eBay 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

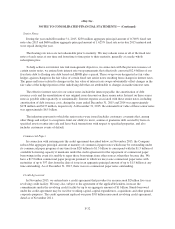

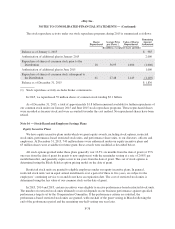

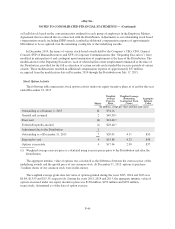

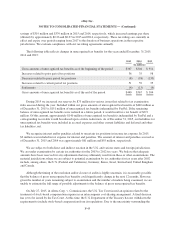

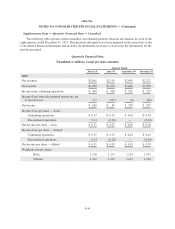

Stock Option Valuation Assumptions

We calculated the fair value of each stock option award on the date of grant using the Black-Scholes option

pricing model. The following weighted average assumptions were used for the years ended December 31, 2015,

2014 and 2013:

Year Ended December 31,

2015 2014 2013

Risk-free interest rate 1.4% 1.2% 0.6%

Expected life (in years) 4.1 4.1 4.1

Dividend yield — % — % — %

Expected volatility 27% 29% 34%

Our computation of expected volatility is based on a combination of historical and market-based implied

volatility from traded options on our common stock. Our computation of expected life is based on historical

experience of similar awards, giving consideration to the contractual terms of the stock-based awards, vesting

schedules and expectations of future employee behavior. The interest rate for periods within the contractual life

of the award is based on the U.S. Treasury yield curve in effect at the time of grant.

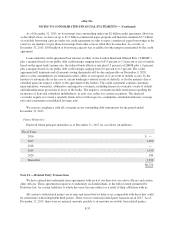

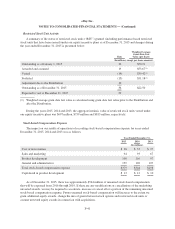

Note 17 — Income Taxes

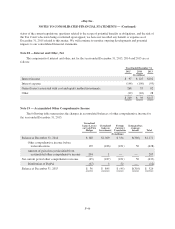

The components of pretax income for the years ended December 31, 2015, 2014 and 2013 are as follows:

Year Ended December 31,

2015 2014 2013

(In millions)

United States $ 396 $ 510 $ 768

International 2,010 2,005 1,803

$2,406 $2,515 $2,571

The provision for income taxes is comprised of the following:

Year Ended December 31,

2015 2014 2013

(In millions)

Current:

Federal $ 363 $ 489 $ 408

State and local 22 20 (5)

Foreign 106 127 134

$ 491 $ 636 $ 537

Deferred:

Federal $ (53) $2,091 $ (15)

State and local (2) 21 (7)

Foreign 23 632 (11)

(32) 2,744 (33)

$ 459 $3,380 $ 504

F-42