Symantec 1997 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Restructuring Expenses In fiscal 1997, the Company recorded

a charge of $3 million for costs related to the restructuring of

certain domestic and international sales and research and

development operations, settlement of the Carmel lawsuit

(see Note 11 of Notes to Consolidated Financial Statements

in Part IV, Item 14 of this Form 10-K) and other expenses.

The restructuring plans have been completed.

In February 1995, Symantec announced a plan to

consolidate certain research and development activities.

This plan was designed to gain greater synergy between

the Company’s Third Generation Language and Fourth

Generation Language development groups. During fiscal

1996, the Company completed the consolidation and

recorded $2 million for the relocation costs of moving

equipment and personnel.

Other Expenses In fiscal 1997, Symantec recorded a $2

million charge in connection with the write-off of an equity

investment and a $3 million charge for the write-off of

certain in-process research and development acquired by

the Company.

In fiscal 1996, Symantec sold the assets of Time Line

Solutions Corporation, a wholly-owned subsidiary, to

a group comprised of Time Line Solutions Corporation’s

management and incurred a $3 million loss on the sale. In the

fourth quarter of fiscal 1996, the Company recorded $2

million for estimated legal fees expected to be incurred in

connection with a securities class action complaint filed in

March 1996 and other legal matters (See Note 11 of Notes to

Consolidated Financial Statements in Part IV, Item 14 of this

Form 10-K).

As of March 31, 1997, total accrued cash related acquisi-

tion and restructuring expenses were $4 million and included

less than $1 million for estimated legal fees and expenses, less

than $1 million for the elimination of duplicative and excess

facilities and $3 million for other acquisition related expenses.

Interest Income, Interest Expense and

Other Income (Expense)

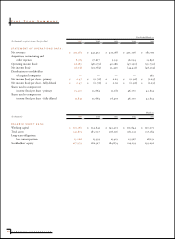

Interest income was $7 million, $8 million and $6 million in

fiscal 1997, 1996 and 1995, respectively. Higher average cash

balances during fiscal 1997 compared to fiscal 1996 were

offset by lower interest rates on invested cash during the year.

Interest income increased 33% in fiscal 1996 over fiscal 1995

due to higher average invested cash balances. Interest expense

was $1 million, $2 million and $2 million in fiscal 1997, 1996

and 1995, respectively. The April 1995 conversion of convertible

subordinated debentures totaling $10 million, which were

originally issued in April 1993, for 833,333 shares of Symantec

common stock, resulted in a reduction in interest expense in

fiscal 1997 from 1996 and in fiscal 1996 from 1995. Other

income (expense) is primarily comprised of foreign currency

exchange gains and losses from fluctuations in currency

exchange rates.

Income Taxes

The effective income tax provision for fiscal 1997 was 14%,

which compares to an effective income tax benefit of 10% in

fiscal 1996 and an effective tax provision of 25% in fiscal 1995.

The 1997 income tax provision of 14% is lower than the

statutory rate primarily due to the utilization of previously

unbenefitted losses.

Realization of the $13 million of net deferred tax asset

that is reflected in the financial statements is dependent upon

the Company’s ability to generate sufficient future U.S.

taxable income. Management believes that it is more likely

than not that the asset will be realized based on forecasted

U.S. earnings. A valuation allowance of approximately $40

million was provided in the financial statements.

Approximately $22 million of the valuation allowance for

deferred tax assets is attributable to unbenefitted stock option

deductions, the benefit of which will be credited to equity

when realized. Approximately $4 million of the valuation

allowance represents net operating loss and tax credit carry-

forwards of various acquired companies that are limited by

separate return limitations and under the “change of owner-

ship” rules of Internal Revenue Code Section 382, and the

remaining $14 million of the valuation allowance relates to

unbenefitted temporary differences and net operating loss

and tax credit carryforwards.

Symantec projects the effective tax rate to be 23% in

fiscal 1998. This rate is lower than the expected U.S. federal

and state combined statutory rate of 40% is due to a lower

tax rate from the Company’s Irish operation and the utilization

of previously unbenefitted losses. However, this projection is

subject to change due to fluctuations in and the geographic

allocation of earnings. (See further discussion in Item 7:

Management’s Discussion and Analysis of Financial

Condition and Results of Operations - Business Risks -

Fluctuations in Quarterly Operating Results.)

23

SYMANTEC CORPORATION