eBay 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

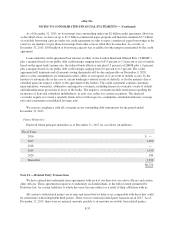

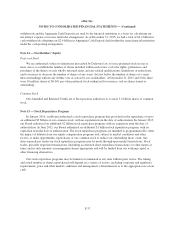

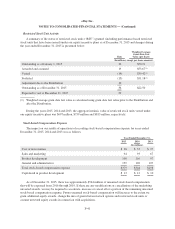

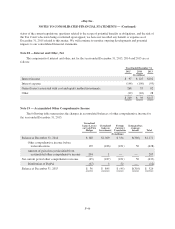

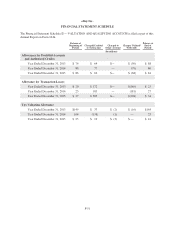

The following is a reconciliation of the difference between the actual provision for income taxes and the

provision computed by applying the federal statutory rate of 35% for 2015, 2014 and 2013 to income before

income taxes:

Year Ended December 31,

2015 2014 2013

(In millions)

Provision at statutory rate $ 843 $ 881 $ 900

Permanent differences:

Prior year foreign earnings no longer considered indefinitely reinvested — 2,991 —

Foreign income taxed at different rates (399) (432) (403)

Change in valuation allowance 1 (142) —

Stock-based compensation 23 22 18

State taxes, net of federal benefit 20 42 (12)

Research and other tax credits (27) (14) (26)

Divested business — — 21

Other (2) 32 6

$ 459 $ 3,380 $ 504

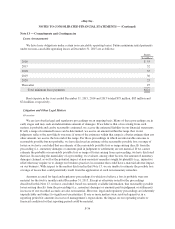

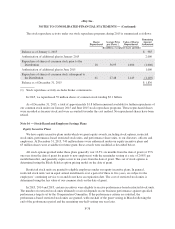

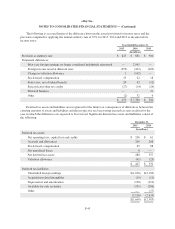

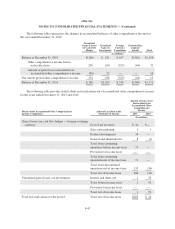

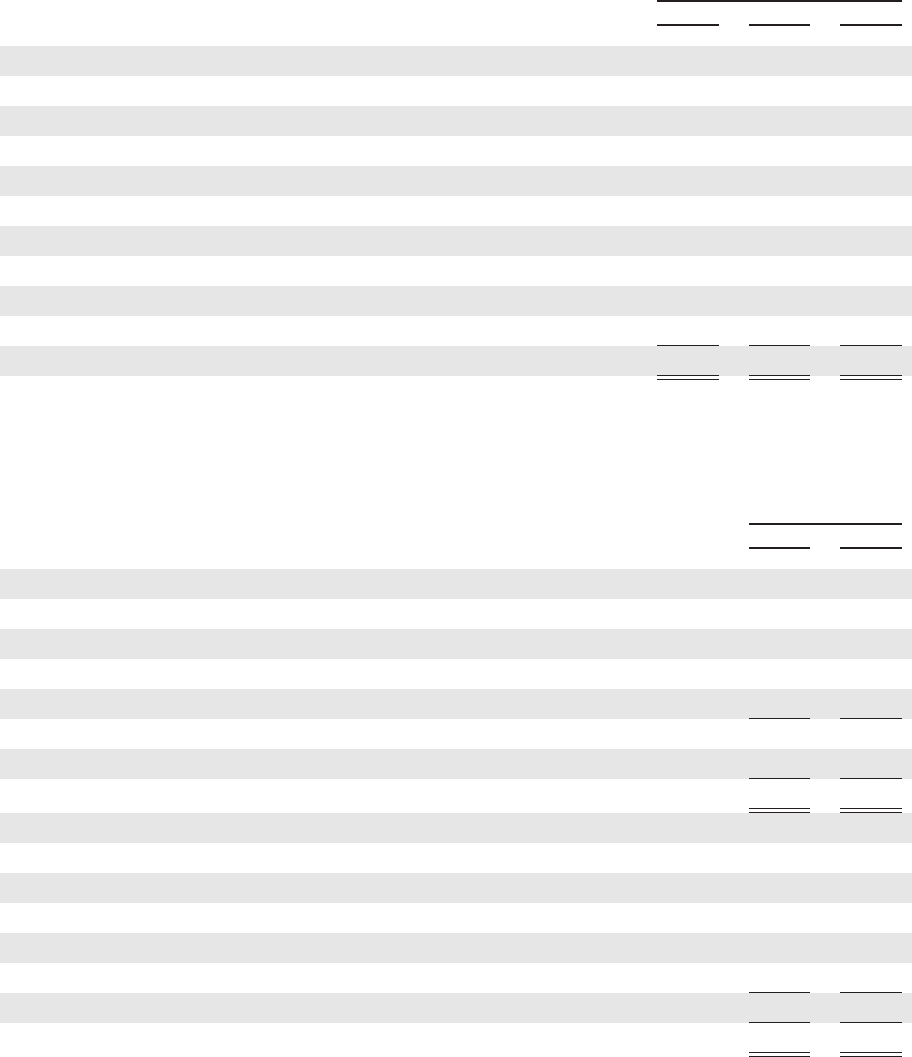

Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the

carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates in effect for the

year in which the differences are expected to be reversed. Significant deferred tax assets and liabilities consist of

the following:

December 31,

2015 2014

(In millions)

Deferred tax assets:

Net operating loss, capital loss and credits $ 206 $ 61

Accruals and allowances 209 208

Stock-based compensation 65 88

Net unrealized losses 8 —

Net deferred tax assets 488 357

Valuation allowance (41) (25)

$ 447 $ 332

Deferred tax liabilities:

Unremitted foreign earnings $(1,656) $(2,109)

Acquisition-related intangibles (19) (11)

Depreciation and amortization (190) (212)

Available-for-sale securities (251) (286)

Other — (17)

(2,116) (2,635)

$(1,669) $(2,303)

F-43