Symantec 1997 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 SYMANTEC CORPORATION

has been estimated at the date of grant using a Black-Scholes

option pricing model assuming no expected dividends and

the following weighted average assumptions:

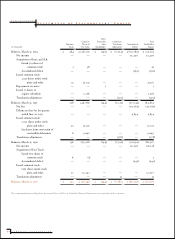

Employee Employee Stock

Stock Options Purchase Plan

Range of Exercise Prices 1997 1996 1997 1996

Expected life (years) 4.34 4.34 0.50 0.50

Expected volatility 0.63 0.74 0.74 0.60

Risk free interest rate 6.7% 6.0% 5.4% 5.4%

During March 1996, the Board of Directors authorized

the Company to offer to each employee with stock options

having an exercise price greater than $13.10 (the “Old

Options”) the opportunity to cancel the affected grants and

receive a new grant for the same number of shares dated

March 4, 1996 (the “New Options”). On the date of grant,

the New Options have an exercise price equal to $13.10 and a

stock price of $12.63. Under the terms of this stock option

cancellation and regrant, all options began vesting as of the

new grant date and no portion of any regranted options were

exercisable until March 4, 1997. Options representing a total

of approximately 2.3 million shares of common stock were

canceled and regranted. The weighted average fair value of

these New Options was $14.79. The President and Chief

Executive Officer, the then Executive Vice President,

Worldwide Operations and Chief Financial Officer, the

majority of the then members of the Executive Staff, and

all members of the Board of Directors elected to exclude

themselves from this stock option cancellation and regrant.

The Black-Scholes option valuation model was devel-

oped for use in estimating the fair value of traded options

that have no vesting restrictions and are fully transferable. In

addition, option valuation models require the input of highly

subjective assumptions, including the expected stock price

volatility. Because the Company’s options have characteristics

significantly different from those of traded options, and

because changes in the subjective input assumptions can

materially affect the fair value estimate, in the opinion of

management, the existing models do not necessarily provide

a reliable single measure of the fair value of its options.

The weighted-average estimated fair value of employee

stock options for fiscal years 1997 and 1996 were $7.81

and $10.44 per share, respectively. The weighted-average

estimated fair value of employee stock purchase rights granted

under the Employee Stock Purchase Plan during fiscal years

1997 and 1996 were $7.74 and $18.94, respectively.

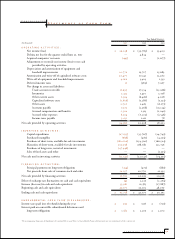

For purposes of pro forma disclosures, the estimated fair

value of the options is amortized to expense over the options’

vesting period (for employee stock options) and the six-

month purchase period (for stock purchases under the

Employee Stock Purchase Plan). The Company’s pro forma

information is as follows:

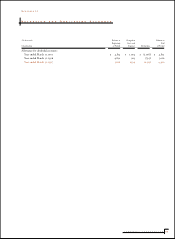

Year ended March 31,

(In thousands, except per share data) 1997 1996

Net income (loss) - Pro forma $14,123 $ (47,015)

Net income (loss) per share - Pro forma 0.27 (0.89)

The effects on pro forma disclosures of applying SFAS

No. 123 are not likely to be representative of the effects on

pro forma disclosures of future years. Because SFAS 123 is

applicable only to options granted subsequent to March 31,

1995, its pro forma effect will not be fully reflected until

approximately fiscal 2000.

Note 9. Sale of Product Rights

During September 1996, Symantec sold its electronic forms

software products and related tangible assets to JetForm

for approximately $100.0 million, payable over four years

in quarterly installments through the June 2000 quarter.

JetForm has the option to tender payment in either cash or in

registered JetForm common stock, within a contractually

defined quantity threshold. Due to the uncertainty regarding

the ultimate collectibility of these installments, Symantec is

recognizing the related revenue as payments are due and

collectibility is assured from JetForm. Symantec recognized

revenue of approximately $18.3 million from JetForm during

fiscal 1997.

In March 1997, Symantec also sold the software prod-

ucts and related tangible assets of its Networking Business

Unit to Hewlett-Packard, resulting in the receipt of approxi-

mately $1.0 million of revenue and a $2.0 million research

and development reimbursement in the fourth quarter of fis-

cal 1997. Additionally, a two year quarterly royalty payment

stream not to exceed a present value of $27.0 million as of the

date of the transaction date will commence beginning in fis-

cal 1998, which is solely contingent on future sales of certain

Hewlett-Packard products. Due to the uncertainty regarding

the amounts upon which these royalties will be determined,

Symantec is recognizing these amounts as they are estimable.

In association with this sale to Hewlett-Packard, during the

fourth quarter of fiscal 1997, Symantec wrote off approxi-