eBay 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We recognize and measure uncertain tax positions in accordance with generally accepted accounting

principles in the U.S., or GAAP, pursuant to which we only recognize the tax benefit from an uncertain tax

position if it is more likely than not that the tax position will be sustained on examination by the taxing

authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements

from such positions are then measured based on the largest benefit that has a greater than 50 percent likelihood of

being realized upon ultimate settlement. We report a liability for unrecognized tax benefits resulting from

uncertain tax positions taken or expected to be taken in a tax return. GAAP further requires that a change in

judgment related to the expected ultimate resolution of uncertain tax positions be recognized in earnings in the

quarter in which such change occurs. We recognize interest and penalties, if any, related to unrecognized tax

benefits in income tax expense.

We file annual income tax returns in multiple taxing jurisdictions around the world. A number of years may

elapse before an uncertain tax position is audited by the relevant tax authorities and finally resolved. While it is

often difficult to predict the final outcome or the timing of resolution of any particular uncertain tax position, we

believe that our reserves for income taxes reflect the most likely outcome. We adjust these reserves, as well as

the related interest, where appropriate in light of changing facts and circumstances. Settlement of any particular

position could require the use of cash.

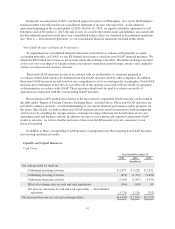

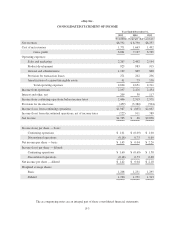

The following table illustrates our effective tax rates for 2015, 2014 and 2013:

Year Ended December 31,

2015 2014 2013

(In millions, except percentages)

Provision for income taxes $ 459 $3,380 $ 504

As a % of income before income taxes 19% 134% 20%

Our future effective tax rates could be adversely affected by earnings being lower than anticipated in

countries where we have lower statutory rates and higher than anticipated in countries where we have higher

statutory rates, by changes in the valuation of our deferred tax assets or liabilities, or by changes or

interpretations in tax laws, regulations or accounting principles. In addition, we are subject to the continuous

examination of our income tax returns by the Internal Revenue Service, as well as various state and foreign tax

authorities. We regularly assess the likelihood of adverse outcomes resulting from these examinations to

determine the adequacy of our provision for income taxes.

Based on our results for the year ended December 31, 2015, a one-percentage point change in our provision

for income taxes as a percentage of income before taxes would have resulted in an increase or decrease in the

provision of approximately $24 million, resulting in an approximate $0.02 change in diluted earnings per share.

Stock-Based Compensation

We measure and recognize stock-based compensation expense based on the fair value measurement for all

share-based payment awards made to our employees and directors, including employee stock options, employee

stock purchases and restricted stock awards, over the service period for awards expected to vest. Stock-based

compensation expense recognized for 2015, 2014 and 2013 was $379 million, $344 million and $298 million,

respectively. See “Note 16 — Stock-Based and Employee Savings Plans” to the consolidated financial statements

included in this report.

We calculated the fair value of each restricted stock award based on our stock price on the date of grant. We

calculated the fair value of each stock option award on the date of grant using the Black-Scholes option pricing

model. The determination of fair value of stock option awards on the date of grant using an option-pricing model

is affected by our stock price as well as assumptions regarding a number of additional variables described below.

The use of a Black-Scholes model requires extensive actual employee exercise behavior data and a number of

55