Symantec 1997 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 1997 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 SYMANTEC CORPORATION

agents and distributors. Fluctuations of the U.S. dollar against

foreign currencies, changes in local regulatory or economic

conditions, piracy or nonperformance by independent agents

or distributors could adversely affect operating results.

Financial instruments that potentially subject the

Company to concentrations of credit risk consist principally

of short-term investments, restricted investments and trade

accounts receivable. The Company’s investment portfolio is

diversified and consists of investment grade A-1/P-1 securities.

The Company is exposed to credit risks in the event of

default by these institutions to the extent of the amount

recorded on the balance sheet. The credit risk in the

Company’s trade accounts receivable is substantially mitigated

by the Company’s credit evaluation process, reasonably short

collection terms and the geographical dispersion of sales

transactions. The Company generally does not require

collateral and maintains reserves for potential credit losses,

and such losses have been within management’s expectations.

Advertising

Advertising expenditures are charged to operations

as incurred except for certain direct mail campaigns which

are deferred and amortized over the expected period of bene-

fit or twelve months, whichever is shorter. Deferred

advertising costs have not been material in all periods

presented. Advertising expense for fiscal 1997, 1996 and 1995

was approximately $39.1 million, $43.0 million and $41.0

million, respectively.

Impairment of Long-Lived Assets

Statement of Financial Accounting Standards (SFAS) No. 121,

“Accounting for the Impairment of Long-Lived Assets and

for Long-Lived Assets to be Disposed of,” applicable for the

fiscal year beginning April 1, 1996, did not have a material

effect on the Company’s consolidated financial condition or

results of operations.

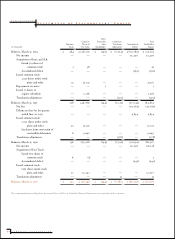

Common Stock Repurchase

On April 29, 1997, the Board of Directors of Symantec

authorized the repurchase of up to 1,000,000 shares of

Symantec common stock by June 13, 1997. The shares will be

used for employee stock purchase programs and option

grants. As of June 13, 1997, management completed the

repurchase of 500,000 shares at prices ranging from $16.57 to

$17.00 per share.

Recent Accounting Pronouncements

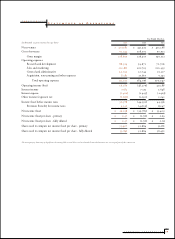

In February 1997, the Financial Accounting Standards Board

issued Statement (SFAS) No. 128, “Earnings per Share”,

which is required to be adopted on December 31, 1997. At

that time, the Company will be required to change the

method currently used to compute earnings per share and to

restate all prior periods. The application of the SFAS 128 new

“basic earnings per share” calculation results in basic earnings

per share of $0.48 for the year ended March 31, 1997, basic loss

per share of $0.76 for the year ended March 31, 1996 and basic

earnings per share of $0.68 for the year ended March 31, 1995.

The Company does not expect the new diluted calculation to

be materially different to fully diluted earnings per share.

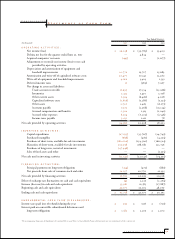

Reclassifications

Certain previously reported amounts have been reclassified

to conform to the current presentation format. During fiscal

1997, certain deferred revenue amounts which were previ-

ously classified as accrued liabilities have been reclassified to

accounts receivable. The reclassification amounted to approx-

imately $19.0 million, $13.0 million, and $3.0 million in fiscal

1997, 1996, and 1995, respectively. All financial information

has been restated to conform to this presentation.