Toyota 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2014

President’s MessagePresident’s Message

Overview of

Four Business Units

Overview of

Four Business Units

Special FeatureSpecial Feature

Review of OperationsReview of Operations

Consolidated Performance

Highlights

Consolidated Performance

Highlights

Management and

Corporate Information

Management and

Corporate Information

Investor InformationInvestor Information

Financial SectionFinancial Section

Page 25

NextPrev

ContentsSearchPrint

systems that support efficient workplace practices. We will place consider-

able weight on investments that accurately reflect market trends and lead

toward sustainable growth over the long term.

For example, and as a part of the Company’s environmental activities,

Toyota is working diligently to improve the fuel economy of conventional

engines and is actively engaging in the development of a wide range of

technologies, including hybrid technologies for plug-in hybrid, electric, and

fuel cell vehicles (FCVs). The Company is placing particular emphasis on

FCVs, which are being designed as part of efforts to respond to the grow-

ing diversity of automotive fuels. Boasting zero CO2 or environmentally

hazardous substance emissions while running as well as a level of conve-

nience that is comparable to current gasoline vehicles, FCVs are the ulti-

mate in eco cars. In a bid to promote their widespread use, Toyota plans to

launch a sedan-type FCV in Japan before March 2015 and some time in

summer 2015 in the United States and Europe.

From the perspective of safety, Toyota is drawing on the integrated safety

concept, which pursues connectivity between a wide variety of safety

systems while providing optimal driver support across all driving scenarios,

to vigorously develop safety technologies, including the practical applica-

tion of advanced driver assistance systems.

In the area of information and telecommunications technology, Toyota is

active across a broad spectrum of fields. In addition to an interactive inter-

face that links directly to a vehicle’s operations, sophisticated navigation

systems, and big data analysis, the Company has begun developing technol-

ogies that deliver new value both in terms of vehicle safety and performance.

For example, Toyota is rolling out T-Connect, an innovative new telematics

service. T-Connect features an interactive voice response service that

handles queries about locations and news, as well as a predictive information

service that draws on data from user route histories to predict a car’s desti-

nation. Based on the predicated destination, T-Connect provides voice guid-

ance on relevant traffic accidents, congestion, and road surface conditions.

2. Efficiency: Improving profitability and capital efficiency

Toyota will continue its push forward with the Toyota New Global

Architecture (TNGA), an initiative to overhaul the way we work with the goal

of facilitating the timely launch of appealing products globally. Under TNGA,

we are improving development efficiency and making ever-better cars by

standardizing parts and components through grouped development. In

addition to actively investing in the development of new technologies, we

are carrying out “simple and slim” activities that facilitate the effective use of

existing equipment.

Looking ahead, we will strive to further improve our earnings structure

through efficient investment that emphasizes the areas in which we want to

advance, including hybrids, other eco-cars, and emerging markets.

3. Stability: Maintaining a solid financial base

To ensure a solid financial base, we secure sufficient liquidity and stable

shareholders’ equity. This allows us to maintain capital expenditure and

R&D investment at levels conducive to future growth as well as to maintain

working capital at a level sufficient for operations, even when business

conditions are difficult due to such factors as steep increases in raw materi-

als prices or volatility in foreign exchange rates. We plan to refine and

implement measures to improve business continuity planning in the event

of a major disaster. Amid expectations that the global automotive market

will expand over the medium to long term, we believe that, in addition to

putting crisis measures into place, maintaining adequate liquidity is essen-

tial to the implementation of forward-looking investment aimed at improving

product appeal and the development of next-generation technologies as

well as to the establishment of global production and sales structures. We

will continue to pursue improvements in capital efficiency and cash flow.

Dividends and Share Acquisitions

Toyota considers the enhancement of shareholder value a priority manage-

ment policy and to this end is aiming for sustainable growth through corpo-

rate reorganization to increase corporate value. We aim to pay stable,

ongoing dividends, targeting a consolidated payout ratio of 30%, while

giving due consideration to such factors as performance each term, invest-

ment plans, and cash and cash equivalents.

To succeed in this highly competitive industry, we plan to use retained earn-

ings to quickly commercialize environment- and safety-related next-generation

technologies, with emphasis on customer safety and peace of mind.

Within this context, Toyota declared an annual dividend payment of ¥165

per share for the fiscal year ended March 31, 2014.

At the Company’s 110th General Meeting of Shareholders, Toyota

received approval to dispose of 30 million common shares of treasury stock

in order to establish the Toyota Mobility Fund. The Company also plans to

repurchase up to 60,000,000 shares of its common stock at a total

purchase price of up to ¥360 billion during the fiscal year ending March 31,

2015. Taking the aforementioned into consideration, we cancelled 30

million shares of our treasury stock on June 30, 2014.

With an eye to long-term capital efficiency, Toyota will adopt a flexible

approach toward the future acquisition of its own shares.

Moving forward, we will continue striving to further improve profits and

meet the expectations of our shareholders.

