Symantec 1997 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

SYMANTEC CORPORATION

reference (prime) interest rate (8.50% at March 31, 1997), the

U.S. offshore rate plus 1.25%, a CD rate plus 1.25% or London

Interbank Offering Rate (“LIBOR”) plus 1.25%, at the

Company’s discretion. The line of credit requires bank

approval for the payment of cash dividends. Borrowings

under this line are unsecured and are subject to the Company

maintaining certain financial ratios and profits. The

Company was in compliance with the line of credit covenants

as of March 31, 1997. At March 31, 1997, there was approxi-

mately $0.3 million of standby letters of credit outstanding

under this line of credit. There were no borrowings out-

standing under this line at March 31, 1997.

Note 6. Commitments

Symantec leases all of its facilities and certain equipment

under operating leases that expire at various dates through

2026. The Company currently subleases some space under

various operating leases which will expire at various dates

through 2000.

The future fiscal year minimum operating lease

commitments were as follows at March 31, 1997:

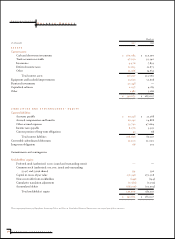

(In thousands)

1998 $ 15,800

1999 15,029

2000 13,831

2001 10,612

2002 7,639

Thereafter 24,352

Operating lease commitments 87,263

Sublease income (5,343)

Net operating lease commitments $ 81,920

Rent expense charged to operations totaled approxi-

mately $12.4 million, $11.3 million and $9.7 million for the

years ended March 31, 1997, 1996 and 1995, respectively.

In fiscal 1997, Symantec entered into lease agreements

for two existing office buildings, land and one office building

under construction in Cupertino, California. The lease agree-

ments are for seven years and the lease payments per year

total approximately $1.0 million in fiscal 1997, $4.1 million

in fiscal 1998 and $4.8 million in fiscal years 1999 through

2004. Lease payments are based on the three month LIBOR

in effect at the beginning of each fiscal quarter. Symantec has

the right to acquire the related properties at any time during

the seven year lease period. If at the end of the lease term

Symantec does not renew the lease, purchase the property

under lease or arrange a third party purchase, then the

Company will be obligated to the lessor for a guaranteed

residual amount equal to a specified percentage of the

Company’s purchase price of the property. Symantec would

also be obligated to the lessor for all or some portion of this

amount if the price paid by the third party is below the guar-

anteed residual amount. The guaranteed residual payment on

the lease agreements for the two existing office buildings

totals approximately $38.4 million. The guaranteed residual

payment on the lease agreements for the land and office

building under construction was approximately $7.0 million

at March 31, 1997 and will increase to approximately $31.7

million at the completion of the construction during fiscal

year 1999. As security against this guaranteed residual

payment, Symantec is required to maintain a corresponding

investment in U.S. Treasury securities with maturities not

to exceed three years. Symantec is restricted in its use of

these investments per the terms of the lease agreement. The

investments total approximately $47.4 million and are

classified as non-current restricted investments within the

financial statements.

The Company currently occupies a portion of these

office buildings and has assumed the right to sub-lease

income provided by the other tenants. The sub-lease

agreements have terms expiring in April 1997 through

September 2000.

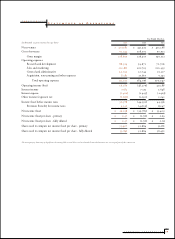

Note 7. Income Taxes

The components of the provision (benefit) for income taxes

were as follows:

Year Ended March 31,

(In thousands) 1997 1996 1995

Current:

Federal $514 $ (5,882) $ 998

State 302 130 349

International 3,472 2,149 2,825

4,288 (3,603) 4,172

Deferred:

Federal 565 (1,006) 6,431

State 126 — 1,761

International (639) — (1,217)

52 (1,006) 6,975

$ 4,340 $ (4,609) $ 11,147