Whirlpool 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Whirlpool 2014AR p 48 / 49

Whirlpool Corporation’s Annual Report on Form 10-K, and

other financial information, is available free of charge to

stockholders.

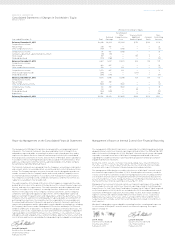

The Financial Summary contained in this Annual Report

should be read together with Whirlpool Corporation’s Finan-

cial Statements and related notes, and “Management’s

Discussion and Analysis.” This information appears in the

Company’s 2014 Annual Report on Form 10-K filed with the

Securities and Exchange Commission, which is available on the

Company’s website at investors.whirlpoolcorp.com/sec.cfm.

This Annual Report contains forward-looking statements.

These statements are based on current expectations and

assumptions that are subject to risks and uncertainties.

Actual results could differ materially because of the factors

discussed in the “Risk Factors” section of the Form 10-K.

The Annual Report on Form 10-K and Company earnings

releases for each quarter—typically issued in April, July,

October and February—can be obtained by contacting:

Chris Conley

Senior Director, Investor Relations

Whirlpool Corporation

2000 N. M-63, Mail Drop 2609

Benton Harbor, MI 49022-2692

Telephone: 269-923-2641

Fax: 269-923-3525

Email: investor_relations@whirlpool.com

Stock Exchanges

Common stock of Whirlpool Corporation (exchange symbol:

WHR) is listed on the New York and Chicago stock exchanges.

Annual Meeting

Whirlpool Corporation’s next annual meeting is scheduled

for April 21, 2015, at 8 a.m. (Central time), at 120 East

Delaware Place, 8th Floor, Chicago.

Transfer Agent, Shareholder Records, Dividend

Disbursements and Corporate Secretary

For information about or assistance with individual stock

records, transactions, dividend checks or stock certificates,

contact:

Computershare Trust Company, N.A.

Shareholder Services

P.O. Box 30170

College Station, TX 77842-3170

Telephone: 877-453-1504

Outside the United States: 781-575-2879

TDD/TTY for hearing impaired: 800-952-9245

www.computershare.com

For additional information, contact:

Bridget K. Quinn

Assistant Secretary

Whirlpool Corporation

2000 N. M-63, Mail Drop 3602

Benton Harbor, MI 49022-2692

Telephone: 269-923-5355

Email: corporate_secretary@whirlpool.com

Direct Stock Purchase Plan

As a participant in the DirectSERVICE Investment and

Stock Purchase Program, you can be the direct owner of

your shares of Whirlpool Corporation Common Stock.

New shareholders and current participants may make cash

contributions of up to $250,000 annually, invested daily, with

or without reinvesting their dividends, and can sell part of the

shares held in the program without exiting the plan. There

are modest transaction processing fees and brokerage com-

missions for purchases, sales and dividend reinvestment.

For details, contact Computershare or visit its website at

www-us.computershare.com/investor to enroll.

Stock-Split and Dividend History

March 1952: 2-for-1 stock exchange

December 1954: 100% stock dividend

May 1965: 2-for-1

May 1972: 3-for-1

December 1986: 2-for-1

Example: 100 shares of Whirlpool Corporation Common

Stock purchased in February 1952 equaled 4,800 shares in

January 2015.

For each quarter during 2012 and Q1 2013, Whirlpool

Corporation paid a dividend of $0.50 per share. For each

quarter of Q2 2013 through Q1 2014, the Company paid a

dividend of $0.625 per share. Beginning in Q2 2014, the

Company paid a quarterly dividend of $0.75 per share.

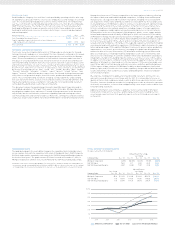

Market Price

High Low Close

4Q 2014 $ 196.71 $ 139.85 $ 193.74

3Q 2014 156.13 135.37 145.65

2Q 2014 156.71 136.64 139.22

1Q 2014 160.01 124.39 149.46

4Q 2013 $ 159.22 $ 129.22 $ 156.86

3Q 2013 151.84 111.70 146.44

2Q 2013 134.09 107.88 114.36

1Q 2013 120.00 101.74 118.46

Trademarks

360˚ Bloom Wash, 6th Sense, Ace 8.0 Supreme Plus, Amana,

Brastemp, Diqua, Duet, Every day, care, Every Moment

Matters, Gladiator, Hotpoint,* Hybridcare, Indesit, Jenn-Air,

KitchenAid, Maytag, PrimeTime, RoyalStar, Torrent, Whirlpool

and the design of the stand mixer are trademarks of Whirlpool

Corporation or its wholly or majority-owned affiliates.

