Symantec 1997 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

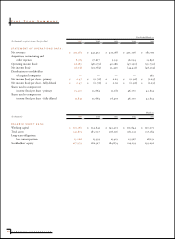

P r oduct Returns

The level of actual product returns and related product return

provision are largely a factor of the level of product sell-in

(gross revenue) from normal sales activity and the replace-

ment of obsolete quantities with the current version of the

Company’s products. Changes in the levels of product

returns and related product return provision are generally

offset by changing levels of gross revenue and, therefore, do

not typically have a material impact on reported net revenues.

The Company’s product return provision typically

fluctuate from period to period based upon the level and timing

of product upgrade releases and changes in product sell-in.

The product return provision for fiscal 1997 was higher than

the provision for fiscal 1996 due to increased returns

exposure for Windows 95 products due to additional product

sell-in during fiscal 1997. The product return provision for

fiscal 1996 was higher than the provision for fiscal 1995, due

to the introduction of Symantec’s Windows 95 products

during the last three quarters of fiscal 1996, which had

unusually high sell-in volumes.

Gross Margin

Gross margin represents net revenues less cost of revenues.

Cost of revenues consists primarily of manufacturing

expenses, costs for producing manuals, packaging costs,

royalties paid to third parties under publishing contracts and

amortization and write-off of capitalized software.

Prior to fiscal 1997, accounting rules requiring capital-

ization of certain software development costs did not

materially affect the Company, except for amounts capitalized

by Delrina prior to its acquisition by Symantec in fiscal 1996.

Amounts capitalized during fiscal 1997 primarily related to

the networking business unit which was sold to Hewlett-

Packard in March 1997, at which time the amounts were

written off.

Amortization of capitalized software, including amorti-

zation and the write-off of both purchased product rights and

capitalized software development expenses, totaled $10

million, $19 million and $13 million for fiscal 1997, 1996 and

1995, respectively. Included in the fiscal 1997 total is approx-

imately $7 million of unamortized capitalized software

development expenses and $1 million of unamortized

purchased software product rights related to network admin-

istration technology written off as part of the sale to

Hewlett-Packard in March 1997. The fiscal 1997 write-off of

unamortized FormFlow technology sold to JetForm was

immaterial. Amortization expense in fiscal year 1997 was

lower than in 1996 due to capitalized software write-offs in

fiscal 1996 related to de-emphasized products and Delrina

Windows 3.1 products. The fiscal 1996 amortization of

capitalized software expense included the aforementioned

write-offs, resulting in the significant increase in expense

from fiscal 1995.

Gross margins increased to 80% of net revenues in fiscal

1997 from 75% in fiscal 1996 and from 79% in fiscal 1995.

The increase in gross margin percentage in fiscal 1997

compared to fiscal 1996 was due to the decrease in capitalized

software amortization and write-offs noted above. In addition,

revenues, with no related cost of revenues, from JetForm

totaling $18 million and from Hewlett-Packard totaling $1

million were included in net revenues during fiscal 1997.

The decline in the gross margin percentage in fiscal 1996

compared to fiscal 1995 was due to an increase in the

amortization and write-off of purchased product rights and

capitalized software development expenses noted above and

increased inventory reserves related to Delrina products

designed to operate on Windows 3.1 and other products

de-emphasized by Symantec during fiscal 1996. Due to an

anticipated reduction in software amortization and the recog-

nition of the potential future revenue streams from JetForm

and Hewlett-Packard, for which there will be no associated

costs, Symantec believes that the gross margin percentage

may increase to approximately 81% to 84% in fiscal 1998,

unless there is a significant change in Symantec’s net revenues.

Research and Development Expenses

Research and development expenses decreased 6% to

$89 million or 19% of net revenues in fiscal 1997 from $95

million or 21% of net revenues in fiscal 1996 and were $71

million or 17% of net revenues in fiscal 1995. The decrease in

research and development expenses in fiscal 1997 as compared

to fiscal 1996 is due primarily to decreased product develop-

ment efforts associated with the Company’s decision to cease

developing certain software products, and an increase in

capitalized software development costs. In fiscal 1997,

Symantec capitalized approximately $8 million of software

development costs, primarily related to network administra-

tion technology, which was subsequently sold to Hewlett-

Packard in March 1997 and resulted in the write off of

approximately $7 million in unamortized costs during the

fourth quarter of fiscal 1997. In addition, a $2 million

research and development expense reimbursement was

21

SYMANTEC CORPORATION