eBay 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

savings of $319 million and $339 million in 2015 and 2014, respectively, which increased earnings per share

(diluted) by approximately $0.26 and $0.27 in 2015 and 2014, respectively. These tax rulings are currently in

effect and expire over periods ranging from 2017 to the duration of business operations in the respective

jurisdictions. We evaluate compliance with our tax ruling agreements annually.

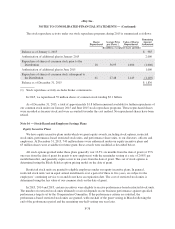

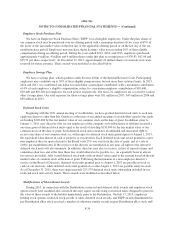

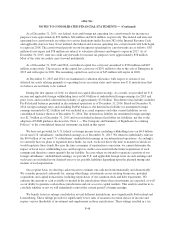

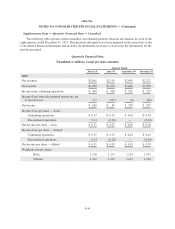

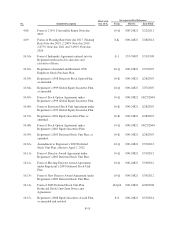

The following table reflects changes in unrecognized tax benefits for the years ended December, 31 2015,

2014 and 2013:

2015 2014 2013

(In millions)

Gross amounts of unrecognized tax benefits as of the beginning of the period $367 $304 $ 314

Increases related to prior period tax positions 36 35 98

Decreases related to prior period tax positions (8) (18) (139)

Increases related to current period tax positions 51 59 35

Settlements (6) (13) (4)

Gross amounts of unrecognized tax benefits as of the end of the period $440 $367 $ 304

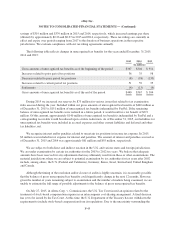

During 2015 we increased our reserves by $73 million for various issues that related to tax examination

risks assessed during the year. Included within our gross amounts of unrecognized tax benefits of $440 million as

of December 31, 2015 is $151 million of unrecognized tax benefits indemnified by PayPal. If the remaining

balance of unrecognized tax benefits were realized in a future period, it would result in a tax benefit of $372

million. Of this amount, approximately $140 million of unrecognized tax benefit is indemnified by PayPal and a

corresponding receivable would be reduced upon a future realization. As of December 31, 2015, our liabilities for

unrecognized tax benefits were included in accrued expenses and other current liabilities and deferred and other

tax liabilities, net.

We recognize interest and/or penalties related to uncertain tax positions in income tax expense. In 2015,

$2 million was included in tax expense for interest and penalties. The amount of interest and penalties accrued as

of December 31, 2015 and 2014 was approximately $61 million and $55 million, respectively.

We are subject to both direct and indirect taxation in the U.S. and various states and foreign jurisdictions.

We are under examination by certain tax authorities for the 2003 to 2012 tax years. We believe that adequate

amounts have been reserved for any adjustments that may ultimately result from these or other examinations. The

material jurisdictions where we are subject to potential examination by tax authorities for tax years after 2002

include, among others, the U.S. (Federal and California), Germany, Korea, Israel, Switzerland, United Kingdom

and Canada.

Although the timing of the resolution and/or closure of audits is highly uncertain, it is reasonably possible

that the balance of gross unrecognized tax benefits could significantly change in the next 12 months. However,

given the number of years remaining subject to examination and the number of matters being examined, we are

unable to estimate the full range of possible adjustments to the balance of gross unrecognized tax benefits.

On July 27, 2015, in Altera Corp. v. Commissioner, the U.S. Tax Court issued an opinion related to the

treatment of stock-based compensation expense in an intercompany cost-sharing arrangement. A final decision

has yet to be issued by the Tax Court. At this time, the U.S. Department of the Treasury has not withdrawn the

requirement to include stock-based compensation from its regulations. Due to the uncertainty surrounding the

F-45