eBay 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

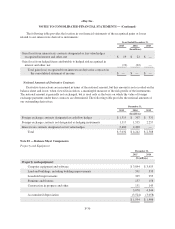

Total depreciation expense on our property and equipment in the years ended December 31, 2015, 2014 and

2013 totaled $614 million, $559 million and $495 million, respectively.

Accrued Expenses and Other Current Liabilities

Total compensation and related benefits included in accrued expenses and other current liabilities was $448

million and $422 million for the years ended December 31, 2015 and 2014, respectively.

Total advertising accruals included in accrued expenses and other current liabilities was $135 million and

$160 million for the years ended December 31, 2015 and 2014, respectively.

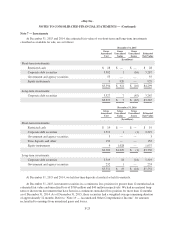

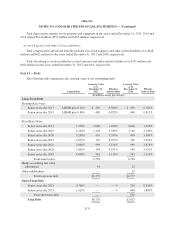

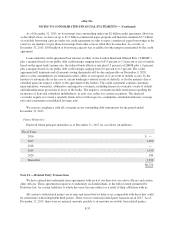

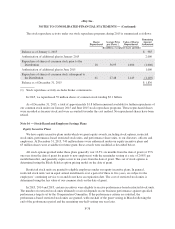

Note 11 — Debt

The following table summarizes the carrying value of our outstanding debt:

Coupon Rate

Carrying Value

as of

December 31,

2015

Effective

Interest Rate

Carrying Value

as of

December 31,

2014

Effective

Interest Rate

(In millions, except percentages)

Long-Term Debt

Floating Rate Notes:

Senior notes due 2017 LIBOR plus 0.20% $ 450 0.586% $ 450 0.560%

Senior notes due 2019 LIBOR plus 0.48% 400 0.825% 400 0.811%

Fixed Rate Notes:

Senior notes due 2017 1.350% 1,000 1.456% 1,000 1.456%

Senior notes due 2019 2.200% 1,148 2.346% 1,148 2.346%

Senior notes due 2020 3.250% 499 3.389% 498 3.389%

Senior notes due 2021 2.875% 749 2.993% 749 2.993%

Senior notes due 2022 2.600% 999 2.678% 999 2.678%

Senior notes due 2024 3.450% 749 3.531% 749 3.531%

Senior notes due 2042 4.000% 744 4.114% 743 4.114%

Total senior notes 6,738 6,736

Hedge accounting fair value

adjustments 41 22

Other indebtedness — 19

Total long-term debt $6,779 $6,777

Short-Term Debt

Senior notes due 2015 0.700% — — % 250 0.820%

Senior notes due 2015 1.625% — — % 600 1.805%

Total short-term debt — 850

Total Debt $6,779 $7,627

F-31