Whirlpool 2014 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2014 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Whirlpool 2014AR p 2 / 3

Chairman’s Message

During the year, we completed two very important

acquisitions that contributed to our record results in

2014 and create an even larger platform for growth

in the future. Our investments in our brands and

products generated more than 70 new product

launches that have set the stage for future years of

margin expansion. We effectively managed through

volatility and headwinds in emerging markets and

continued our focus on driving benefits through

ongoing cost productivity programs.

As a result, we created value for our shareholders

as our stock finished the year at an all-time high

in December and over the last three years, total

shareholder return was 335 percent. We increased

quarterly dividends on the company’s common stock

by 20 percent and repurchased $25 million of shares

under the current share repurchase program that has

$475 million in authorized funds remaining.

NEW GLOBAL GROWTH PLATFORM

As we turn the page to 2

015,

we expect to be an even

larger global branded consumer products company

with substantial earnings and free cash flow growth.

We have a fundamentally different platform for growth

than we did a decade ago with four value creating

regions, seven brands that generate more than $1 billion

in revenue, truly global earnings diversification

and unprecedented global scale. We are now No.1 in

North America, Europe, and Latin America, and the

No.1 Western Company in Asia.

At our Investor Day in December, we laid out strong

value creation targets through 2018 as we continue

to grow our core appliance business, expand our

adjacent businesses and drive acquisition cost

synergies of nearly $400 million, resulting in:

• Growing revenues by more than 30%

•

Doubling ongoing EPS to $22–$24 per diluted share

• Doubling free cash flow to $1.3–$1.6 billion

MULTIPLE PATHS TO PROFITABLE GROWTH AND

MARGIN EXPANSION

Our acquisitions provide us with outstanding

opportunities for geographic growth and transformation

in Europe and Asia, creating substantial sources of

value creation and diversification of our earnings

profile. Additionally, we have opportunities for growth

as demand in the U.S. continues to recover and we are

well positioned to capitalize when growth returns to

emerging markets such as Brazil, China and India.

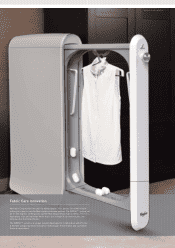

In 2014,

we invested more than $700 million in

capital expenditures and will continue accelerating

our investments in relevant technologi

es and

products that benefit our consumers. We are also

driving revenue growth in areas that expand and

extend beyond our core appliance business, and by

leveraging our core infrastructure we will continue to

grow in these higher margin categories.

We also h

ave a significant opportunity to create value

with what we believe is the best global cost structure

in the industry. We wil

l continue to drive ongoing cost

productivity programs, leverage a right-sized fixed cost

structure with volume growth, and reduce complexity

through high volume global platforms. As a result of

these opportunities, we are expecting revenue growth

and margin expansion in every region.

STRATEGIC ARCHITECTURE

These multiple opportunities for growth support our

vision to be the best branded consumer products

company in every home around the world. We leverage

four strategic planks as we strive to create demand

and earn trust with our consumers every day. The first

two planks focus on “what” we do to fulfill that mission.

First, we have to bring great product leadership to

the market every day, driving innova

tion in ways that

matter to consumers. That’s our economic engine.

Second, we have to continue to invest in our great

brands that help us to create demand as each brand

connects with our consumers in a unique way tailored

toward their preferences.

In addition to understanding “what” we do, we must

also focus on “how” we fulfill our mission. The third

and fourth planks address just that. We drive

operating excellence in every part of our business —

from des

ign and manufacturing to selling, shipping

and servicing — as we implement the best practices

from around the world to ensure we are getting better

each and every day. And last, but probably most

important, is people excellence. We invest in our

people just as we invest in our products and have

created a great global employee team. Operating with

2014 RESULTS

2014 was a milestone year for Whirlpool

Corporation as we delivered record

results, created strong shareholder

value and built an exceptional platform

for growth and margin expansion for

2015 and beyond.

• Record revenue of $19.9 billion

•

Record EPS of $11.39

(ongoing business earnings per diluted share)

• Strong cash generation of $854 million

(free cash flow)