eBay 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

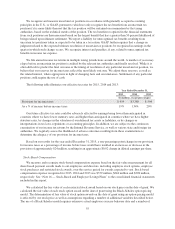

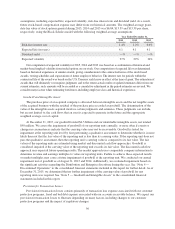

assumptions, including expected life, expected volatility, risk-free interest rate and dividend yield. As a result,

future stock-based compensation expense may differ from our historical amounts. The weighted-average grant-

date fair value of stock options granted during 2015, 2014 and 2013 was $6.84, $13.59 and $15.39 per share,

respectively, using the Black-Scholes model with the following weighted-average assumptions:

Year Ended December 31,

2015 2014 2013

Risk-free interest rate 1.4% 1.2% 0.6%

Expected life (in years) 4.1 4.1 4.1

Dividend yield —% —% —%

Expected volatility 27% 29% 34%

Our computation of expected volatility for 2015, 2014 and 2013 was based on a combination of historical and

market-based implied volatility from traded options on our stock. Our computation of expected life was determined

based on historical experience of similar awards, giving consideration to the contractual terms of the stock-based

awards, vesting schedules and expectations of future employee behavior. The interest rate for periods within the

contractual life of the award was based on the U.S. Treasury yield curve in effect at the time of grant. The estimation of

awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from our

current estimates, such amounts will be recorded as a cumulative adjustment in the period estimates are revised. We

consider many factors when estimating forfeitures, including employee class and historical experience.

Goodwill and Intangible Assets

The purchase price of an acquired company is allocated between intangible assets and the net tangible assets

of the acquired business with the residual of the purchase price recorded as goodwill. The determination of the

value of the intangible assets acquired involves certain judgments and estimates. These judgments can include,

but are not limited to, the cash flows that an asset is expected to generate in the future and the appropriate

weighted average cost of capital.

At December 31, 2015, our goodwill totaled $4.5 billion and our identifiable intangible assets, net totaled

$90 million. We assess the impairment of goodwill of our reporting units annually, or more often if events or

changes in circumstances indicate that the carrying value may not be recoverable. Goodwill is tested for

impairment at the reporting unit level by first performing a qualitative assessment to determine whether it is more

likely than not that the fair value of the reporting unit is less than its carrying value. If the reporting unit does not

pass the qualitative assessment, then the reporting unit’s carrying value is compared to its fair value. The fair

values of the reporting units are estimated using market and discounted cash flow approaches. Goodwill is

considered impaired if the carrying value of the reporting unit exceeds its fair value. The discounted cash flow

approach uses expected future operating results. The market approach uses comparable company information to

determine revenue and earnings multiples to value our reporting units. Failure to achieve these expected results

or market multiples may cause a future impairment of goodwill at the reporting unit. We conducted our annual

impairment test of goodwill as of August 31, 2015 and 2014. Additionally, we evaluated impairment based on

the significant activities regarding the Distribution and Enterprise divestiture during the year. See “Note 4 —

Discontinued Operations” to the consolidated financial statements included in this report for further detail. As of

December 31, 2015, we determined that no further impairment of the carrying value of goodwill for any

reporting units was required. See “Note 5 — Goodwill and Intangible Assets” to the consolidated financial

statements included in this report.

Provision for Transaction Losses

Provision for transaction losses consists primarily of transaction loss expense associated with our customer

protection programs, fraud and bad debt expense associated with our accounts receivable balance. We expect our

provision for transaction losses to fluctuate depending on many factors, including changes to our customer

protection programs and the impact of regulatory changes.

56