Toyota 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2014

President’s MessagePresident’s Message

Overview of

Four Business Units

Overview of

Four Business Units

Special FeatureSpecial Feature

Review of OperationsReview of Operations

Consolidated Performance

Highlights

Consolidated Performance

Highlights

Management and

Corporate Information

Management and

Corporate Information

Investor InformationInvestor Information

Financial SectionFinancial Section

Page 58

NextPrev

ContentsSearchPrint

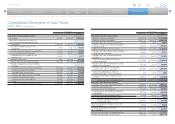

fiscal year. This increase in operating income was

due mainly to the ¥900.0 billion favorable impact of

changes in exchange rates, the ¥290.0 billion

impact of cost reduction efforts, and the ¥190.0 bil-

lion of favorable impact of changes in vehicle unit

sales and sales mix, partially offset by the ¥480.0

billion increase in miscellaneous costs and others.

The changes in vehicle unit sales and changes in

sales mix were due primarily to the increase in

Toyota’s vehicle unit sales by 245 thousand vehicles

compared with the prior fiscal year resulting from

the increase in vehicle unit sales in North America,

Europe and Other. The increase in miscellaneous

costs and others was due mainly to the ¥125.0 bil-

lion payment to the U.S. government based on the

agreement with the U.S. Attorney’s Office for the

Southern District of New York to resolve its investi-

gation, the ¥100.0 billion increase in labor costs, the

¥100.0 billion increase in research and development

expenses, and the ¥83.0 billion increase in costs

related to ending the vehicle and engine production

in Australia, partially offset by the ¥90.0 billion

charge for costs related to the settlement of the

economic loss claims in the consolidated federal

action in the U.S. recorded in the prior fiscal year.

Financial Services Operations Segment

Net revenues for the financial services operations

increased during fiscal 2014 by ¥250.3 billion, or

21.4%, to ¥1,421.0 billion compared with the prior

fiscal year. This increase was primarily due to the

¥199.8 billion favorable impact of fluctuations in for-

eign currency translation rates.

Operating income from financial services opera-

tions decreased by ¥20.9 billion, or 6.6%, to ¥294.8

billion during fiscal 2014 compared with the prior

fiscal year. This decrease was due primarily to the

recording of ¥22.0 billion of valuation losses on

interest rate swaps stated at fair value.

All Other Operations Segment

Net revenues for Toyota’s other operations seg-

ments increased by ¥84.8 billion, or 8.0%, to

¥1,151.2 billion during fiscal 2014 compared with

the prior fiscal year.

Operating income from Toyota’s other operations

segments increased by ¥10.6 billion, or 19.9%, to

¥64.2 billion during fiscal 2014 compared with the

prior fiscal year.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations [11 of 14] Consolidated Financial Statements

As for our future business environment, the world

economy is expected to benefit from ongoing mod-

erate recovery in the U.S. and a gradual move

toward recovery in Europe, meanwhile, some

emerging countries show signs of uncertainty. The

Japanese economy is expected to remain on a

recovery trend, backed by an improved environment

for exports and the effects of various policy mea-

sures. Due attention should be paid, however, to

downside risks mainly from the continuing uncer-

tainty of overseas economies, especially in emerg-

ing countries, and the downturn in consumption

following a surge in last-minute demand spurred by

the consumption tax increase in Japan.

The automotive market is expected to see expan-

sion mainly in the U.S.; however, amid the change in

market structure, as seen in the expansion and

diversification of demand for eco-cars backed by

rising environmental consciousness and rapid

advances in information and communications tech-

nology, fierce competition exists on a global scale.

In light of the foregoing external factors, Toyota

expects that net revenues for fiscal 2015 will

increase compared with fiscal 2014 due to price

revisions and other factors, partially offset by the

unfavorable impact of fluctuations in foreign curren-

cy translation rates and a decrease in vehicle unit

sales. Toyota expects that operating income will

increase in fiscal 2015 compared with fiscal 2014

due mainly to the favorable impact of cost reduction

efforts and marketing efforts, partially offset by an

increase in miscellaneous costs, decrease in vehicle

unit sales and changes in sales mix and the unfa-

vorable impact of fluctuations in foreign currency

rates. Toyota expects that income before income

taxes and equity in earnings of affiliated companies

and net income attributable to Toyota Motor

Corporation will decrease in fiscal 2015 due to for-

eign exchange gains and losses and other factors.

For the purposes of this outlook discussion,

Toyota is assuming an average exchange rate of

¥100 to the U.S. dollar and ¥140 to the euro.

Exchange rate fluctuations can materially affect

Toyota’s operating results. In particular, a strength-

ening of the Japanese yen against the U.S. dollar

can have a material adverse effect on Toyota’s oper-

ating results. See “Operating and Financial Review

and Prospects — Operating Results — Overview —

Currency Fluctuations” for further discussion in

Toyota’s annual report on Form 20-F.

The foregoing statements are forward-looking state-

ments based upon Toyota’s management’s assump-

tions and beliefs regarding exchange rates, market

demand for Toyota’s products, economic conditions

and others. See “Cautionary Statement Concerning

Forward-Looking Statements”. Toyota’s actual results

of operations could vary significantly from those

described above as a result of unanticipated changes

in the factors described above or other factors, includ-

ing those described in “Risk Factors”.

Outlook