Toyota 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2014

President’s MessagePresident’s Message

Overview of

Four Business Units

Overview of

Four Business Units

Special FeatureSpecial Feature

Review of OperationsReview of Operations

Consolidated Performance

Highlights

Consolidated Performance

Highlights

Management and

Corporate Information

Management and

Corporate Information

Investor InformationInvestor Information

Financial SectionFinancial Section

Page 57

NextPrev

ContentsSearchPrint

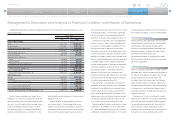

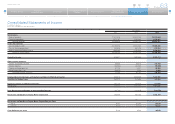

Interest and dividend income increased by ¥16.7

billion, or 17.0%, to ¥115.4 billion during fiscal 2014

compared with the prior fiscal year.

Interest expense decreased by ¥3.3 billion, or

14.5%, to ¥19.6 billion during fiscal 2014 compared

with the prior fiscal year.

Foreign exchange gain, net increased by ¥44.7

billion, or 805.4%, to ¥50.2 billion during fiscal 2014

compared with the prior fiscal year. Foreign

exchange gains and losses include the differences

between the value of foreign currency denominated

assets and liabilities recognized through transac-

tions in foreign currencies translated at prevailing

exchange rates and the value at the date the trans-

action settled during the fiscal year, including those

settled using forward foreign currency exchange

contracts, or the value translated by appropriate

year-end exchange rates. The ¥44.7 billion increase

in foreign exchange gain, net was due mainly to the

losses recorded in fiscal 2013 resulting from the

Japanese yen being stronger against foreign cur-

rencies at the time foreign currency bonds were

redeemed during that fiscal year than the Japanese

yen at the time of purchase.

Other loss, net increased by ¥1.4 billion, or

94.7%, to ¥2.9 billion during fiscal 2014 compared

with the prior fiscal year.

The provision for income taxes increased by ¥216.1

billion, or 39.2%, to ¥767.8 billion during fiscal 2014

compared with the prior fiscal year due mainly to

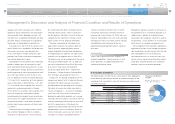

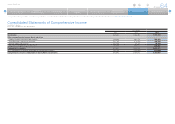

Other comprehensive income increased by ¥61.5

billion to ¥884.2 billion for fiscal 2014 compared

with the prior fiscal year. This increase resulted from

unrealized holding gains on securities in fiscal 2014

of ¥493.7 billion compared with gains of ¥368.5 bil-

lion in the prior fiscal year, and from pension liability

adjustments in fiscal 2014 of ¥93.5 billion com-

pared with gains of ¥19.5 billion in the prior fiscal

year, partially offset by unfavorable foreign currency

translation adjustments gains of ¥296.9 billion in fis-

cal 2014 compared with gains of ¥434.6 billion in

the prior fiscal year.

the increase in income before income taxes and

equity in earnings of affiliated companies. The effec-

tive tax rate for fiscal 2014 was 31.5%, which was

lower than the statutory tax rate in Japan. This was

due mainly to the increase in tax credits and income

before income taxes and equity in earnings of affili-

ated companies from foreign subsidiaries where

statutory tax rates are lower than that of Japan.

Net income attributable to noncontrolling interests

increased by ¥47.2 billion, or 38.9%, to ¥168.5 bil-

lion during fiscal 2014 compared with the prior fiscal

year. This was due mainly to an increase during fis-

cal 2014 in net income attributable to the share-

holders of consolidated subsidiaries.

Equity in earnings of affiliated companies during

fiscal 2014 increased by ¥86.8 billion, or 37.5%, to

¥318.3 billion compared with the prior fiscal year.

This increase was due mainly to an increase during

fiscal 2014 in net income attributable to the share-

holders of affiliated companies accounted for by the

equity method.

Net income attributable to the shareholders of

Toyota Motor Corporation increased by ¥860.9 bil-

lion, or 89.5%, to ¥1,823.1 billion during fiscal 2014

compared with the prior fiscal year.

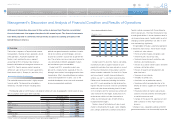

Net Income Attributable to

Toyota Motor Corporation and ROE

Net income attributable to Toyota Motor Corporation

ROE (Right scale)

(¥ Billion)

FY

(%)

2,000

0

20

1,500 15

1,000 10

500 5

0

’10 ’11 ’12 ’13 ’14

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations [10 of 14] Consolidated Financial Statements

Other Income and Expenses

Income Taxes

Net Income Attributable to Noncontrolling

Interests and Equity in Earnings of

Affiliated Companies

Other Comprehensive Income and Loss

Net Income Attributable to Toyota Motor

Corporation

The following is a discussion of the results of operations for each of Toyota’s operating segments. The

amounts presented are prior to intersegment elimination.

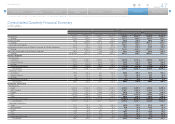

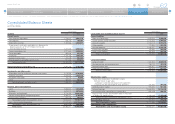

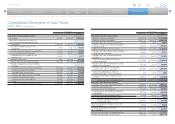

Yen in millions

Years ended March 31, 2014 vs. 2013 Change

2013 2014 Amount Percentage (%)

Automotive: Net revenues 20,419,100 23,781,404 3,362,304 +16.5

Operating income 944,704 1,938,778 994,074 +105.2

Financial Services: Net revenues 1,170,670 1,421,047 250,377 +21.4

Operating income 315,820 294,891 (20,929) –6.6

All Other: Net revenues 1,066,461 1,151,280 84,819 +8.0

Operating income 53,616 64,270 10,654 +19.9

Intersegment elimination/

unallocated amount:

Net revenues (592,039) (661,820) (69,781) —

Operating income 6,748 (5,827) (12,575) —

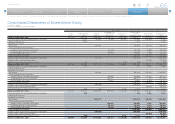

Automotive Operations Segment

The automotive operations segment is Toyota’s

largest operating segment by net revenues. Net rev-

enues for the automotive segment increased during

fiscal 2014 by ¥3,362.3 billion, or 16.5%, to

¥23,781.4 billion compared with the prior fiscal year.

The increase mainly reflects the ¥2,304.9 billion

favorable impact of fluctuations in foreign currency

translation rates and the ¥300.0 billion favorable

impact of changes in vehicle unit sales and

sales mix.

Operating income from the automotive operations

increased by ¥994.0 billion, or 105.2%, to ¥1,938.7

billion during fiscal 2014 compared with the prior

Segment Information