* Whirlpool ownership of the Hotpoint brand in EMEA and Asia Pacific

regions is not affiliated with the Hotpoint brand sold in the Americas.

Boys & Girls Clubs of America, Cook for the Cure, ENERGY

STAR, Habitat for Humanity, Instituto Consulado da Mulher,

Nespresso, SodaStream, SWASH, Trees for the Future,

United Way and certain other trademarks are owned by

their respective companies.

© 2015 Whirlpool Corporation.

All rights reserved.

Shareholder and Other Information

WHIRLPOOL CORPORATION

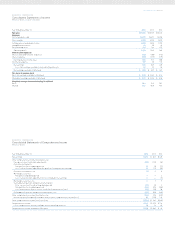

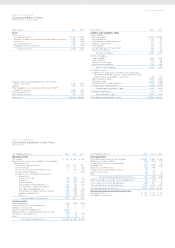

Five-Year Selected Financial Data

(Millions of dollars, except share and employee data)

2014 2013 2012 2011 2010

Consolidated Operations

Net sales $ 19,872 $ 18,769 $ 18,143 $ 18,666 $ 18,366

Restructuring costs 136 196 237 136 74

Depreciation and amortization 560 540 551 558 555

Operating profit 1,188 1,249 869 792 1,008

Earnings (loss) before income taxes and other items 881 917 558 (28) 586

Net earnings 692 849 425 408 650

Net earnings available to Whirlpool 650 827 401 390 619

Capital expenditures 720 578 476 608 593

Dividends paid 224 187 155 148 132

Consolidated Financial Position

Current assets $ 8,098 $ 7,022 $ 6,827 $ 6,422 $ 7,315

Current liabilities 8,403 6,794 6,510 6,297 6,149

Accounts receivable, inventories and accounts

payable, net 778 548 694 947 1,410

Property, net 3,981 3,041 3,034 3,102 3,134

Total assets 20,002 15,544 15,396 15,181 15,584

Long-term debt 3,544 1,846 1,944 2,129 2,195

Total debt(1) 4,347 2,463 2,461 2,491 2,509

Whirlpool stockholders’ equity 4,885 4,924 4,260 4,181 4,226

Per Share Data

Basic net earnings available to Whirlpool $ 8.30 $ 10.42 $ 5.14 $ 5.07 $ 8.12

Diluted net earnings available to Whirlpool 8.17 10.24 5.06 4.99 7.97

Dividends 2.88 2.38 2.00 1.93 1.72

Book value(2) 61.39 60.97 53.70 53.50 54.48

Closing Stock Price—NYSE 193.74 156.86 101.75 47.45 88.83

2014 2013 2012 2011 2010

Key Ratios

Operating profit margin 6.0% 6.7% 4.8% 4.2% 5.5%

Pre-tax margin(3) 4.4% 4.9% 3.1% (0.2)% 3.2%

Net margin(4) 3.3% 4.4% 2.2% 2.1% 3.4%

Return on average Whirlpool stockholders’ equity(5) 13.3% 18.0% 9.5% 9.3% 15.7%

Return on average total assets(6) 3.7% 5.3% 2.6% 2.5% 4.0%

Current assets to current liabilities 1.0 1.0 1.0 1.0 1.2

Total debt as a percent of invested capital(7) 42.9% 33.0% 36.0% 36.8% 36.7%

Price earnings ratio(8) 23.7 15.3 20.1 9.5 11.2

Other Data

Common shares outstanding (in thousands):

Average number—on a diluted basis 79,578 80,761 79,337 78,143 77,628

Year-end common shares outstanding 77,956 77,417 78,407 76,451 76,030

Year-end number of stockholders 11,225 11,889 12,759 13,527 14,080

Year-end number of employees 100,000 69,000 68,000 68,000 71,000

Five-year annualized total return to stockholders(9) 22.0% 34.0% 7.6% (8.1)% 3.8%

(1) Total debt includes notes payable and current and long-term debt.

(2) Total Whirlpool stockholders’ equity divided by average number of shares on a diluted basis.

(3) Earnings (loss) before income taxes, as a percent of net sales.

(4) Net earnings available to Whirlpool, as a percent of net sales.

(5) Net earnings available to Whirlpool, divided by average Whirlpool stockholders’ equity.

(6) Net earnings available to Whirlpool, divided by average total assets.

(7) Total debt divided by total debt and total stockholders’ equity.

(8) Closing stock price divided by diluted net earnings available to Whirlpool.

(9) Stock appreciation plus reinvested dividends, divided by share price at the beginning of the period.