eBay 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

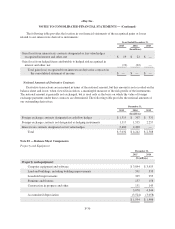

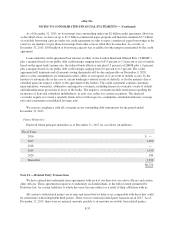

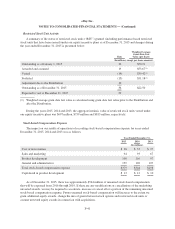

Senior Notes

During the year ended December 31, 2015, $250 million aggregate principal amount of 0.700% fixed rate

notes due 2015 and $600 million aggregate principal amount of 1.625% fixed rate notes due 2015 matured and

were repaid during the year.

The floating rate notes are not redeemable prior to maturity. We may redeem some or all of the fixed rate

notes of each series at any time and from time to time prior to their maturity, generally at a make-whole

redemption price.

To help achieve our interest rate risk management objectives, in connection with the previous issuance of

certain senior notes, we entered into interest rate swap agreements that effectively converted $2.4 billion of our

fixed rate debt to floating rate debt based on LIBOR plus a spread. These swaps were designated as fair value

hedges against changes in the fair value of certain fixed rate senior notes resulting from changes in interest rates.

The gains and losses related to changes in the fair value of interest rate swaps substantially offset changes in the

fair value of the hedged portion of the underlying debt that are attributable to changes in market interest rates.

The effective interest rates for our senior notes include the interest payable, the amortization of debt

issuance costs and the amortization of any original issue discount on these senior notes. Interest on these senior

notes is payable either quarterly or semiannually. Interest expense associated with these senior notes, including

amortization of debt issuance costs, during the years ended December 31, 2015 and 2014 was approximately

$178 million and $137 million, respectively. At December 31, 2015, the estimated fair value of these senior notes

was approximately $6.5 billion.

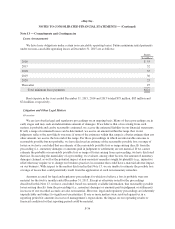

The indenture pursuant to which the senior notes were issued includes customary covenants that, among

other things and subject to exceptions, limit our ability to incur, assume or guarantee debt secured by liens on

specified assets or enter into sale and lease-back transactions with respect to specified properties, and also

includes customary events of default.

Commercial Paper

In connection with entering into the credit agreement described below, in November 2015, the Company

reduced the aggregate principal amount at maturity of commercial paper notes which may be outstanding under

its commercial paper program at any time from $2.0 billion to $1.5 billion to correspond with the $1.5 billion of

available borrowing capacity it maintains under the credit agreement for the repayment of commercial paper

borrowings in the event it is unable to repay those borrowings from other sources when they become due. We

have a $1.5 billion commercial paper program pursuant to which we may issue commercial paper notes with

maturities of up to 397 days from the date of issue in an aggregate principal amount of up to $1.5 billion at any

time outstanding. As of December 31, 2015, there were no commercial paper notes outstanding.

Credit Agreement

In November 2015, we entered into a credit agreement that provides for an unsecured $2 billion five-year

revolving credit facility. We may also, subject to the agreement of the applicable lenders, increase the

commitments under the revolving credit facility by up to an aggregate amount of $1 billion. Funds borrowed

under the credit agreement may be used for working capital, capital expenditures, acquisitions and other general

corporate purposes. The credit agreement replaced our prior $3.0 billion unsecured revolving credit agreement,

dated as of November 2011.

F-32