Whirlpool 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

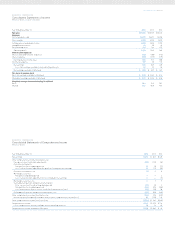

Whirlpool 2014AR p 38 / 39

FREE CASH FLOW

As defined by the company, free cash flow is cash provided by operating activities after capi-

tal expenditures, proceeds from the sale of assets and businesses and changes in restricted

cash. The reconciliation provided below reconciles twelve-month 2014, 2013 and 2012 full-

year free cash flow with cash provided by operating activities, the most directly comparable

GAAP financial measure. The change in restricted cash relates to the private placement

funds paid by Whirlpool to acquire a majority control of Hefei Sanyo and which are used to

fund capital and technical resources to enhance Hefei Sanyo’s research and development

and working capital.

(Millions of dollars)

2014 2013 2012

Cash Provided by Operating Activities $ 1,479 $1,262 $ 696

Capital expenditures, proceeds from sale of assets/businesses

and changes in restricted cash (625)(572)(466)

Free Cash Flow $ 854 $ 690 $ 230

FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-

looking statements made by us or on our behalf. Certain statements contained in this annual

report, including those within the forward-looking perspective section within this Manage-

ment’s Discussion and Analysis, and other written and oral statements made from time to

time by us or on our behalf do not relate strictly to historical or current facts and may con-

tain forward-looking statements that reflect our current views with respect to future events

and financial performance. As such, they are considered “forward-looking statements” which

provide current expectations or forecasts of future events. Such statements can be identified

by the use of terminology such as “may,” “could,” “will,” “should,” “possible,” “plan,” “predict,”

“forecast,” “potential,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “may

impact,” “on track,” and similar words or expressions. Our forward-looking statements gen-

erally relate to our growth strategies, financial results, product development, and sales

efforts. These forward-looking statements should be considered with the understanding

that such statements involve a variety of risks and uncertainties, known and unknown, and

may be affected by inaccurate assumptions. Consequently, no forward-looking statement

can be guaranteed and actual results may vary materially.

This document contains forward-looking statements about Whirlpool Corporation and its

consolidated subsidiaries (“Whirlpool”) that speak only as of this date. Whirlpool disclaims

any obligation to update these statements. Forward-looking statements in this document

may include, but are not limited to, statements regarding expected earnings per share,

cash flow, productivity and raw material prices. Many risks, contingencies and uncertainties

could cause actual results to differ materially from Whirlpool’s forward-looking statements.

Among these factors are: (1) intense competition in the home appliance industry reflecting

the impact of both new and established global competitors, including Asian and European

manufacturers; (2) acquisition and investment-related risk, including risk associated with

our acquisitions of Hefei Sanyo and Indesit, and risk associated with our increased presence

in emerging markets; (3) Whirlpool’s ability to continue its relationship with significant trade

customers and the ability of these trade customers to maintain or increase market share;

(4) risks related to our international operations, including changes in foreign regulations,

regulatory compliance and disruptions arising from natural disasters or terrorist attacks;

(5) fluctuations in the cost of key materials (including steel, plastic, resins, copper and alu-

minum) and components and the ability of Whirlpool to offset cost increases; (6) the ability

of Whirlpool to manage foreign currency fluctuations; (7) litigation, tax, and legal compliance

risk and costs, especially costs which may be materially different from the amount we expect

to incur or have accrued for; (8) the effects and costs of governmental investigations or

related actions by third parties; (9) changes in the legal and regulatory environment including

environmental and health and safety regulations; (10) Whirlpool’s ability to maintain its repu-

tation and brand image; (11) the ability of Whirlpool to achieve its business plans, productivity

improvements, cost control, price increases, leveraging of its global operating platform,

and acceleration of the rate of innovation; (12) information technology system failures and

data security breaches; (13) product liability and product recall costs; (14) inventory and

other asset risk; (15) changes in economic conditions which affect demand for our products,

including the strength of the building industry and the level of interest rates; (16) the ability

of suppliers of critical parts, components and manufacturing equipment to deliver sufficient

quantities to Whirlpool in a timely and cost-effective manner; (17) the uncertain global econ-

omy; (18) our ability to attract, develop and retain executives and other qualified employees;

(19) the impact of labor relations; (20) Whirlpool’s ability to obtain and protect intellectual

property rights; and (21) health care cost trends, regulatory changes and variations between

results and estimates that could increase future funding obligations for pension and post-

retirement benefit plans.

We undertake no obligation to update any forward-looking statement, and investors are

advised to review disclosures in our filings with the SEC. It is not possible to foresee or

identify all factors that could cause actual results to differ from expected or historic results.

Therefore, investors should not consider the foregoing factors to be an exhaustive statement

of all risks, uncertainties, or factors that could potentially cause actual results to differ from

forward-looking statements.

Additional information concerning these and other factors can be found in Whirlpool

Corporation’s filings with the Securities and Exchange Commission, including the most

recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports

on Form 8-K.