July 2014

Nobuyori Kodaira

Executive Vice President

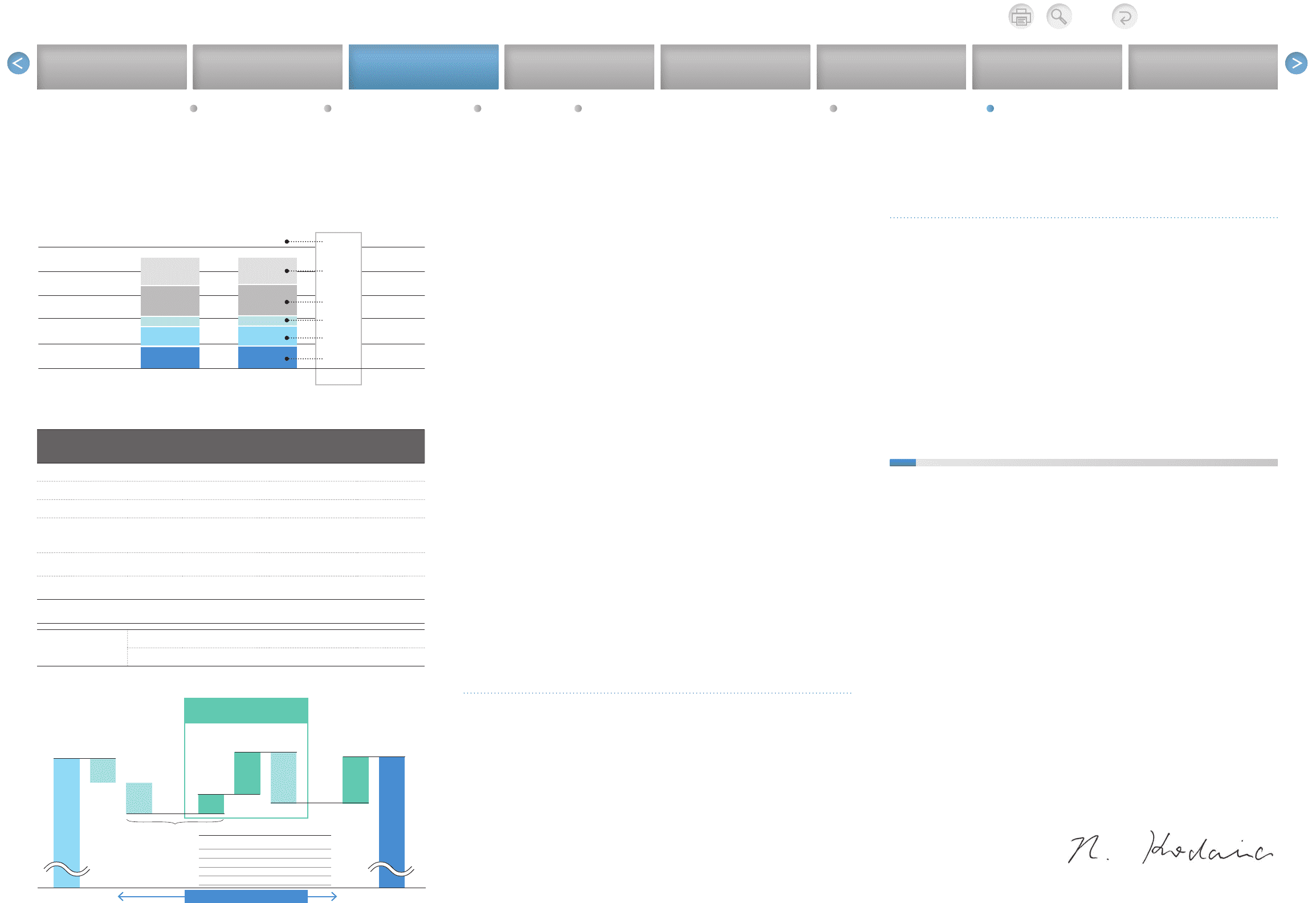

FY2015 Forecasts: Consolidated Financial Summary (Billions of yen)

FY2015 Forecasts

(Apr. 1, 2014–

Mar. 31, 2015)

FY2014 Results

(Apr. 1, 2013–

Mar. 31, 2014)

Change

Net Revenues ¥25,700.0 ¥25,691.9 +8.1

Operating Income 2,300.0 2,292.1 +7.9

Operating Margin 8.9% 8.9% —

Income before Income Taxes

and Equity in Earnings of

Affiliated Companies

2,390.0 2,441.0 –51.0

Equity in Earnings of

Affiliated Companies 300.0 318.3 –18.3

Net Income Attributable to

Toyota Motor Corporation 1,780.0 1,823.1 –43.1

Net Margin Attributable to

Toyota Motor Corporation 6.9% 7.1% —

FOREX Rates Yen/US$ ¥100 ¥100 +

–

0

Yen/Euro 140 134 –6

10,000

8,000

6,000

4,000

2,000

0

FY2015 Forecast: Consolidated Vehicle Sales

(Thousands of units)

ChangeFY2014 Results FY2015 Forecasts

Japan North America Europe Asia Other

9,100

2,210

2,620

850

1,630

1,790

9,116

2,365

2,529

844

1,609

1,769 +21

+21

+6

+91

–155

–16

Message from the Executive Vice President Responsible for Accounting

Analysis of FY2015 Forecast: Consolidated Operating Income

(Billions of yen)

FY2015 ForecastsFY2014 Results Operating Income (+7.9)

Profit Improvement

Activities +40.0

2,292.1 2,300.0

–95.0

–120.0 +75.0

+165.0 –200.0 +182.9

Effects of

FOREX

Rates

Volume/

Model Mix

Effects of Marketing Activities –45.0

Other

Marketing

Efforts

Cost

Reduction

Effort

Increase

in

Expenses*

Non-recurring

Expenses

for FY2014,

etc.

* Details:

Investment for strengthening competitiveness

R&D Expenses –50.0

Depreciation and CAPEX-related Costs –35.0

Labor Costs –65.0

Expenses, etc. –50.0

Toyota in 10 Years and 100 Years Our DNA is Creating Ever-Better Cars What Sets Toyota Apart Enriching Lives and Building Tomorrow’s Toyota through Innovation New Values for the Next Hundred Years Message from the Executive Vice President Responsible for Accounting [2 of 2]