Whirlpool 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

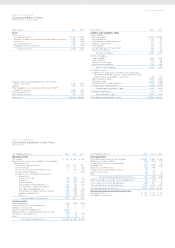

Whirlpool 2014AR p 36 / 37

FINANCIAL SUMMARY

The following pages include Whirlpool Corporation’s financial condition and results of

operations for 2014, 2013 and 2012. For a more complete understanding of our financial

condition and results, this summary should be read together with Whirlpool Corporation’s

Financial Statements and related notes, and “Management’s Discussion and Analysis.” This

information appears in the Company’s 2014 Annual Report on Form 10-K filed with the

Securities and Exchange Commission, which is available on the company’s website at

investors.whirlpoolcorp.com/sec.cfm.

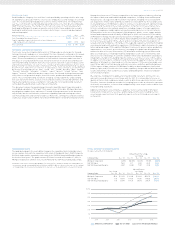

FORWARD-LOOKING PERSPECTIVE

We currently estimate earnings per diluted share and industry demand for 2015 and target

earnings per diluted share for 2018 to be within the following ranges:

2015

Current Outlook

2018

Target

Estimated earnings per diluted share,

for the year ending December 31, 2015 $10.75–$11.75 $21.50–$23.50

Including:

Restructuring Expense $(2.85) $(0.50)

Acquisition Related Transition Cost $(0.24) —

Pension Settlement Charge $(0.11) —

Acquisition Purchase Price Accounting Adjustment—Inventory $(0.01) —

Industry demand

North America +4% – +6%

Latin America (3)% – +0%

EMEA 0% – +2%

Asia +1% – +3%

For the full-year 2015, we expect to generate free cash flow between $700 and $800 million,

including restructuring cash outlays of up to $250 million, capital spending of $800 to

$850 million and U.S. pension contributions of approximately $80 million.

The projections above are based on many estimates and are inherently subject to change

based on future decisions made by management and the Board of Directors of Whirlpool,

and significant economic, competitive and other uncertainties and contingencies.

The table below reconciles projected 2015 and targeted 2018 cash provided by operating

activities determined in accordance with GAAP to free cash flow, a non-GAAP measure.

Management believes that free cash flow provides stockholders with a relevant measure of

liquidity and a useful basis for assessing Whirlpool’s ability to fund its activities and obliga-

tions. There are limitations to using non-GAAP financial measures, including the difficulty

associated with comparing companies that use similarly named non-GAAP measures whose

calculations may differ from our calculations. We define free cash flow as cash provided by

continuing operations less capital expenditures and including proceeds from the sale of

assets/businesses, and changes in restricted cash. The change in restricted cash relates

to the private placement funds paid by Whirlpool to acquire majority control of Hefei Sanyo

and which are used to fund capital and technical resources to enhance Hefei Sanyo’s

research and development and working capital.

(Millions of dollars)

2015

Current Outlook

2018

Target

Cash provided by operating activities $1,500–$1,650 $2,275–$2,625

Capital expenditures, proceeds from sale of assets/businesses

and changes in restricted cash (800)–(850) (975)–(1,025)

Free cash flow $700–$800 $1,300–$1,600

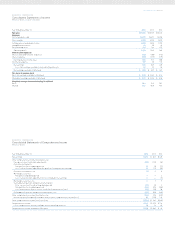

ONGOING BUSINESS OPERATIONS MEASURES: OPERATING PROFIT AND

EARNINGS PER DILUTED SHARE

The reconciliation provided below reconciles the non-GAAP financial measures, ongoing

business operating profit and ongoing business earnings per diluted share, with the most

directly comparable GAAP financial measures, reported operating profit and earnings per

diluted share avail able to Whirlpool, for the twelve months ended December 31, 2014,

December 31, 2013, and December 31, 2012. Ongoing business operating profit margin is

calculated by dividing ongoing business operating profit by adjusted net sales. Ongoing busi-

ness net sales excludes Brazilian (BEFIEX) tax credits from reported net sales. For more

information, see document titled “GAAP Reconciliations” at investors.whirlpoolcorp.com/

annuals.cfm.

