Symantec 1997 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

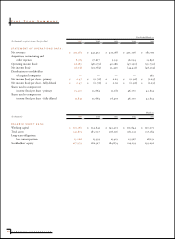

Liquidity and Capital Resources

Cash, short-term investments and restricted investments

increased $79 million to $208 million at March 31, 1997 from

$129 million at March 31, 1996. This increase was largely due

to cash provided from operating activities, net proceeds from

the exercise of stock options and the sales of common stock

under the Employee Stock Purchase Plan, and improved cash

collections of trade accounts receivable. Cash provided by

operating activities was partially offset by the reclassification

of $47 million to restricted investments, a non-current asset.

The restricted investment balance relates to collateral require-

ments under lease agreements entered into by Symantec

during the current fiscal year. Symantec is obligated under

lease agreements for two existing office buildings, one parcel

of land and one office building under construction in

Cupertino, California to maintain a restricted cash balance

invested in U.S. treasury notes with maturities not to exceed

three years. In accordance with the lease terms, these funds

would not be available to meet operating cash requirements.

Net cash provided by operating activities was $94 million and

was comprised of the Company’s net income of $26 million

and non-cash related expenses of $37 million and a net

decrease in assets and liabilities of $31 million.

Trade accounts receivable decreased $11 million from $59

million at March 31, 1996 to $48 million at March 31, 1997

primarily due to improved cash collections during the year.

On April 29, 1997, the Board of Directors of Symantec

authorized the repurchase of up to 1,000,000 shares of

Symantec common stock by June 13, 1997. The shares will be

used for employee stock purchase programs and option

grants. As of June 13, 1997, management completed the

repurchase of 500,000 shares at prices ranging from $16.57 to

$17.00 per share.

The Company has a $10 million line of credit that

expires in March 1998. The Company was in compliance with

the debt covenants at March 31, 1997. At March 31, 1997,

there were no borrowings outstanding under this line and

there were less than $1 million of standby letters of credit

outstanding under this agreement. Future acquisitions by the

Company may cause the Company to be in violation of the

line of credit covenants; however, the Company believes that

if the line of credit were canceled or amounts were not avail-

able under the line, there would not be a material adverse

impact on the financial results, liquidity or capital resources

of the Company.

Symantec is obligated under lease agreements for two

existing office buildings, one parcel of land and one office

building under construction in Cupertino, California to

maintain a restricted cash balance invested in U.S. treasury

notes with maturities not to exceed three years. In accordance

with the lease terms, these funds would not be available to

meet operating cash requirements.

If Symantec were to sustain significant losses, the Company

could be required to reduce operating expenses, which could

result in product delays, reassessment of acquisition oppor-

tunities, which could negatively impact the Company’s

growth objectives, and/or pursue further financing options.

The Company believes existing cash and short-term invest-

ments will be sufficient to fund operations for the next year.

(See further discussion in Item 7: Management’s Discussion

and Analysis of Financial Condition and Results of Operations

- Business Risks - Fluctuations in Quarterly Operating

Results and Management of Expanding Operations.)

Business Risks

The preceding discussion contains forward-looking state-

ments that are subject to significant risks and uncertainties.

There are several important factors that could cause actual

results to differ materially from historical results and

percentages and results anticipated by the forward-looking

statements contained in the following discussion.

Rapid Technological Change and

Development Risks

The Company participates in a highly dynamic industry.

Future technology or market changes may cause certain of

Symantec’s products to become obsolete more quickly than

expected and the trend towards server-based applications in

networks and over the Internet could have a material adverse

effect on sales of the Company’s products. The impact of the

market’s acceptance and adoption rate of Symantec’s

products may result in reduced revenues, gross margins and

net income, as well as significant increases in the volatility of

Symantec’s stock price.

Stock Price Volatility

The Company’s earnings and stock price have been and may

continue to be subject to significant volatility, particularly

on a quarterly basis. Symantec has previously experienced

shortfalls in revenue and earnings from levels expected by

securities analysts, which has had an immediate and signifi-

24 SYMANTEC CORPORATION