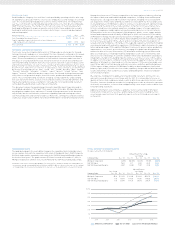

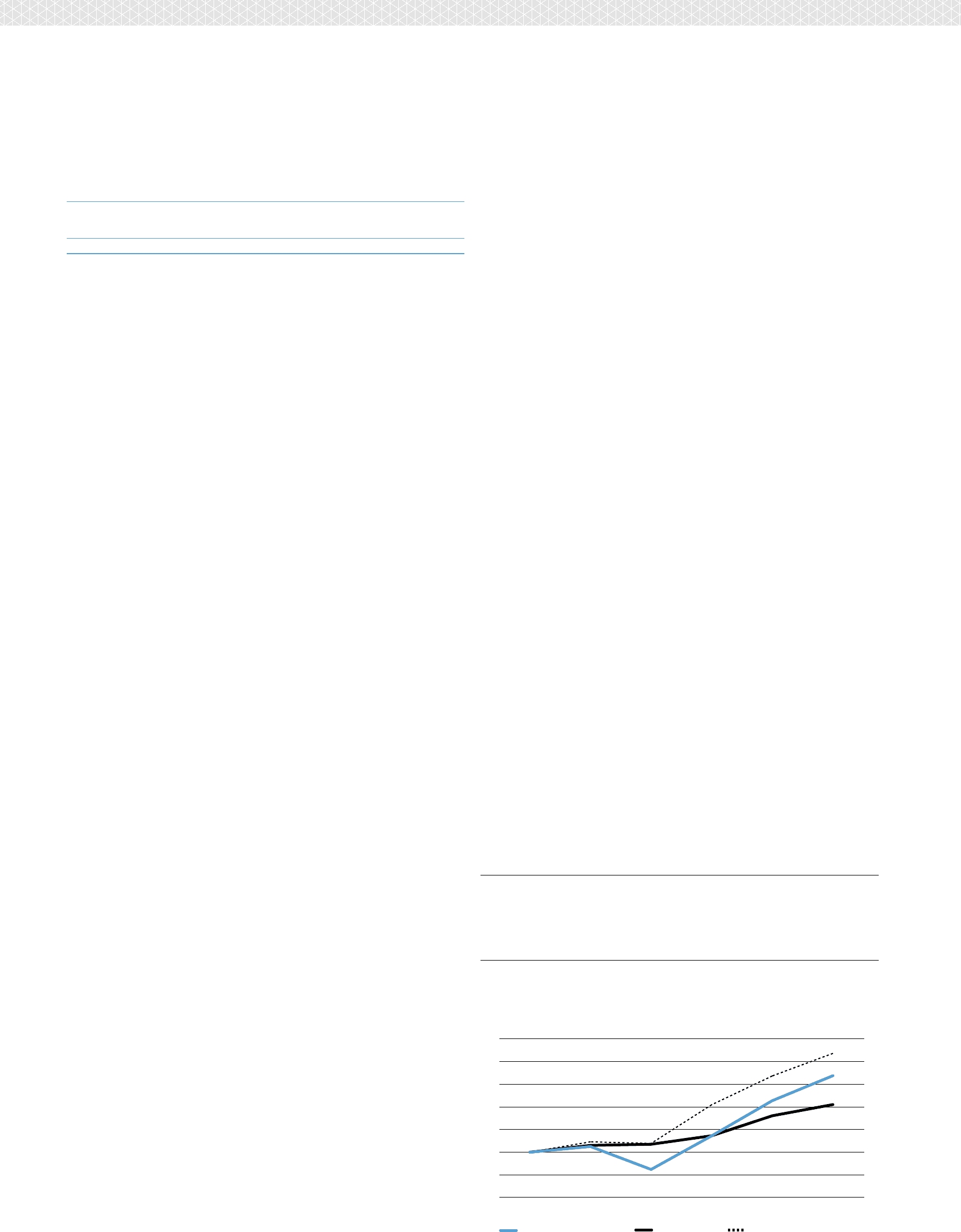

PERFORMANCE GRAPH

The graph below depicts the yearly dollar change in the cumulative total stockholder return

on our common stock with the cumulative total return of Standard & Poor’s [S&P] Composite

500 Stock Index and the cumulative total return of the S&P 500 Household Durables Index for

the last five fiscal years.* The graph assumes $100 was invested on December 31, 2009, in

Whirlpool Corporation common stock, the S&P 500 and the S&P Household Durables Index.

* Cumulative total return is measured by dividing [1] the sum of [a] the cumulative amount of the dividends for the

measurement period, assuming dividend reinvestment, and [b] the difference between share price at the end and

at the beginning of the measurement period by [2] the share price at the beginning of the measurement period.

TOTAL RETURN TO SHAREHOLDERS

(Includes reinvestment of dividends)

Annual Return Percentage

Years Ending

Company/Index Dec. ’10 Dec. ’11 Dec. ’12 Dec. ’13 Dec. ’14

Whirlpool Corporation 12.45% (45.00)% 120.12% 57.00% 25.81%

S&P 500 Index 15.06 2.11 16.00 32.39 13.69

S&P 500 Household Durables 22.87 (2.88) 71.57 31.08 18.54

Base Period

Indexed Returns

Years Ending

Company/Index Dec. ’09 Dec. ’10 Dec. ’11 Dec. ’12 Dec. ’13 Dec. ’14

Whirlpool Corporation $100 $112.45 $ 61.85 $136.14 $213.74 $268.90

S&P 500 Index 100 115.06 117.49 136.30 180.44 205.14

S&P 500 Household Durables 100 122.87 119.33 204.74 268.37 318.13

WHIRLPOOL CORPORATION S&P 500 INDEX S&P 500 HOUSEHOLD DURABLES

2009

0

50

100

150

200

250

300

$350

2010 2011 2012 2013 2014