eTrade 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cost recovery/contra assets — 197 —

Other loan debits/HELOC advances 13 971 525

Increase in total loans receivable 2,018,245 1,361,320 364,150

Loans receivable—net at end of period $ 4,172,754 $ 2,154,509 $ 904,854

Our primary method of purchasing loans is through the secondary market, utilizing private investors. We purchase the loans in pools

made up of multiple whole loans. In fiscal 2000, 1999 and 1998 we purchased 851 pools with 7,047 loans, 477 pools with 6,245 loans

and 171 pools with 2,472 loans, respectively.

We have not originated any consumer loans during fiscal 2000, 1999 or 1998. Prior to fiscal 1998 we originated consumer loans as an

accommodation to our customers or purchased such loans as part of larger loan packages. To service our loan portfolio, we enter into

loan servicing contracts with multiple third party servicers.

CRA Lending Activities. The Bank participates in various community development programs in an effort to meet its responsibilities

under the Community Reinvestment Act (‘‘CRA’ ’ ). We invest in loans or other investments secured by affordable housing for low- or

moderate-income individuals and have committed to invest up to $500,000 in a low-income housing tax credit fund that qualifies as a

community development loan under the CRA. Senior management of the Bank serves on the boards of directors of non-profit

organizations to promote community development. We also provide loan servicing for Habitat for Humanity of Northern Virginia,

Inc., a non-profit organization whose purpose is to create affordable housing for those in need.

In 1995, the federal financial regulatory agencies revised the regulations that implement the CRA. The revised regulations set forth

specific types of evaluations for wholesale banks, which are those that are not in the business of extending home mortgage, small

business, small farm, or consumer loans to retail customers. Satisfaction of a wholesale bank’ s responsibilities under the CRA is

measured by various criteria including the number and amount of community development loans, qualified investments, or community

development services, and the use of innovative or complex community development services, qualified investments, or community

development loans. The Bank has been approved as a wholesale bank and is currently in compliance with CRA requirements.

Delinquent, Non-performing and Other Problem Assets

General. We continually monitor our loan portfolio so that we will be able to anticipate and address potential and actual

delinquencies. Based on the length of the delinquency period, we reclassify these assets as

14

non-performing and if necessary take possession of the underlying collateral. Once the Bank takes possession of the underlying

collateral, the property is classified on our balance sheet as Real Estate Owned (“REO”).

Non-performing Assets . Non-performing assets consist of loans for which interest is no longer being accrued, troubled debt

restructuring (“TDRs”) which are loans that have been restructured in order to increase the opportunity to collect amounts due on the

loan and real estate acquired in settlement of loans. Interest previously accrued but not collected on non-accrual loans is reversed

against current income when a loan is placed on non-accrual status. Accretion of deferred fees is discontinued for non-accrual loans.

All loans at least ninety days past due, as well as other loans considered uncollectible, are placed on non-accrual status. Payments

received on non-accrual loans are applied to principal when it is doubtful that full payment will be collected.

REO . We initially record REO at estimated fair value less selling costs. Fair value is defined as the estimated amount that a real estate

parcel would yield in a current sale between a willing buyer and a willing seller. Subsequent to foreclosure, management periodically

reviews REO and establishes an allowance if the estimated fair value of the property, less estimated costs to sell, declines.

As of September 30, 2000, all of our REO consisted of one- to four-family real estate loans.

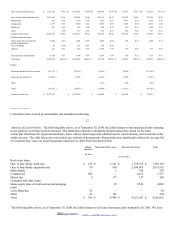

The following table presents information about our non-accrual loans, TDRs, and REO at the dates indicated.

September30,

2000

September 30,

1999

September30,

1998

September30,

1997

September30,

1996

(dollars in thousands)

Loans accounted for on a non-accrual

basis:

Real estate loans:

One- to four-family $ 11,391 $ 7,595 $ 7,727 $ 10,359 $ 8,979

2002. EDGAR Online, Inc.