Symantec 1997 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SYMANTEC CORPORATION

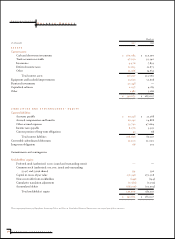

The difference between the Company’s effective income

tax rate and the federal statutory income tax rate as a per-

centage of income (loss) before income taxes was as follows:

Year Ended March 31,

1997 1996 1995

Federal statutory rate 35.0% (35.0)% 35.0%

State taxes, net of federal benefit 2.9 0.3 3.3

Non-deductible acquisition expenses —6.8 2.6

Non-deductible acquired

in-process R&D ——1.1

Impact of international operations (9.2) — (11.2)

Losses for which no benefit

is currently recognizable —16.9 —

Benefit of pre-acquisition

losses of acquired entities (16.5) — (6.7)

Other, net 2.1 0.7 1.0

14.3% (10.3)% 25.1%

The principal components of deferred tax assets were as follows:

March 31,

(In thousands) 1997 1996

Tax credit carryforwards $9,158 $ 8,213

Net operating loss carryforwards 7,969 19,813

Inventory valuation accounts 2,327 2,704

Other reserves and accruals not

currently tax deductible 8,570 9,403

Accrued compensation and benefits 2,392 1,916

Deferred revenue 10,187 5,465

Sales incentive programs 5,005 4,054

Allowance for doubtful accounts 984 1,104

Acquired software 2,613 2,979

Accrued acquisition, restructuring

and other expenses 1,077 2,364

Other 2,868 579

53,150 58,594

Valuation allowance (40,327) (45,719)

$ 12,823 $ 12,875

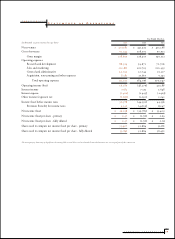

Realization of the $12.8 million of net deferred tax asset

that is reflected in the financial statements is dependent upon

the Company’s ability to generate sufficient future U.S. taxable

income. Management believes that it is more likely than not

that the asset will be realized based on forecasted U.S. earnings.

Approximately $22.3 million of the valuation allowance

for deferred tax assets is attributable to unbenefitted stock

option deductions, the benefit of which will be credited to

equity when realized. Approximately $4.3 million of the

valuation allowance represents net operating loss and tax

credit carryforwards of various acquired companies that are

limited by separate return limitations and under the “change

of ownership” rules of Internal Revenue Code Section 382

and the remaining $13.7 million of the valuation allowance

relates to unbenefitted temporary differences and net oper-

ating loss and tax credit carryforwards. The change in the

valuation allowance for the years ended March 31, 1997, 1996

and 1995 were a net decrease of $5.4 million and net increases

of $14.8 million and $1.6 million, respectively.

Pretax income (loss) from international operations was

approximately $24.9 million, $(4.1) million and $25.9 million for

the years ended March 31, 1997, 1996 and 1995, respectively.

At March 31, 1997, the Company had tax credit carry-

forwards of approximately $9.2 million that expire in fiscal 1998

through 2011 and net operating loss carryforwards of approx-

imately $19.3 million that expire in fiscal 1999 through 2012.

Note 8. Employee Benefits

401(k) Plan Symantec maintains a salary deferral 401(k) plan

for all of its domestic employees. The plan allows employees

to contribute up to 15% of their pretax salary up to the max-

imum dollar limitation prescribed by the Internal Revenue

Code. Symantec matches 100% of the first $500 of employees’

contributions and then 50% of the employee’s contribution

up to 6% of the employees’ eligible compensation. Company

contributions under the plan were $2.0 million, $1.5 million

and $1.2 million for the years ended March 31, 1997, 1996 and

1995, respectively.

Employee Stock Purchase Plan In October 1989, the Company

established the 1989 Employee Stock Purchase Plan (the

“ESPP”). Subject to certain limitations, Company employees

may purchase, through payroll deductions of 2 to 10% of

compensation, shares of common stock at a price per share

that is the lesser of 85% of the fair market value as of the

beginning of the offering period or the end of the purchase

period. On September 25, 1996, stockholders approved an

amendment to the ESPP which included increasing by 1.4

million to 3.4 million the number of shares reserved for

issuance under the ESPP. As of March 31, 1997, approximately

1.9 million shares had been issued and 1.5 million shares

remain to be issued under the ESPP.

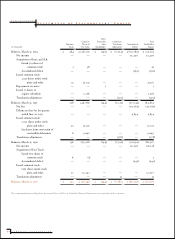

Stock Option Plans The Company maintains stock option

plans pursuant to which an aggregate total of approximately

17.4 million shares of Common stock have been reserved for

issuance as incentive and nonqualified stock options to

employees, officers, directors, consultants, independent

contractors and advisors to the Company (or of any parent,

subsidiary or affiliate of the Company as the Board of