Twelve Months Ended December 31,

Operating

Profit

Earnings Per

Diluted Share

(Millions of dollars, except per share data)

2014 2013 2012 2014 2013 2012

Reported GAAP measure $ 1,188 $ 1,249 $ 869 $ 8.17 $ 10.24 $ 5.06

Restructuring expense 136 196 237 1.34 1.84 2.15

Brazilian tax credits [BEFIEX] (14) (109) (37) (0.18) (1.35) (0.47)

Combined Acquisition Related Transition costs 98 — — 1.09 — —

U.S. Energy Tax Credits —— — —(1.56) —

Inventory Purchase Price Allocations 13 — — 0.13 — —

Antitrust and Contract resolutions 2— — 0.04 0.40 —

Brazilian collection dispute and antitrust resolutions —— — —— 0.32

Investment expense 52 6 — 0.86 0.19 —

Brazilian government settlement —11 — —0.26 —

Investment and intangible impairment —— 4 —— 0.12

Benefit plan curtailment gain —— (49) —— (0.38)

Contract and patent resolutions —— — —— 0.17

Normalized tax rate adjustment —— — (0.06) — 0.08

Ongoing business operations measure $ 1,475 $ 1,353 $ 1,024 $ 11.39 $ 10.02 $ 7.05

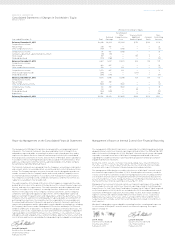

World’s Most Admired Companies

Fourth consecutive distinction from

Fortune

magazine

(Home Equipment, Furnishings Industry sector)

World’s Most Reputable Companies

Seventh consecutive honor from

Forbes

magazine and

the Reputation Institute

FTSE4Good Index

Global responsible investment index

Dow Jones Sustainability Index, North America

Global corporate sustainability index

Top 50 Best Corporate Citizens

Twelfth consecutive inclusion in

CR

magazine listing

(United States)

Best Places to Work for LGBT Equality

Eleventh perfect score of 100 from the Human Rights

Campaign (United States)

Best Customer Satisfaction

First among all major appliance companies from

American Customer Service Index

Top Company for Leaders

Ninth in North America and thirteenth globally from

Aon Hewitt

Leadership in Energy and Environmental Design

(LEED®) Silver Certification

Benton Harbor, Mich., Global Headquarters facility

Leadership in Energy and Environmental Design

(LEED®) Gold Certification

Benton Harbor, Mich., Riverview campus, Bldg. C—

U.S. Green Building Council

ENERGY STAR® Sustained Excellence Award

Whirlpool Canada—Natural Resources Canada

Green Rankings

Sixth in consumer products from

Newsweek

magazine

Melhores e Maiores/Biggest and Best Company in

Electronics

Exame

magazine (Brazil)

10 Most Innovative Organizations

Best Innovator ranking, A.T. Kearney together with

Época Negócios

magazine (Brazil)

20 Most Sustainable Companies

Fourth recognition by

Exame

magazine (Brazil)

25 Most Admired Companies

Recognized by human resources professionals in

Gestão RH

magazine (Brazil)

Great Place to Work

Época Negócios

magazine (Brazil)

Best Companies to Work For

Recognized by

Você S/A

magazine and the Institute of

Administration (Brazil)

Companies that Most Respect Consumers in Brazil

Consumidor Moderno

magazine (Brazil)

100 Companies with Best Reputation in Brazil

Exame

magazine (Brazil)

At Whirlpool Corporation, we’ve learned that hard work and doing the

right things the right way for 103 years pave the path for success.

We are humbled by the recognition from well-respected organizations

for our leadership in reputation, citizenship, sustainability and

innovation. 2014 awards include:

Corporate Recognition