Symantec 1997 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

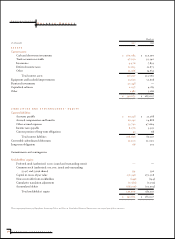

46 SYMANTEC CORPORATION

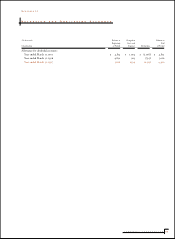

Cash equivalents and short-term investments

(In thousands) 1997 1996

Taxable commercial paper $64,196 $ 77,392

Money market funds 2,598 21,601

Taxable corporate notes 5,130 5,022

Taxable certificates of deposit 5,030 5,008

Treasury bills 33,648 —

Taxable fixed deposit 15,725 —

$126,327 $ 109,023

All of the Company’s available-for-sale cash equivalent

and short-term investment securities as of March 31, 1997 and

1996 have a contractual maturity of less than one year. As of

March 31, 1997 and 1996, the estimated fair value of the

restricted investments consisted of the following:

Restricted investments

(In thousands) 1997 1996

Maturities of less than one year:

Money market funds $ 6 $ —

Treasury bills 19,815 —

$ 19,821 $ —

Maturities of one to three years:

Treasury notes $27,627 $ —

$ 27,627 $ —

The Company’s available-for-sale restricted investments

relate to certain collateral requirements for lease agreements

associated with the Symantec’s corporate Cupertino,

California facilities and have maturities of three years or less

(See Note 6 of Notes to Consolidated Financial Statements).

Fair values of cash, cash equivalents, short-term invest-

ments and restricted investments approximate cost due to the

nature of the investments and/or their short period to maturity.

During the period covered by the financial statements,

the Company has not used any derivative instrument for

trading purposes. Symantec utilizes some natural hedging to

mitigate the Company’s transaction exposures and hedges

some residual transaction exposures through the use of one-

month foreign exchange forward contracts. The Company

enters into foreign exchange forward contracts with financial

institutions primarily to protect against currency exchange

risks associated with certain firmly committed transactions.

Fair value of foreign exchange forward contracts are based on

quoted market prices. At March 31, 1997, there was a total

notional amount of approximately $46.3 million of out-

standing foreign exchange forward contracts all of which

mature in 35 days or less. The net liability of forward

contracts was a notional amount of approximately $45.8

million at March 31, 1997. The fair value of foreign currency

exchange forward contracts approximates cost due to the

short maturity periods and the minimal fluctuations in

foreign currency exchange rates. The Company does not

hedge its translation risk.

Note 4. Convertible Subordinated

Debentures

On April 2, 1993, the Company issued convertible subordi-

nated debentures totaling $25.0 million. The debentures bear

interest at 7.75% payable semiannually and are convertible

into Symantec common stock at $12 per share at the option

of the investor. The debentures are due in three equal annual

installments beginning in 1999 and are redeemable at the

option of the investors in the event of a change in control of

Symantec or the sale of all or substantially all of the assets of

the Company. Symantec, at its option, may redeem the notes

at any time on 30 to 60 days notice; however, the Company

could incur a prepayment penalty for early redemption. The

holders are entitled to certain registration rights relating to

the shares of common stock resulting from the conversion of

the debentures. The Company reserved 2,083,333 shares of

common stock to be issued upon conversion of these deben-

tures. The debentures limit the payment of cash dividends and

the repurchase of capital stock to a total of $10.0 million plus

25% of cumulative net income subsequent to April 2, 1993.

On April 26, 1995, convertible subordinated debentures

totaling $10.0 million were converted into 833,333 shares of

Symantec common stock, leaving 1,250,000 shares of common

stock reserved for future conversion as of March 31, 1997.

The estimated fair value of the $15.0 million convertible

subordinated debentures was approximately $17.9 million at

March 31, 1997. The estimated fair value was based on the

total shares of common stock reserved for issuance upon

conversion of the debentures at the closing price of the

Company’s common stock at March 31, 1997, which exceeded

the conversion price of $12 per share, plus accrued interest.

Note 5. Line of Credit

The Company has a $10.0 million bank line of credit that

expires in March 1998. The line of credit is available for

general corporate purposes and bears interest at the banks’