eBay 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

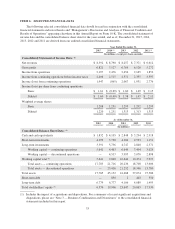

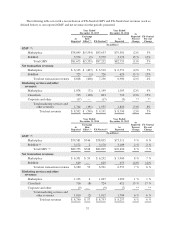

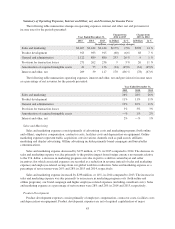

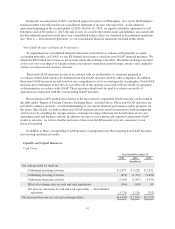

Summary of Operating Expenses, Interest and Other, net, and Provision for Income Taxes

The following table summarizes changes in operating expenses, interest and other, net and provision for

income taxes for the periods presented:

Year Ended December 31,

Change from

2014 to 2015

Change from

2013 to 2014

2015 2014 2013 in Dollars in % in Dollars in %

(In millions, except percentage changes)

Sales and marketing $2,267 $2,442 $2,144 $(175) (7)% $298 14 %

Product development 923 983 915 (60) (6)% 68 7 %

General and administrative 1,122 889 880 233 26 % 9 1 %

Provision for transaction losses 271 262 236 9 3 % 26 11 %

Amortization of acquired intangible assets 41 75 136 (34) (45)% (61) (45)%

Interest and other, net 209 39 117 170 436 % (78) (67)%

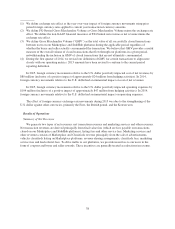

The following table summarizes operating expenses, interest and other, net and provision for income taxes

as a percentage of net revenues for the periods presented:

Year Ended December 31,

2015 2014 2013

Sales and marketing 26% 28% 26%

Product development 11% 11% 11%

General and administrative 13% 10% 11%

Provision for transaction losses 3% 3% 3%

Amortization of acquired intangible assets —% 1% 2%

Interest and other, net 2% —% 1%

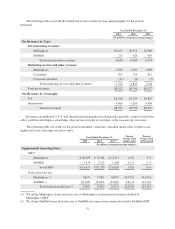

Sales and Marketing

Sales and marketing expenses consist primarily of advertising costs and marketing programs (both online

and offline), employee compensation, contractor costs, facilities costs and depreciation on equipment. Online

marketing expenses represent traffic acquisition costs in various channels such as paid search, affiliates

marketing and display advertising. Offline advertising includes primarily brand campaigns and buyer/seller

communications.

Sales and marketing expense decreased by $175 million, or 7%, in 2015 compared to 2014. The decrease in

sales and marketing expense was due primarily to the positive impact from foreign currency movements relative

to the U.S. dollar, a decrease in marketing program costs due in part to a shift in certain buyer and seller

incentives (for which associated expenses are recorded as a reduction in revenue instead of sales and marketing

expense) and employee-related savings from our global workforce reduction. Sales and marketing expense as a

percentage of net revenues were 26% and 28% in 2015 and 2014, respectively.

Sales and marketing expense increased by $298 million, or 14%, in 2014 compared to 2013. The increase in

sales and marketing expense was due primarily to an increase in marketing program costs (both online and

offline programs), our brand campaign and higher employee-related expenses (including consultant costs). Sales

and marketing expense as a percentage of net revenues were 28% and 26% in 2014 and 2013, respectively.

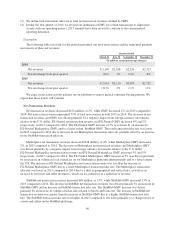

Product Development

Product development expenses consist primarily of employee compensation, contractor costs, facilities costs

and depreciation on equipment. Product development expenses are net of required capitalization of major

43