthly

Weighted

Average

Rate

Maximum

Amount At

Month-End

Yearly

Weighted

Average

Balance

Yearly

Weighted

Average

Rate

(dollars in thousands)

At or for the year ended September 30, 2000:

Advances from the FHLB of Atlanta $ 1,637,000 6.47 %

$ 2,074,500 $ 1,225,783 6.17 %

Securities sold under agreement to

repurchase

$ 1,894,000 6.71 %

$ 2,173,410 $ 1,471,435 6.39 %

At or for the year ended September 30, 1999:

Advances from the FHLB of Atlanta $ 477,000 5.55 %

$ 852,000 $ 473,849 5.25 %

Securities sold under agreement to

repurchase

$ 790,474 5.47 %

$ 790,474 $ 555,552 5.32 %

GLOBAL AND INSTITUTIONAL

Business Overview

Our global and institutional business segment is comprised principally of the business activities of our international subsidiaries

offering foreign investors online retail brokerage services and the business activities of TIR and VERSUS, which offer financial

services to institutional investors.

We are actively pursuing a global expansion strategy that leverages our internationally recognized brand name, award-winning Web

site design, and proprietary Stateless Architecture SM technology platform. On the retail side, our goal is to create a fully electronic

cross-border trading network, linking the top financial markets globally and making electronic trading in foreign securities an

affordable reality for the retail investor. We launched this trading network during fiscal 2000 with E*TRADE Sweden, allowing

Swedish customers to buy U.S. equities in real-time, online. Through a fully electronic process, we seamlessly handle the execution,

clearing and settlement of the transactions, while simultaneously processing the foreign exchange transactions.

With the acquisition of TIR in August 1999, we extended our business to include institutional investors. TIR is active in equity, fixed

income, currency and derivatives markets in over 35 countries and holds seats on multiple stock exchanges around the world. TIR’ s

management team is assisting in running selected segments of our international retail brokerage operations, given their existing

clearing and operational infrastructure in both Europe and Asia. We are currently developing an electronic platform for the

institutional investor, which will bring greater efficiencies in trading, order routing and management, and back office processing. With

the acquisition of VERSUS in August 2000, we have expanded our institutional customer base and anticipate leveraging the VERSUS

Network, a proprietary electronic network that connects institutional clients and participating broker-dealers to the major Canadian

Stock Exchanges and alternative liquidity pools. It also integrates with market data providers and

21

back-office service providers to enhance the electronic trading environment. We will expand the VERSUS Network by incorporating

the technology into our global cross-border trading platform, enabling institutions and investment dealers worldwide to route orders

globally through the VERSUS and E*TRADE networks.

2002. EDGAR Online, Inc.