eBay 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

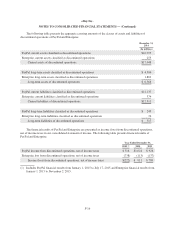

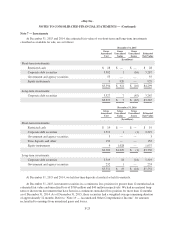

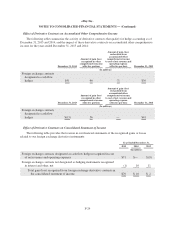

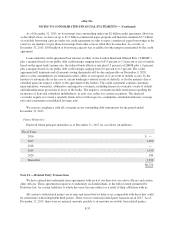

Description

Balances as of

December 31, 2014

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

(In millions)

Assets:

Cash and cash equivalents $ 4,105 $1,694 $ 2,411

Short-term investments:

Restricted cash 19 19 —

Corporate debt securities 2,519 — 2,519

Government and agency securities 3 — 3

Time deposits 152 — 152

Equity instruments 1,037 1,037 —

Total short-term investments 3,730 1,056 2,674

Derivatives 84 — 84

Long-term investments:

Corporate debt securities 5,319 — 5,319

Government and agency securities 233 — 233

Total long-term investments 5,552 — 5,552

Total financial assets $13,471 $2,750 $10,721

Liabilities:

Derivatives $ 20 $ — $ 20

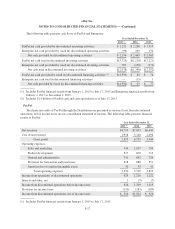

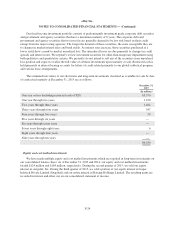

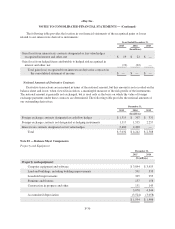

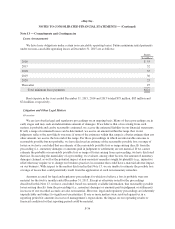

Our financial assets and liabilities are valued using market prices on both active markets (level 1) and less

active markets (level 2). Level 1 instrument valuations are obtained from real-time quotes for transactions in

active exchange markets involving identical assets. Level 2 instrument valuations are obtained from readily

available pricing sources for comparable instruments, identical instruments in less active markets, or models

using market observable inputs. The majority of our derivative instruments are valued using pricing models that

take into account the contract terms as well as multiple inputs where applicable, such as equity prices, interest

rate yield curves, option volatility and currency rates. We did not have any transfers of financial instruments

between valuation levels during 2015 or 2014.

Cash and cash equivalents are short-term, highly liquid investments with original or remaining maturities of

three months or less when purchased and are comprised primarily of bank deposits, certificates of deposit and

commercial paper.

In addition, we had cost and equity method investments of approximately $124 million and $184 million

included in long-term investments on our consolidated balance sheet at December 31, 2015 and 2014,

respectively.

Our derivative instruments vary in duration depending on contract type. Our foreign exchange derivative

contracts are primarily short-term in nature, generally one month to one year in duration. Certain foreign

F-26