Whirlpool 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

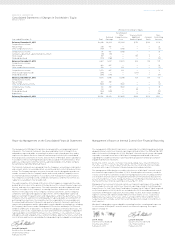

WHIRLPOOL CORPORATION

Consolidated Statements of Changes In Stockholders’ Equity

(Millions of dollars)

Whirlpool Stockholders’ Equity

Year ended December 31, Total

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Treasury Stock/

Additional

Paid-in-Capital

Common

Stock

Non-

Controlling

Interests

Balances, December 31, 2011 $ 4,280 $4,922 $(1,226) $ 379 $106 $ 99

Comprehensive income

Net earnings 425 401 — — — 24

Other comprehensive loss (309) — (305) — — (4)

Comprehensive income 116 401 (305) — — 20

Cumulative adjustment, equity method investment (18) (18) — — — —

Stock issued 159 — — 157 2 —

Dividends declared (170) (158) — — — (12)

Balances, December 31, 2012 4,367 5,147 (1,531) 536 108 107

Comprehensive income

Net earnings 849 827 — — — 22

Other comprehensive income 230 — 233 — — (3)

Comprehensive income 1,079 827 233 — — 19

Stock issued (repurchased) (206) — — (207) 1 —

Dividends declared (206) (190) — — — (16)

Balances, December 31, 2013 5,034 5,784 (1,298) 329 109 110

Comprehensive income

Net earnings 692 650 — — — 42

Other comprehensive income (546) — (542) — — (4)

Comprehensive income 146 650 (542) — — 38

Stock issued 59 — — 58 1 —

Dividends declared (244) (225) — — — (19)

Acquisitions 801 — — 19 — 782

Balances, December 31, 2014 $ 5,796 $6,209 $(1,840) $ 406 $110 $911

Whirlpool 2014AR p 44 / 45

The management of Whirlpool Corporation has prepared the accompanying financial

statements. The financial statements have been audited by Ernst & Young LLP, an

independent registered public accounting firm, whose report, based upon their audits,

expresses the opinion that these financial statements present fairly the consolidated

financial position, statements of income and cash flows of Whirlpool and its subsidiaries

in accordance with accounting principles generally accepted in the United States. Their

audits are conducted in conformity with the auditing standards of the Public Company

Accounting Oversight Board (United States).

The financial statements were prepared from the Company’s accounting records, books

and accounts which, in reasonable detail, accurately and fairly reflect all material trans-

actions. The Company maintains a system of internal controls designed to provide rea-

sonable assurance that the Company’s books and records, and the Company’s assets

are maintained and accounted for, in accordance with management’s authorizations.

The Company’s accounting records, compliance with policies and internal controls are

regularly reviewed by an internal audit staff.

The audit committee of the Board of Directors of the Company is composed of five inde-

pendent directors who, in the opinion of the board, meet the relevant financial experience,

literacy, and expertise requirements. The audit committee provides independent and

objective oversight of the Company’s accounting functions and internal controls and

monitors (1) the objectivity of the Company’s financial statements, (2) the Company’s

compliance with legal and regulatory requirements, (3) the independent registered

public accounting firm’s qualifications and independence, and (4) the performance of the

Company’s internal audit function and independent registered public accounting firm. In

performing these functions, the committee has the responsibility to review and discuss

the annual audited financial statements and quarterly financial statements and related

reports with management and the independent registered public accounting firm, including

the Company’s disclosures under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” to monitor the adequacy of financial disclosure. The

committee also has the responsibility to retain and terminate the Company’s independent

registered public accounting firm and exercise the committee’s sole authority to review

and approve all audit engagement fees and terms and pre-approve the nature, extent, and

cost of all non-audit services provided by the independent registered public accounting firm.

Larry M. Venturelli

Executive Vice President and

Chief Financial Officer

February 26, 2015

The management of Whirlpool Corporation is responsible for establishing and maintaining

adequate internal control over financial reporting as defined in Rules 13a–15(f) and 15d–15(f)

under the Securities Exchange Act of 1934. Whirlpool’s internal control system is designed

to provide reasonable assurance to Whirlpool’s management and board of directors

regarding the reliability of financial reporting and the preparation and fair presentation

of published financial statements.

All internal control systems, no matter how well designed, have inherent limitations.

Therefore, even those systems determined to be effective can provide only reasonable

assurance with respect to financial statement preparation and presentation.

The management of Whirlpool assessed the effectiveness of Whirlpool’s internal control

over financial reporting as of December 31, 2014. In making this assessment, it used the

criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commis-

sion (COSO) in

Internal Control—Integrated Framework

(2013 Framework). Based on the

assessment and those criteria, management believes that Whirlpool maintained effective

internal control over financial reporting as of December 31, 2014.

Management’s assessment of internal control over financial reporting as of December 31,

2014 excludes the internal control over financial reporting related to Hefei Rongshida

Sanyo Electric Co., Ltd. (“Hefei Sanyo”) and Indesit Company S.p.A. (“Indesit”) (both acquired

in the fourth quarter of 2014), which are included in the 2014 consolidated financial

statements of Whirlpool Corporation. As of December 31, 2014, Hefei Sanyo and Indesit

together constitute $5.6 billion and $2.9 billion of total and net assets, respectively.

Additionally, they represent net sales and net earnings of $994 million and $15 million,

respectively, which excludes certain non-recurring acquisition-related costs and invest-

ment expenses.

Whirlpool’s independent registered public accounting firm has issued an audit report on

its assessment of Whirlpool’s internal control over financial reporting. This report

appears on page 47.

Jeff M. Fettig Larry M. Venturelli

Chairman of the Board and Executive Vice President and

Chief Executive Officer Chief Financial Officer

February 26, 2015 February 26, 2015

Report by Management on the Consolidated Financial Statements Management’s Report on Internal Control Over Financial Reporting